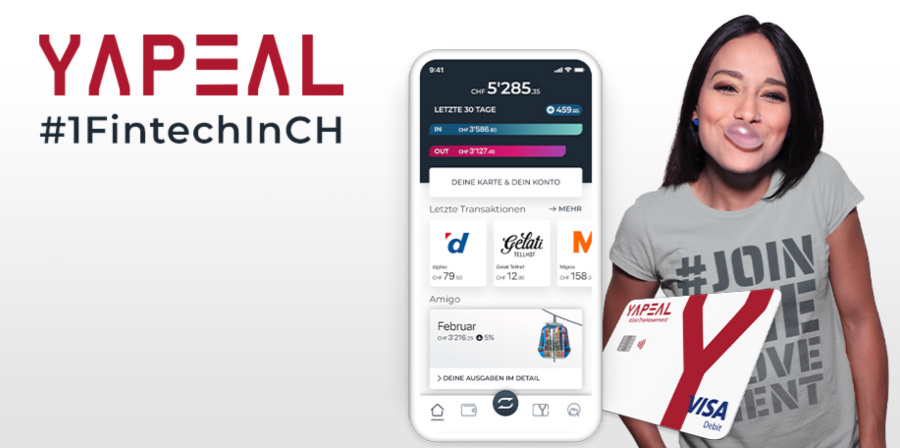

Yapeal Review 2023 – Should you #JoinTheMovement?

This page is also available in:

Deutsch

Overall Rating of our Yapeal Review:

Rating TBC in 2023 · 👀 · One to Watch ·

At Investing Hero, we aim to provide the best investing platform reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence our reviews. Our opinions are our own. The information provided on Investing Hero is for informational purposes only. Please read our disclaimer.

Yapeal is a fresh new player in the field of digital banking, and joins the likes of Revolut, Neon and Zak in an increasingly competitive and challenging space.

But for us the consumer, the more competition in the marketplace, the better 😊

Founded in 2018, Yapeal have now successfully acquired a Swiss fintech license and secured further investor funding – and are quickly maturing and rolling out new updates to their mobile app.

If the marketing is anything to go by, at the very least this is going to be an interesting discovery process for me, and potentially a serious disruptor in the space to replace my other bank cards.

Yapeal promo code: YAPS-8IEH-D705

🎁 Reader Bonus: I’ve partnered with Yapeal to bring Investing Hero readers (that’s you!) a 30CHF welcome bonus when you open an account. No strings attached and no BS. Just click this link from your smartphone when you open an account to claim your bonus. Doesn’t work? use the code: YAPS-8IEH-D705

As usual, I’ll be showing the account opening process, step by step, in order to show you the full journey before committing to opening an account and ‘joining the movement’.

I’ll also be highlighting some of the differences to the other major Swiss digital challenger banks in Switzerland – Neon and Zak.

Onwards with the Yapeal review.

Yapeal Review: Pros and Cons

To be fair to Yapeal – their product isn’t completely ‘finished’ and is constantly evolving ahead of their official launch next year. That said, it’s already an interesting offering, and I look forward to seeing how things develop. Time will tell if I stick with ‘the movement’ and what features come next.

| Pros | Cons |

|

|

How to open an account with Yapeal

Landing on the Yapeal homepage, it’s quick and easy to get started – simply click on the app store link (App Store or Google Play) of your choice, and you can download the app immediately:

You can also just scan the following QR codes to download the app:

I’ll be using iOS in this review. Lets move on. Download the app and open it up:

Hold onto your hats folks:

Tap ‘Become a Yapster’ to move onto the next screen:

A brief overview of what you can expect – sounds good? Tap ‘Register’ to move along:

Pretty interesting – you need to download a second app in order to continue the verification process. First time I’ve seen a digital bank split out the onboarding process across two apps to enhance speed and security:

Appstore. Download. Open. Away we go.

Enter your nickname and move onto the next screen:

Select where you live, and where you are from, in the drop down and tap ‘Continue’:

Another brief overview of what to expect in the process – tap ‘To the Scan’ next:

Select the type of document you have, in my case a passport:

… Swipe through the tips (I won’t show them all) on how to scan your doc, and tap ‘Continue’:

‘OK’ to the camera request here:

You’ll then need to position your passport in the viewframe and let Yapeal take a photo, which happens automatically.

Then you’ll move onto the next screen, and be asked to scan the NFC chip in your passport:

You should see a ‘Tick’ and confirmation message a few seconds later:

With the passport successfully scanned, lets move onto step two – the selfie:

More interesting tech from Yapeal – not just any old selfie, a 3D one!

With the selfie completed we just have the final step to complete – tap ‘To the Questions’ to move on:

Check your details, which have been added from the passport scan, and tap ‘Confirm’:

Now your email:

Then enter the verification code which was just sent to your email:

A slightly ugly looking email (the secure mail feature Yapeal uses disables external content in HTML email – such as images) arrives with your code:

Back in the app to update your code and tap ‘Confirm’. You’ll be passed onto the next screen to enter your address:

Now your mobile number:

Another interesting new security feature from Yapeal – selecting a memorable photo, should you need to recover access to your account:

Tap ‘OK’ to allow access to your photos in order to select one:

Once selected you’ll then be prompted to take a practice test – select your image to move on:

Next, enter a 6 digit pin:

Confirm it’s correct by tapping ‘Confirm’, you’ll then be prompted to enable FaceID (on iOS) which I enabled:

Next up you need to agree to the legal conditions, you can tap ‘Conditions in detail’ to view them in full., before selecting and tapping ‘Confirm’

Now tap ‘Get your account’ to move on:

Before you tap ‘Confirm’ select the small ‘Promo code’ label on the the Visa card:

Then enter your promo code on the next screen and tap ‘Confirm’:

Next, select your occupation from the drop down list and tap ‘Confirm’:

A few more steps to go. Now we can make our own IBAN number and tap ‘Save’

Double check and confirm…

And now your personal IBAN is setup, you can copy it using the icon and then tap ‘Continue’

This screen marks the end of the account opening & onboarding process and we are now ready to take a look at the account itself.

Logging into the Yapeal account for the first time

First up, enable notifications (if you wish) by tapping ‘Allow’:

And here we are! The Yapeal digital bank.

Has a nice feel to it, don’t you think?

From the home screen you can scroll through a release notice, and a random ‘welcome’ animation.

But before you can enable most of the features within the app, you need to fund it, which we’ll do next.

Funding the Yapeal account

Very straight forward – copy your personal IBAN and switch over to another bank account and make a normal transfer.

And it’s quick – I made a transfer at 8PM CET, and at midnight 4 hours later it landed in my Yapeal account. Nice.

Once you open the app again after funding it, you’ll get the following confirmation:

Now we setup the card pin:

Confirm it:

And then you’ll get the confirmation your card is in the post. Tap ‘Close’ to move into your account:

And here we are, back in your account. Now funded and fully functional. Job done.

Login & Security

It’s worth noting Yapeal are the first in Switzerland to receive the new brand of fintech banking license from FINMA, which is aimed exclusively at fintech startups.

The capital requirements for such a license are less compared to a traditional banking license, and Yapeal are not able to use your capital or charge interest on it (Yapeal doesn’t work with your money like other banks) – no big issue considering where interest rates are today. But we could see Yapeal migrate over to a full banking license in the future – time will tell.

As with other FINMA regulated banks in Switzerland, security is a top priority. Yapeal sets a high benchmark with the dedicated shield app, innovative in app security features, and the removal of using SMS authentication which has its challenges from a security standpoint. It’s great to see such innovation in the space.

One other point worth noting is unlike traditional Swiss banks, and even digital banks such as Neon and Zak – you account deposit isn’t insured should the worst case scenario arise, which might be an issue for some. However, as I mentioned above Yapeal doesn’t ‘use’ your money in any way like other bank, its just sitting at the national bank.

Your cash remains in Switzerland and is held at the SNB (Swiss National Bank) so you could argue in the event you can’t get your money from them, you should probably be hiding in a bunker as the world might be about to end.

Fees & Charges

The majority of these are to be confirmed in 2021. Currently the app is free to use, however there will be a monthly fee in the future. We’ll update this section as that information comes in.

My guess? Like Revolut have done. Maybe a 5-7CHF/mth ‘basic’ account, and a 8-12CHF/mth ‘premium’ account with more partner offers, multiple custom IBANs, and better account conditions. Just a hunch based on what I read here.

But as of today, the confirmed costs are as follows:

- ‘Pay what you think its worth’ for the base account

- 2 CHF per cash (CHF) withdrawal in CH

- 5 CHF per cash (EUR) withdrawal in CH

- 5 CHF per cash withdrawal overseas

- No markup on currency rates

- 10 CHF Card replacement fee

- 0.80% management fee for accounts over 25K CHF (0.75% from SNB, 0.05% from Yapeal)

Customer Support

Customer support is responsive and like other digital banks, Yapeal use digital solutions first to support customers as they don’t have a walk in branch or large call centers. Within the app itself you you can shake the phone or tap the cog icon to access your settings, and then select ‘Support Center’ to raise a new request.

For additional support and questions, you can reach them through the public support page.

Additional Resources

No blog or finance related content/education to be found yet, but Yapeal are investing in building up the community forum, which we’ve seen with the likes of Revoult, to support common requests and feedback.

It’s early days here (and no English posts yet) but this will likely pickup as adoption grows.

Yapeal vs Neon

In 2021 I’ll be updating this section with a full Yapeal vs Neon, Yapeal vs Zak and Yapeal vs Revolut comparison table once the pricing is finalised and available publicly.

For now, please refer to the table below for a snapshot of the other three popular digital banks in Switzerland:

|  |  | |

| Investing Hero Rating | 4.8 | 4.7 | N/A |

| Welcome CHF bonus code | investinghero (for 10 CHF) | INVESTINGHERO (for 50 CHF) | None |

| Base fee | Free | Free | Free |

| Account country | CH | CH | UK |

| Swiss IBAN | Yes | Yes | Yes (domestic use only) |

| Card type | Mastercard | Mastercard, Visa, Maestro | Mastercard, Virtual |

| Domestic withdrawl in CHF at ATMs | 2x free/mth, then 2 CHF per withdrawal | Free at Bank Cler ATMs, 2 CHF at others | Free up to £200/mth, then 2% per withdrawal |

| Domestic withdrawl in EUR at ATMs | 1.5% on the amount | Free at Bank Cler ATMs, 5 CHF at others | Free up to £200/mth, then 2% per withdrawal |

| Domestic payments | 0 | 0 | 0 |

| International transaction fees | 0 | 2.5% | 0 up to 1000 CHF, then 0.5% (weekday) or 1% (weekend) |

| International transfer rates | 0.8-1.7% (Transferwise) | 1.5% approx (Corner Bank rate) | 1-6 CHF |

| Exchange rate surcharge | None | 1.7% | None |

| Replacement card | 20 CHF | 20 CHF | 10 GBP |

| Set a new pin code | 0 | 10 CHF | 0 |

| Special case administration | 25 CHF/15min | 0 | 0 |

I haven’t included the Transferwise card here for international currency exchange, which has excellent feedback and fx rates. I’ll be adding Transferwise into a separate review in the future.

Background info on Yapeal

Yapeal was founded in 2018 by 15 Co-Founder’s whereof the initiators were Thomas Hilgendorf & Christian Meier with a mission to “redefine the way people bank.” Today, Yapeal is supported by a team of 26.

Yapeal don’t have a walk in branch, but the registered address is Max-Högger-Strasse 6, 8048 Zürich.

Closing thoughts

Yapeal is exciting, innovative and bringing lots of new ideas to the banking space. They are delivering on great UX and new customer on-boarding, and I’m a fan of the security enhancements and innovation.

It’ll be interesting to see how things play out in 2021 as they communicate their pricing model, and full features to take on the established players such as Neon and Zak. As they are 100% independent with their own fintech licence, and in house built technology stack, there is no doubt plenty more to come. I look forward to digging into the details and updating this review with a final rating in early 2021.

Thanks for reading this Yapeal review!

🎁 Reader Bonus: I’ve partnered with Yapeal to bring Investing Hero readers (that’s you!) a 30CHF welcome bonus when you open an account. No strings attached and no BS. Just click this link from your smartphone when you open an account to claim your bonus. Doesn’t work? Use the code: YAPS-8IEH-D705

Yapeal download

Interested in trying out Yapeal for free? Use the following links to download the app:

Or, just scan the QR codes below to get started:

Yapeal FAQ

Yes, use code YAPS-8IEH-D705 for a 30CHF credit, or follow this link.

You need to be a Swiss resident with an iOS or Android smartphone.

Yapeal are a pure digital bank who use a fully digital on-boarding process and aim to be better value, quicker and easier to use compared to a traditional bank.

Despite not having deposit protection, Yapeal are a FINMA regulated fintech bank and your cash remains in Switzerland and is held at the SNB.

No. They are a Swiss bank regulated by FINMA with a fintech license. Are Yapeal legit? Yup.

About Investing Hero

I’m a British expat who’s been living in Switzerland for the last 10 years. I’m a digital marketing professional by day, and anonymous investing blogger by night. I cover investing basics, robo advisor reviews and epic how to guides. You can call me ‘Mr. IH’ for short, and read more about me here.