Taxes in Switzerland: A Mini Guide to Swiss Tax (+ How to optimize)

This page is also available in:

Deutsch

At Investing Hero, I aim to provide the best investing platform reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence my reviews. My opinions are my own. The information provided on Investing Hero is for informational purposes only. Please read the disclaimer.

This is my mini guide to the Swiss tax system. It’s not the most exciting of topics, but for those of us with a limited grasp of German or financial knowledge, completing your first Swiss tax return can be quite a daunting prospect.

In this guide you’ll learn the basics of the Swiss tax system, how to get started with your personal tax declaration and some hints and tips concerning deductions to help you along the way.

By the end of this mini guide you should have a basic understanding of taxes in Switzerland and feel (hopefully) a little more confident in completing your next declaration. You should also save a few CHF along the way too. Which is never a bad thing.

If you like the look of this tax guide, don’t forget to check out my monster guide to investing in Switzerland. It covers a tonne of topics on getting started investing in Switzerland and worth a read. Plus, more cheesy jokes.

Sound good? Let’s jump right in.

🎁 Reader Bonus: If you need support in completing your Swiss tax return, or have general questions about tax which aren’t covered below – drop me an email.

Who is this mini guide for?

This mini guide was put together for a few different types of native and foreigners living in Switzerland. Like the topic of investing (check out my guide on that) after arriving in Switzerland as an expat, understanding the swiss tax system and submitting my tax return was a little confusing.

Maybe you’ve recently moved to Switzerland, and haven’t yet understood when and what you have to do about declaring your income.

Or maybe you are asking yourself things such as, ‘when are swiss tax returns due?’ ‘How much tax do you have to pay?’ And ‘do foreigner’s even have to pay tax?!’

Or maybe you freak out and feel a bit sick when yet another tax bill arrives. Which is basically everyone. So then, how can you optimize your Swiss taxes? What can you deduct to reduce the amount of tax you pay each year?

Sound like you can relate to the above? Then this mini guide is for you.

A brief intro to the Swiss tax system

Let’s get straight to it – in Switzerland, there are four main levels to consider for personal income tax:

- Federal (the state)

- Canton (e.g. Zurich)

- Commune (e.g. a town in Zurich)

- Church (depending on your faith)

Which means, there isn’t a single tax number to calculate your total tax burden. Fun!

In general, tax rates are progressive in Switzerland (e.g. using a band) so those with higher income and wealth will pay more tax than those with less. The amount of tax you pay will also depend on your personal status, such as being married or single – and having kids or not.

As we’ll see later, the canton you live in has a big impact on this also.

How much tax do you pay in Switzerland?

To work out how much tax you have to pay in Switzerland, lets first breakdown the individual parts which contribute towards your total income tax burden.

Federal

Swiss Federal tax rates come from the state and are the same across Switzerland.

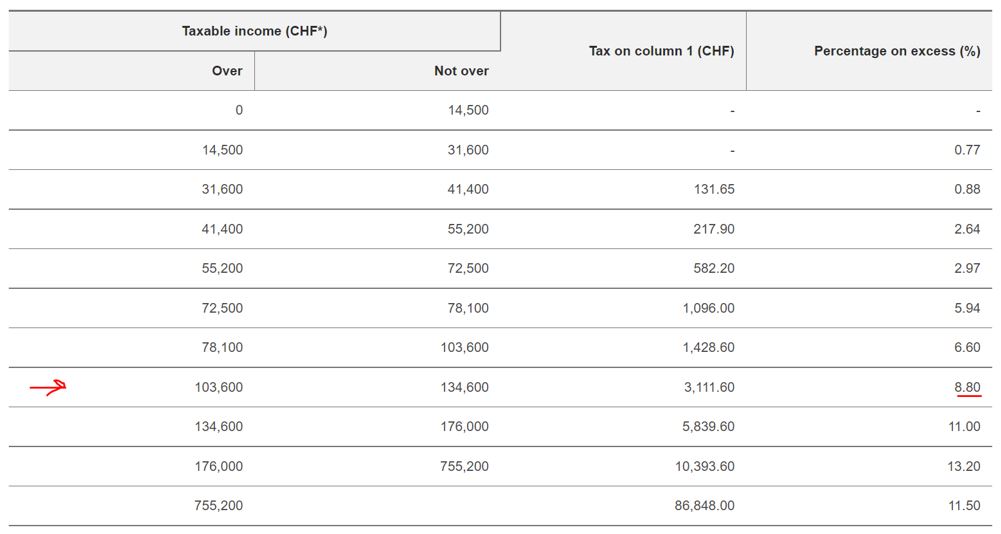

These tax rates are progressive based on your taxable income and if you are married. To save confusion, let’s look at all the rates for singles first in the table below.

Single taxpayers

For example – If you are single and your taxable income amounts to 120K CHF a year, you fall into the band shown above.

You might think you pay 8.8% of 120K, but that’s not correct. Due to a geeky accounting term called ‘marginal tax rate’, you pay the base amount (3.1K) of the band, and then the 8.8% on the additional amount.

Maybe an example will help.

A 120K salary falls into the ‘103.6K > 134.6K’ band shown above. See it?

So you have 120,000 minus 103,600 which leaves us with 16.4K, which will be taxed at 8.8% = 1.4K CHF. Add this to the base amount of 3.1K, and you have a total federal tax bill estimate of 4.5K CHF.

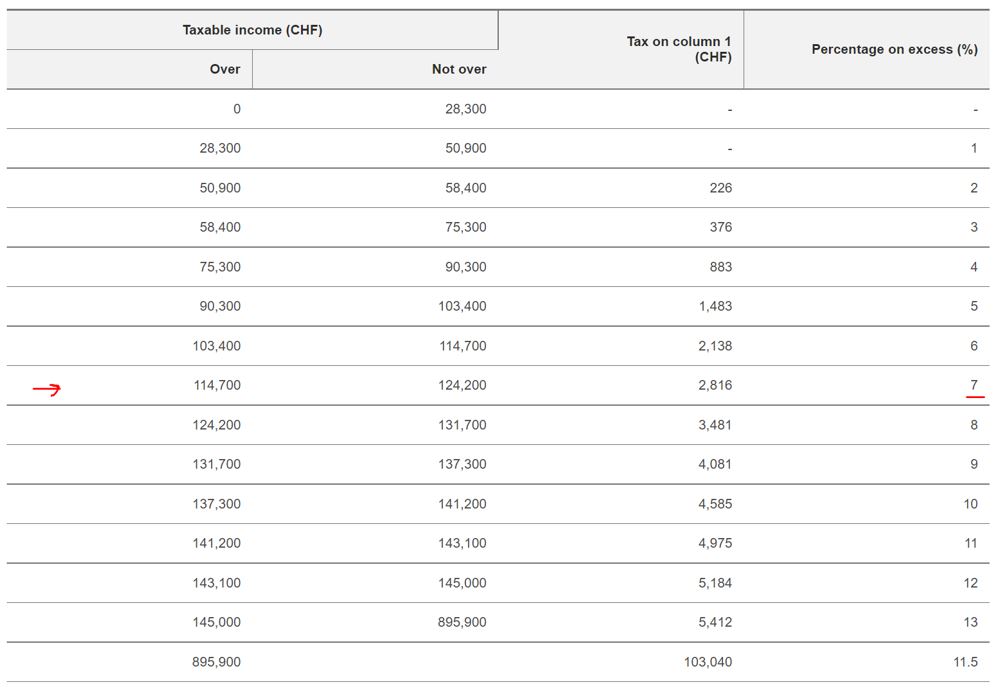

Married taxpayers

Using our same example of 120K taxable income, federal tax rates vary slightly when you are married as shown below, and once you run the numbers (everything else equal) you’ll be paying roughly 3.1K CHF:

In fact, being married has a significant impact on your tax rates.

You’ll receive a nice orange bill in the post at the start of the year, with an estimate based on the year before you have to pay by March 31st.

If there are differences with this amount once your taxes are finalised for the current year, you’ll either receive a tax refund later in the year – or another bill to make up the difference. For example, if you received a significant pay rise in 2020, you’ll likely get another federal tax bill later in 2021 after March 31st.

Ok, that’s the Federal tax. Let’s move on.

Canton

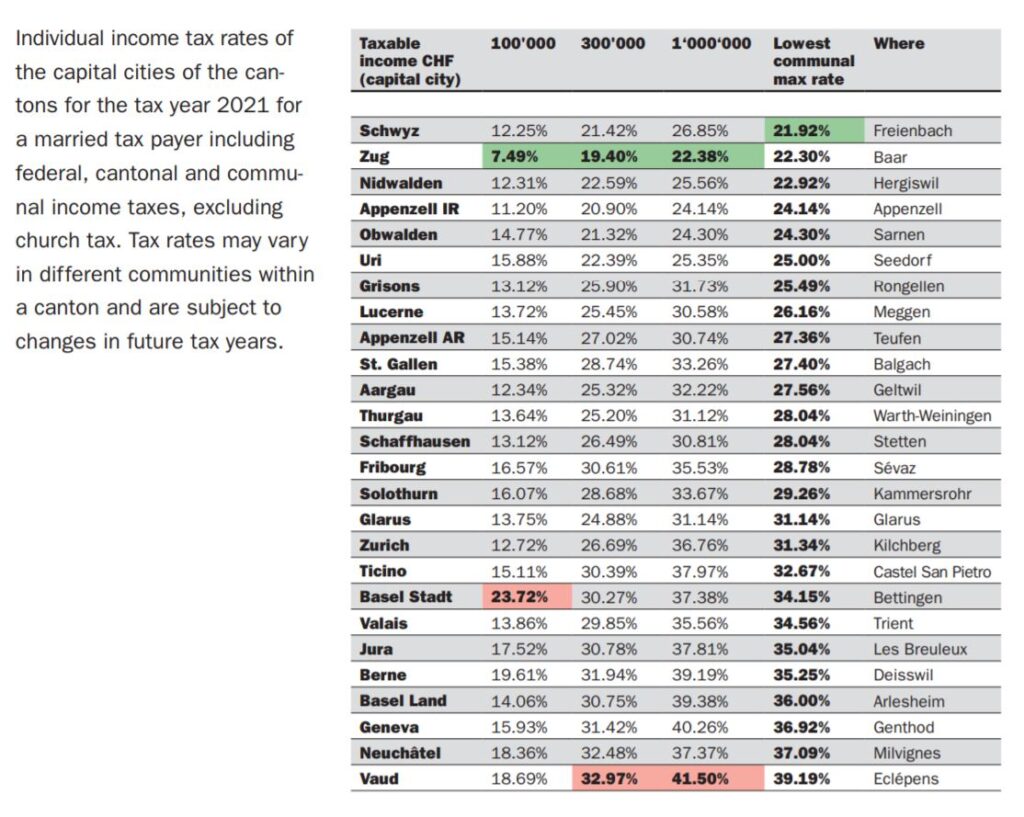

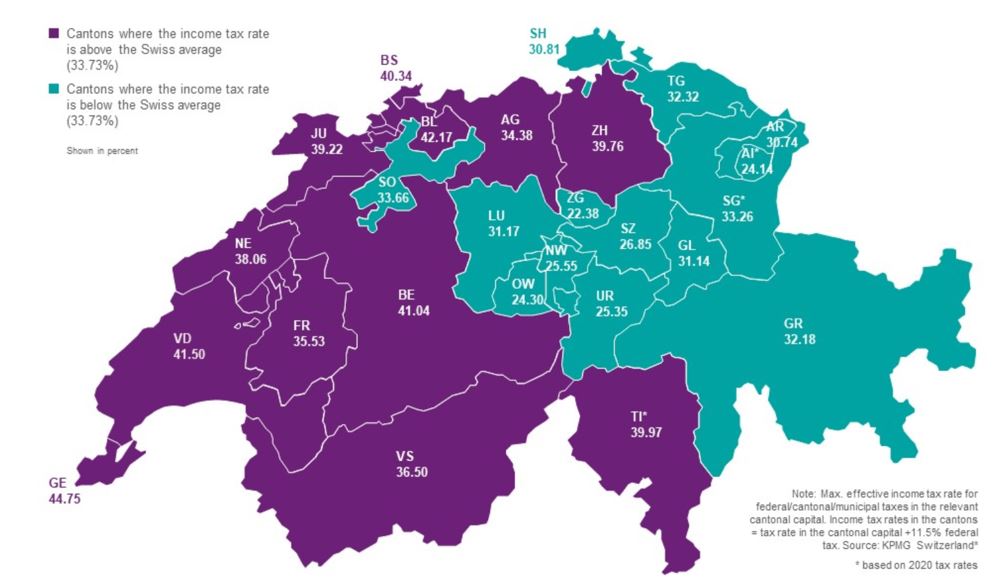

Switzerland comprises of 26 individual cantons, all of which have different tax rates. So, depending on where you choose to live you will pay differing levels of personal income tax. And within Switzerland, this can be quite a difference between cantons – particularly when you compare the French and German cantons of Switzerland.

The cantonal tax will generally make up the bulk of your tax bill, and is the one you’ll spend most time and effort on.

Cantonal tax rates in Switzerland

The list below shows the different tax rates in Switzerland. As mentioned above, there is a significant difference between cantons which over the long term adds up significantly.

For those reading that have yet to move to Switzerland but are considering relocating – the list above is some food for thought.

Especially considering the excellent Swiss public transportation network (e.g. Zug to Zurich by train is only 34minutes) making different ‘home’ and ‘work’ cantons a possibility to leverage tax savings. But of course, there are many other factors to consider when choosing a place to live.

The canton will send your tax paperwork at the beginning of the year, and you have a few months to collect all your statements and complete the details, before submitting it back to the finance department of the canton.

Let’s continue.

Communal

This one relates to the municipality you live in and, amongst other things, pays for the road sweepers and snow gritters during the winter.

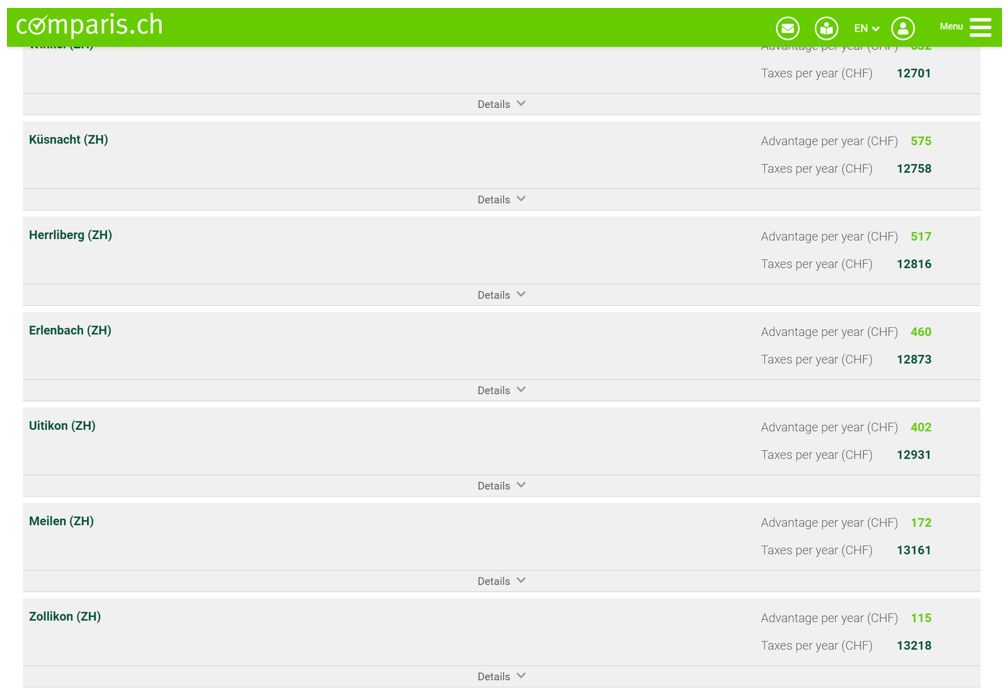

As with cantons, there can be quite a variation between town tax rates across Switzerland. For example, if you are single and living in canton Zurich earning 120K/yr, the municipality tax for Winterthur is 9.4K, compared to 8.4K in Uster and 6.5K in Horgen.

Of course, some of these lower taxed towns and villages are not suitable and accessible for all – and will often demand higher premiums for rent and related services.

You can see a comprehensive overview of municipality tax rates on the comparis website:

Combined with the canton rates, these two pillars are the bulk of the tax you’ll be paying.

In a nutshell, that’s the communal tax topic.

Church

The church taxes are bundled into your cantonal tax bill and calculated based on your religion -be it Roman Catholic, Old Catholic or Protestant. If you are not religious, or your religion isn’t one of the three Swiss recognized religions, you can voluntarily opt out and be assigned with ‘no religion’. Making this switch will reduce your church tax to zero.

Church taxes typically account for around 1% – for example its 0.7% in Zurich, 1.5% in Aargau and 1% in Luzern – and in some cantons such as Geneva and Neuchatel, it’s 0%. Please note these are approximate and might be slightly higher.

Additional taxes

In most cases, the four sections listed above will be responsible for the majority of your tax bill. However, additional taxes which will impact your tax bill include wealth taxes, inheritance & gift taxes, stamp taxes and overseas properties.

I’ll save the details of these for another blog post, but in general you’ll likely have to factor these in too at some point in the future.

Swiss Tax Calculators & Tools

Now you have an understanding of the different buckets where tax is calculated, you can start to work out the firmer numbers on your total tax burden.

The map below shows what these will be and includes the federal, canton and municipal taxes:

For additional calculators and tools, check out these links to input your numbers:

📝 Reader note: If you want an expert to calculate your exact personal tax rates, drop me an email and I’ll connect you.

How does Swiss tax compare to other countries?

Switzerland compares well to other countries within Europe and further afield.

It’ll depend on your canton, but taking Zurich for example the tax rate on 100K taxable income is around 24%. Compared to the likes of Denmark, France and Austria which push 50% – Switzerland is considerably lower.

On the other hand, countries such as Estonia, Hungary and the Czech Republic have personal income tax rates of around 15%. Lower than that and you have to get creative – but the Bahamas, Monaco and the UAE all have 0% personal income tax, but (with the exception of UAE) are not too realistic for most folks reading this blog.

And with everything else considered (quality of life, location, transportation network, cheese…) Switzerland compares very well, even to the Bahamas.

Is Switzerland a tax haven?

As you can see from the section above and the cantonal breakdown, Switzerland is an attractive place to have your wealth calculated for tax purposes. Particularly for businesses and foreign investors, Switzerland ranks very highly in offering favourable tax rates.

This ‘business friendly’ stance and competition between cantons to set their own tax rates all helps to continually offer a good tax environment.

Historically, Switzerland has been regarded to some degree as a ‘tax haven’ (in part unfairly due to old Swiss banking secrecy laws) however today that’s not completely accurate. Since 2019, Switzerland have been fully compliant with international tax standards, however continues to innovate and offer attract rates for individuals and businesses.

That said, large multinational corporations have long leveraged the Swiss system for tax optimization and in some cases avoidance – this continues today to the tune of $12.8 billion.

When are Swiss tax returns due?

The Swiss tax return deadline depends on the canton you live in, but typically they are due around the end of March. For example Zurich, Aargau, Lucerne, Geneva and others are all due at the end of March.

This date can be extended on request, by how much again depends on the canton, but typically a maximum of around 6-7months in the same year.

How to optimize your tax return

There are many ways you can legally (e.g. without hiding paper CHF notes under your mattress) reduce the amount of tax you will pay. These items are known as ‘deductibles’ and it’s worth familiarising yourself with the items you can include to offset your tax bill. The CHF savings over the long term are significant.

Here are a few examples of expenses you can deduct:

- Swiss charity donations

- Child day care

- Commuting and work lunch expenses

- Work expenses you have to pay for (e.g. training, software)

- Health insurances

- Pillar 3A contributions

- Mortgage interest payments

- Renovations & maintenance

- Bank charges & Asset management fees

- Medical expenses (doctors, dentist etc)

- Education & training

🎁 Reader Bonus: If you’d like more details of the tax deductions by canton and the amounts you can deduct for each, just drop me an email.

Finding a certified Swiss tax expert

If you are put off by the idea of completing your tax declaration on your own, then consider the support of a Swiss tax consultant. A Swiss tax expert will be able to breeze through the above and have certified expert knowledge to support your tax declaration.

Of course, you pay a fee for this – around 800CHF depending on the complexity of your personal circumstances, but typically it should be no more than that.

For some, this a worthwhile option to be more ‘hands off’ and to make sure you get everything correct. At least for the first one, which you can use as a template in the future. Using a tax expert or tax firm also enables you to have better tax planning, and they can be used as a ‘proxy’ to field any questions from the tax office and organise needed extensions so no deadlines are missed.

A tax advisor can also help maximise your deductions so you’ll likely have some additional yearly savings.

However, a word of warning with your search for expat tax experts.

It’s important to tread carefully when searching for a Swiss tax advisor, especially if you are an expat. The financial sector within Switzerland is littered with insurance salesmen who will view the ‘tax return’ as a foot in the door, to later sell overpriced life insurance backed pensions and investment products.

This is by no means a jab at all the regulated and credible tax and financial planners in Switzerland, of which there are many. But my personal experience shows this is an area that needs careful research.

Things to look for:

- The tax advisor should offer a fixed fee for any tax consulting services.

- The tax advisor should be accredited and qualified. Do your due diligence.

- The tax advisor should not be pitching pillar 3A (private pension) or life insurance products in your tax consultation. Huge red flag. You can read more about my nightmare on that here.

🎁 Reader Bonus: If you are struggling to find a tax advisor and need support in completing your Swiss tax return, or have general questions about tax which aren’t covered in this article, drop me an email.

Closing thoughts

Hopefully the above has given you a basic understanding of the Swiss tax system and some potential ideas on how you can optimize things come tax season.

Understanding when you can expect the bills and what you can deduct are important areas to consider so do your research, note your canton deadlines and give yourself plenty of time.

As with my other topics, I’ll be expanding on this tax series in the near future.

Have questions? Drop me an email.

I’m anonymous on the blog, so I guess you can call me ‘Mr Investing Hero’, or ‘Mr IH’ for short 🙈

I’m a British expat who’s been living in Switzerland for the last 10 years. I’m a digital marketing professional by day, and a finance and investing blogger by night.

You can read more about me here.

Thanks for reading!

Mr. IH