VIAC Review 2023 – Is the VIAC 3rd pillar any good?

This page is also available in:

Deutsch

Overall Rating

4.8 ⭐⭐⭐⭐⭐ · 🏆 Market Leader ·

At Investing Hero, we aim to provide the best investing basics. To support this, some of the products featured in articles will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence our evaluations. Our opinions are our own. The information provided on Investing Hero is for informational purposes only. Please read our disclaimer.

Headquartered in Basel and founded in 2017 by Daniel Peter, Christian Mathis and Dr. Jonas Gusset, VIAC Switzerland was born from the idea to offer a simple, cost efficient and transparent way to save for your pension. In this review we’ll discover if the VIAC 3a is worth using.

But before we get into the details, a quick primer on the third pillar in Switzerland for those that aren’t familiar. Feel free to skip this part if you know already.

🎁 Bonus: Remember to check out my pillar 3A comparison page which lists the top providers in Switzerland and all the current Investing Hero reader deals & bonuses. Enjoy!

What is a third pillar?

In Switzerland, the third pillar (aka the ‘Pilar 3A’ or ‘Säule 3a’) is part of the pension system and an optional private plan to supplement your state (aka – first pillar) and company (aka – second pillar) pension plans.

Moving money into your third pillar has several benefits, from being tax deductible to having the option to pledge against a property purchase.

Contributing toward a third pillar plan is generally regarded as a good move.

What is the pillar 3a maximum 2021?

If you already have a pension fund the maximum contribution is 6883 CHF per year, without a pension fund it’s 34,416 CHF (up to a max of 20% of your income).

However, with interest rates at historic lows, you risk pumping capital into an account you can’t touch for years, and with tax benefits aside, could result in very little return on your nest egg compared to, say, a traditional index fund.

Insurance companies offer third pillar solutions, but caution should be exercised when dealing in this area. The industry lacks transparency, contracts hide away fees into the small print, and you could easily fall into the trap of bundling life insurance into your policy. Like I did.

Do not go through a broker and overcomplicate your contract with insurance. You’ll pay a penalty to break the contract, and you’ll be overcharged on the insurance.

» Related reading: 8 Common Investing Mistakes to Avoid

OK, I’ll get off the soapbox.

How do you invest your third pillar?

Most banks offer their own branded investing options for your third pillar, however you should take care to avoid many of these due to the eye watering fees and additional charges. An example would be something such as a UBS Vitainvest fund, which have annual fees north of 1.5%. It’s too high for me.

That said, it’s worth looking through what your bank offers, however they tend to bounce around this 1-1.5% range regardless of the bank, even the better value ones from the likes of Post Finance.

What else could you do?

Services such as Swisscanto (e.g. the Swisscanto Index 45 RT, factsheet here) are a little more attractive, and while they are supported on request by most banks, the rates and fees will differ from bank to bank. Again not the perfect solution, but you have quite a range of different funds at your fingertips.

You’ll have to ask the bank, they’ll send you a form in the post which will need returning with the ISIN of the fund you want to buy. It’s an old school paperwork process, but it works.

However, once everything is factored in (e.g. transaction costs, entry & exit fees) the yearly fees could creep over 1% depending on the bank, so it’s not always the most cost effective solution.

But that said, it’s better than leaving it in a ‘vanilla’ bank account and doing nothing (or even worse, contributing to an insurance policy) for 35 years.

However, there is an alternative in this growing space challenging the mainstream.

Enter the VIAC 3a.

The VIAC 3rd pillar offers some of the most competitive rates to invest your third pillar in Switzerland. Infact, as of today, they are the cheapest way to invest and have over 16,000 clients already doing so.

The transparency on these fees is refreshing, but they are also heavily focused on streamlining the customer experience and ensure the account opening process is extremely straight forward and pain free. Which is awesome.

Despite the fancy SAS style front end and slick user interface, VIAC is backed by the Terzo Pension fund from WIR Bank based in Basel, which has some 6 billion CHF under management and is regulated by FINMA. Securites are held with Credit Suisse.

VIAC Switzerland – Pros and Cons

As you can see from the rating above and this review, VIAC is crushing it. For a third pillar option in Switzerland you can’t really go wrong – and the market is playing catchup as VIAC leads the way with rock bottom prices and a slick customer experience.

| Pros | Cons |

|

|

Opening an account with VIAC

VIAC has recently announced tablet and desktop versions of the platform, however this review will focus on the mobile app. You can visit VIAC.ch for more info.

First up, either download the app directly from the homepage, or navigate to the app store for either iOS or Android and download the VIAC mobile app. It’s a light download (under 35MB) that won’t ruin your data usage or phone storage:

Open up the app after installing, and you are ready to get going. Tap register on the screen below:

Enter your name, address and a secure password and proceed through the next 2 screens, you’ll then get the following confirmation message:

Now we move onto the defining the type of investor you are, these can be changed later but select the most relevant for you:

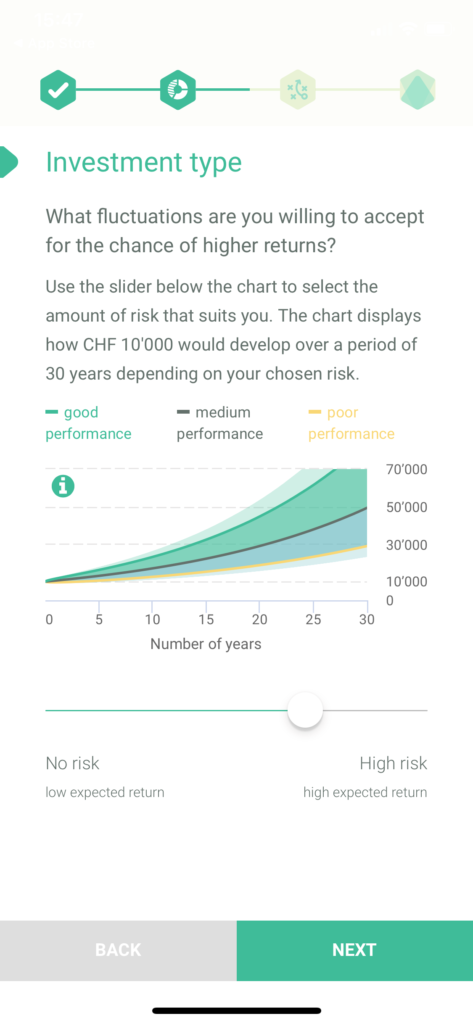

The next screen is similar, although now it shows the potential returns on your investment over the long term. You can drag the slider to adjust your risk profile:

Standard questions for financial compliance are up next – how much do you know about investing? Make your choice and tap next:

You’ll then get an assessment based on the past two choices, which gives a nice summary and the reasoning behind your profile:

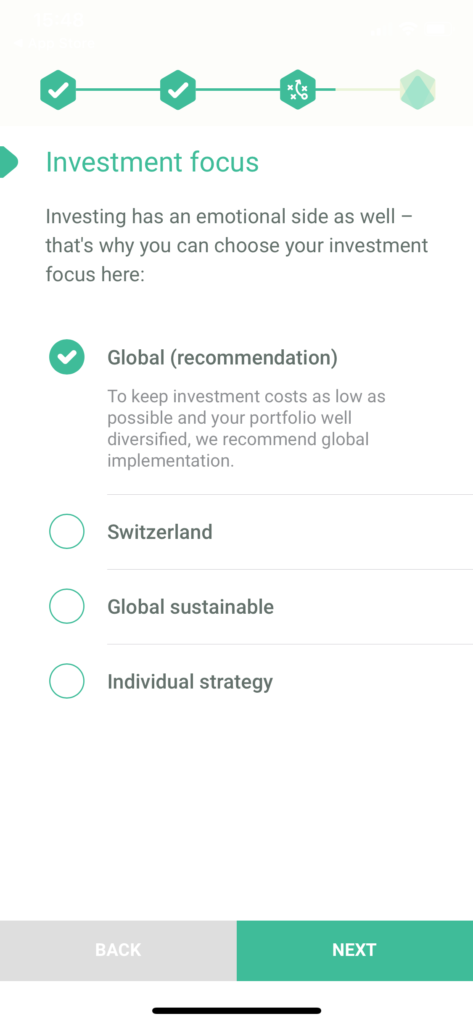

At this point you will start to shape the structure of your potential portfolio. Again all of this can be changed, but generally the global option gives you the most diversification:

And here we go- already we have a portfolio proposal and some future forecasts.

The ‘Global 80’ consists of, unsurprisingly, 80% global equities (e.g. ETF index funds). You can rotate the wheel for the other options, all the way to 100% equities should you wish.

You can also tap the ‘Details’ on the top right to read more about the investment strategy, and what will be included specifically in your future portfolio.

For this demo we’ll select Global 80 and tap ‘Select Strategy’:

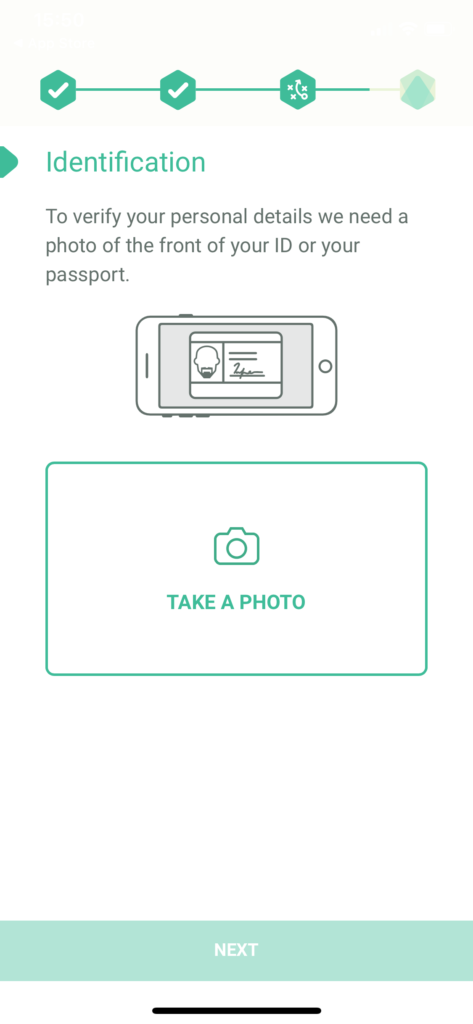

Next is one of my favorite concepts about fintech today in Switzerland – disrupting decade old processes and bringing a massively optimized solution to verify users.

No more signed notary passport photos, or registered letters to post – just take a photo and you are done:

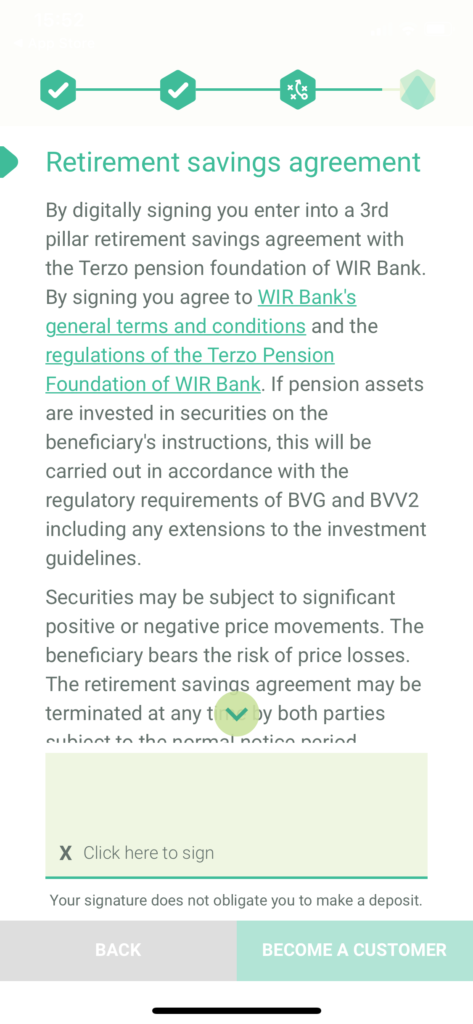

Terms and conditions up next, which you then need to electronically sign with your finger:

Congrats – you’ve opened an account. How easy was that?

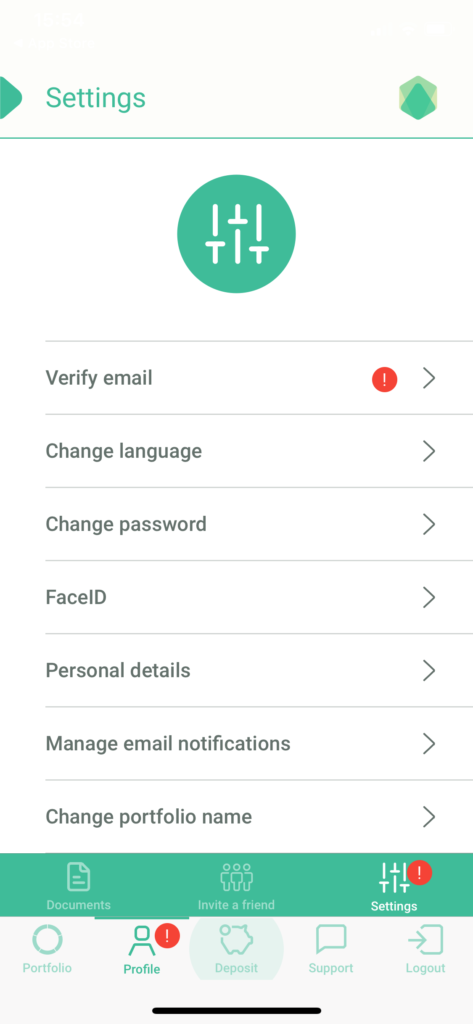

One last thing you need to do before using your account is verifying your email. To do that, tap profile, settings, and ‘Verify email’. You’ll need to enter the code waiting for you in your inbox:

… And that’s it. Your account is open, verified and ready to be deposited with your CHF.

Funding the account

Funding the third pillar is straight forward and can be accessed directly in the app under ‘Deposit’ from any screen. From there you’ll see the bank details to make the transfer, which can also be used to setup a monthly payment – just calculate it correctly to avoid going over 6.8K.

Login & Security

As expected banking grade security is present and of a similar standard to regular online banking. You be asked to create a secure password and you can enable Face ID on iOS. SMS alerts and verification are used for large portfolio changes.

In terms of the cash and securities, they are excluded from being touched should WIR Bank or Credit Suisse go bankrupt.

Viac Fees & Charges

VIAC is transparent and upfront with the fees, which are based on the portfolio you have selected. The standard ‘non invested’ version (like a plain vanilla bank account) is completely free, you only pay when you have equities.

The more equities in the portfolio, the more you pay – but refreshingly with VIAC, the difference isn’t by much as you can see via the table below:

| Global 20 | 0.18% |

| Global 40 | 0.30% |

| Global 60 | 0.42% |

| Global 80 | 0.53% |

| Global 100 | 0.53% |

For the latest rates visit this section on VIAC website.

Customer Support

The live chat is pushed as the preferred method for support and has been very responsive with our tests and support queries. Phone and email are also available.

Additional Resources

I feel expanding the knowledge base and enabling more community interaction would be an interesting idea to explore in order to support their content marketing efforts.

Topics around the various portfolio options available, market trends and thought leadership would be interesting reading (for me anyway) with some product experts chiming in to fuel the discussion.

Reader offers & deals

VIAC are now offering free management on your pilar 3A up to the value of 5000 CHF for an entire lifetime. Due to the volume of discount codes been added to the comments, I’ve pasted them into a single Google Sheet for you to grab them:

-> https://docs.google.com/spreadsheets/d/1Yh7C-9mwuQtRn9JpgTHU4jsPYb1LacLOlJ4ew2pUt5Q/edit?usp=sharing

Enjoy 🙂

🎁 Bonus: Remember to check out my pillar 3A comparison page which lists the top providers in Switzerland and all the current Investing Hero reader deals & bonuses. Enjoy!

Closing thoughts

At the time of writing you’d be hard pressed to come up with reasons not to invest your third pillar through VIAC. Unless something considerable happens in this space the mainstream banks are still a long way off from competing with VIAC. VIAC won’t give you a sitdown meeting and free coffee however.

We could start to see more roboadvisors offering this, but for now the options are limited and VIAC remains the market leader. Until they get bought out by a cantonal bank, its a smart move for a third pillar.

2021 Update

Since this review was published there have been many other providers entering the space, including Selma and Finpension to name a few. Be sure to check out my comparison page for more details and to read about the latest reader offers and deals.

Comments are closed.

Comments: 135

Here are some working codes to get 500 CHF managed for free:

zC1Kub9

JCYRZQh

oCYR20P

BCELfWY

1Czed0s

In case anyone needs a new code (2021):

5CcftW1

OCxFNez

I share with you my codes of the day (February 2021)

WCGVzvm

RCnrU9C

Thank you for the comprehensive article! very nice. If anybody needs more codes – here you go:

KCq5xw4

BCtS0oK

eCgjwXB

fCDvMUh

1CMlalH

Awesome! Thanks for sharing.

Thank you for this interesting and comprehensive article!

Here are some working codes to get 500 CHF managed for free:

CCt5Xoa

CCOxDTf

fC08Aon

oCGTjK2

Welcome Vince & thanks for the reader codes 🙂

Thanks for the article! I just invested and I’m glad I read this.

Here are some codes for anyone seeking to get their first 500 CHF managed for free for a lifetime:

MC3hJWz

ZCLDjg5

4CyQrjH

Nice Jan, thanks for sharing!

Great Article, contains everything I wanted to know.

My codes

JCcK9UB

zCpfcmZ

Thanks for the feedback Gian and the reader discount codes!

Thank you for this article!

In case previous discount codes are no longer working, mine are

pCtcwT7

SCLFp1y

uCQFzSe

Thanks for sharing Javier!

Thank you!

“Fresh” codes to profit:

cC9e3Te

DCjEnuK

pCTvyVS

Have fun!

Danke für die vorhergehenden Codes 🙂

Hier noch aktuelle:

EC8VHEi

ECtp24B

fCeX578

Cheers

Here you go, another “fresh” code:

XC4EI8h

Here are 3 more codes in case the last ones are outdated :

mCI48q1

1CJWteh

Hi everyone, here are some more codes in case you already haven’t signed up. Highly recommended!

SCMoiN2

eDChJD

Regards

Neue Codes vom 03.06.2020->

Verwende bei der Registrierung folgenden Code:

HCjRYuJ

PCoYXXu

8CUxUM8

Wow, ich hätte das nicht gedacht. ETFs statt Aktien Fonds. Das nenne ich die modernste Art von Vorsorge in die Säule 3a, die auch wirklich Sinn macht. Vielen Dank für deine beratetenden Worte über viac.ch

Ganz neu: Verwende bei der Registrierung folgenden Code:

QC4LcNP oder 9Cygmj7

Dann erhällst Du auf den ersten CHF 500.00 Vorsorgevermögen keine Verwaltungsgebühr – ein Leben lang!

Hi everyone, here are some more codes in case you already haven’t signed up. Highly recommended!

qCvodmm

uCxUljm

gCJRKSo

uCevkk2

Here is one code I generated today:

xCm2lwu

4 more codes generated today:

-KCX2rAR

-ACRRHuo

-3CRWi4l

-gCPEOg4

Oh wow My codes were actually used by 2 people. Who would have tough …

Here are 2 more just in case some one needs it:

cCrFKIy

2C49wkj

Thank you for the review and the codes ! I used one from above ! Great stuff:

Here are some generated today:

GCQdzpm

0CVNpX5

eCdMvXn

Some working codes in case anyone is interested:

MCJQDKE

LCThbWd

iC3NGT1

Hi there,

good review. I just opened my VIAC account – like the flexibility and low fees.

You take some, you give some – here are three codes, freshly minted:

zC1pW1o

QCo8jQ4

4C0DvTB

Cheers,

J

Hi everyone, here is a fresh referral code: rCLMrdh

Feel free to use this referral code to get 500 CHF managed for free:

JCIMNKI

GCNrriv

TC9Op2y

Feel free to use this referral code to get 500 CHF managed for free:

VCfMkys

Fresh codes!

jCZ8JWm

XCIieHG

VCBNuVl

Hey – great review!

Feel free to use the following referral codes:

dCaEWuV

zCiIZ2J

7CfmGUY

UCI2ddb

oCQdoIN

Neue Codes

9CCfaAr

sCKAOvY

kCJhoyM

7Cmhxr2

DCyWbKo

Thank you for the review!

If you are looking for referral codes:

cCQy3n4

gCEuDmJ

Hello,

I have a doubt regarding VIAC or UBS. I have 3a in UBS without been invested in any funds and I would like to put in a funds. I was going to transfer my 3a pillar money from UBS to VIAC but UBS worker told me that there is no commission in you have a 3 pillar in UBS and put the money in Vivainvest fund. Please, read below the conversation I had with the UBS worker:

Hello Jesus,

Yes there is indeed fees related to the vitainvest fund but it is supported by UBS.

The client does not pay any fees/charges related to funds invested through 3rd pillar.

The fees apply for regular fund (outside of the 3rd pillar).

I hope this answer your question and I remain at your disposal for any other information.

Have a nice afternoon

Best regards

UBS Switzerland AG

Agence de Neuchâtel

Conseiller Clientèle

Anthony Ribeiro

—— Message original ——

Hi Anthony

I found fee in Vivainvest https://www.ubs.com/2/e/files/RET/FS_RET_CH0293174600_CH_EN.pdf

management fee 1,28% and ongoing charges 1,67%.

Please, can you check it. You informed me that invest my 3rd pillar in vivainves doesn´t have any fee but the brochure says yes.

Thansk

Jesus

Is it correct the info he gave me?

Thanks for your help,

Jesús Sanchez

Feel free to use the following referral codes:

6CpdkmJ

TCyaZ1h

OCmbASg

4CsnwSb

Hi, thanks for the helpful article!

Feel free to use my codes for an easier start:

qCqCBvs

RCIsc9a

gCNZ2gW

@Jesús Sanchez – Are UBS saying the fund is free in that case? 😀 No commissions, no custody, no entry/exit, no conversion fees… lol yeah right.

Hello, I would like to share my codes too:

LCKihAO

UCbBtjT

9CwwkrH

Hi, thanks for the very helpful article.

Here are some fresh codes if someone is interested:

nCaDouI

wC043sV

gCzfhuF

Here are some new codes:

bCms6n9

8CbvPuu

yCmWzNC

gCX01Eg

Each code is new worth up to 1500.- CHF of assets managed for free!

I recently opened my VIAC account and I’m very satisfied. Here are my codes to get 500 CHF managed for free:

1Cf97H8

TCWI2yj

qC0mj1f

I have Viac since 1 year and I can only recommend it. i have 3 accounts. global 60 where i transferred the money from a previous bank account, and 2 young accounts global 80 and swiss 80. overall about 4% plus this year. not bad, considering covid!

some codes below, as the referral program has just been improved, increasing the tax free amount from 2000 to 5500 chf!

nCDatkB

BCY6Eih

PC0tV2w

RC0jvAz

bCSIPO1

KCoeWJN

0C7iESr

CCYfrqt

Fresh codes for you all.

VIAC changed to get up to 5K managed for free:

8CzffBY

LCdfczw

Some new codes:

QCW0QYc

qCNej7o

sCUUUO6e

8CLvVq1

KCTfjfQ

Good article. I’m absolutely satisfied with Viac and recommend it to everyone.

Codes to get 500 CHF managed for free

uCusmun

ICqjucw

Cheers

Here are some working codes (as of 13.11.20) to get your first 500CHF managed for free:

2C5Y8oi

TCxb2rH

BC7wcxE

zCA8XtO

gC13kPL

hey all… quick question… how does one apply these codes ? only whenever money has hit/been deposited into the viac account ?

Hi all,

How do these codes work?? Only during initial viac signup?? I created viac account last year before finding investinghero.ch.

Cheers

freshly generated code (16. November 2020): PCOtHus

These codes were freshly baked this morning-16.11. Enjoy your first 500 CHF managed for free!!!

lCf9gzu

pCnm1K

pCnm1KA

UC6fAWu

Some new codes her:

BCvl5gD

uCYtrgt

ACYC3JS

YC2RhyN

Thanks for the article! I’m also very happy with VIAC 3a so far.

Here are some more codes for people to use:

VCQam81

aC9bhvr

vCXN465

QCC9V5E

Cheers!

Great article! Very happy with VIAC 3a! Here a few codes, for others to enjoy as well:

ECIR7fB

oCSiJzl

SChkqgX

HCerO14

cCbwrrY

Hallo!

Dank dieser Empfehlung bezahlst du auf den ersten CHF 500.00 Vorsorgevermögen keine Verwaltungsgebühr – ein Leben lang! 🙌

Verwende bei der Registrierung einer folgenden Codes:

rCgPXeC

ACGB2uh

wC4I4HX

4CSiG7U

Viel Spass beim Sparen!!

Gruss

Simone

Hi all,

here are new codes:

hCOyars

dCzIu6c

yCxMUcD

Regards,

Klaus

Hier sind weitere Codes für euch

zCS9knZ

mCvYHz0

GCNeMaL

zCnSwHf

4CJH13K

VIAC was absolutely the right choice. If you also want to move your 3rd pillar to VIAC you can use one of these codes to get your first 500CHF managed for free.

0CUDwzI

sCJ90bP

RCdVxwu

…und noch ein paar neue Codes:

mCVqRW5

hCSuBdS

jCVeDC1

gCib4wl

JCZNuQH

Thanks for this great article, it convinced me to switch!

Here are a few fresh codes for those who need one:

zCAVBhY

GCxgDHu

mCHrgkB

OCCKk3Z

5CILgz2

Use the code and get your first CHF 5000 managed free with VIAC. Last three left only

zCiX2Ub

8CTQMGl

tCzo6fd

Thanks for this wonderful article Mr IH.

get FREE maintenance of your first CHF 500 with codes below:

YCurxpz

4CAejd0

MCn4uNj

UC4WEFG

MCakA5G

Thank you and enjoy your CHF 500 freely maintained with VIAC

Referral codes for administration fee waiver; get your first 500 CHF managed for free for your entire lifetime 🙂

sCQqFLd

kC8gfNo

sCidN4r

NCBP1rY

pCwKzyo

Thanks,

David

Thank you David for sharing.

Thank you so much for sharing this article, really helpful.

Some very fresh codes to save fees on your first 500chf with VIAC (only these two left)

jCxYt6N

RCpM2pP

Thank you!

Great, thanks Fernando!

I just joined VIAC thanks to your review!

Here a some new codes for other joiners (no fees for first 500 CHF invested):

7CYICQN

BCLoykl

7C6cUJE

5Cgm6wr

Thanks for sharing Alexandra!

Thanks for the article!

Paying it forward with the referral codes:

dCw8U0K

LCwDUUV

WCOQQJ6

iCW5hkM

ACDAz7j

Cheers,

Daniel

Welcome & thanks for sharing!

Referral codes for administration fee waiver; get your first 500 CHF managed for free for your entire lifetime 🙂

KCAFcEM

LCpCqFn

9CT2krq

mCgyQB4

yCETQqX

Thanks,

Mirriam

Thanks for your review! I just joined VIAC and got a code through the comments above. 🙂 Here a some new codes for other joiners (no fees for first 500 CHF invested):

iCkzrJI

HCBAUUJ

qCQV5jn

Thanks for the article! I’m also very happy with VIAC 3a so far.

Here is my last code to get your first 500 CHF managed for free for lifetime.

ZCBH57f

Thank you

Hi,

thx a lot for the review and thx for sharing the codes, too!

Here are new codes:

oCzsK3t

NC3fAPZ

hCH1GKx

QCqdJo6

rCViV07

Regards,

Klaus

Great article and review! Used a code from above and sharing mine if anyone wants to use and get their first 500CHF managed for free with viac.ch

UC40zET

nCxpFpM

Thank you

Thanks for the article!

Here are some codes for new joiners (no admin costs for first 500 CHF):

qCrFxW6

NCD8hkH

kChdQ9u

gCzVmfv

Thanks for the review, I’ve just signed up for VIAC in no small part because of this. 🙂

Also thanks everyone for your codes!

I would also like to share mine if you don’t mind, since it’s a win-win situation. Get rid of the administrative fees on your first CHF 500 for life. If one of the codes is already used, try the next one.

Don’t be alarmed when you can’t enter the code right at the beginning of the registration: The code can be entered towards the end of the initial sign-up process.

DC1VS7c

ZCjKCWZ

ZCIMSuF

ZCKOLyQ

mCbxzPF

And here are the codes of my SO 🙂

wC51XdZ

JCjHXBK

lCdAzdi

jCX8hPZ

Cheers and happy saving/investing!

LM

Great article, and thanks for the codes.

Here are some fresh ones 🙂

0C2CCMj

sCGuNvC

fCDkeRC

CCr4AfU

XCxuCli

Thank you for the article.

Find below referral codes (no fees for first 500 CHF invested):

4CGRqpF

rCGMNFk

LCrBWxg

vCFkSFR

Paying it forward also with the referral codes 🙂

wCZJZK6

3CAvWA6

6C0brHZ

0C2p5nh

Thanks a lot for the article

Here a some new codes for other joiners (no fees for first 500 CHF invested):

BC6i0dC

QCdyTSh

fCSkhs1

ICmoLNZ

6C5LABI

Best regards,

Ismael

Thanks for this great article!

Here are two of my referall codes to save the management fees on the first 500chf

LCAwGxx

UCJZ2al

Thank you!

Hi,

Thanks for the review and also for sharing the codes!

Paying it forward with 2 new codes:

1CFzubY

0C0AM9g

Regards,

Daniel

Hi

Thanks for the review.

Here are new codes:

dCfE8JG

pCY0EyP

nC2GlBn

fCNZ5jf

UCIOLLc

Regards

Hil

Hi,

Thanks for the review and also for sharing the codes! Here are new codes:

TCHQRsX

6C8orVK

kCqzixS

tCrHlWR

Hi,

Thanks for this great article.

Below are 4 new codes:

nCTm2lj

qCkzxMX

jCzhRBz

bCqUDMN

Regards,

Greg

Thank you very much for this helpful article. Please find below some more working VIAC codes so we can save together. Happy end of year holidays!

jC9f22g

8CYlT9i

9CBrvTQ

hCxO4no

Hello everybody and thanks Mr.IH,

Here are codes to continue the chain:

wCrLAXy

2Cqfnux

YCKRPnq

Nice review thanks. I second your review completely. Viac is by far the easiest investment platform for 3a pillar I’ve seen around.

A few more codes to get 500 CHF off:

bCJaFOH

uCUxF9N

VCrV7Wk

Thanks for the review! Some more codes:

JCUdyYc

1CSRUR5

xCphNyl

mC2PhNe

PCRSA5X

Thanks for the review.

Use the following code to register to get 500 off:

NCcTzpa

lC3RbkE

jCttjEu

qCgztck

7CNyeIt

Thanks for the article.

Here are some codes :

8CJZOAs

tCVtbtV

9CgNunA

Hello

Referral codes for administration fee waiver; get your first 500 CHF managed for free for your entire lifetime 🙂

yCy2oie

5CSkZJs

XCV9m2G

MCwrRsU

Thanks,

Chriso

Here are some of my new codes:

XCdvINX

fCoP2xY

OCVYVMe

9CF9djt

Thank you for this guide. Your tips and info was very helpful !

Great review, thank you! Here is a code to get 500 managed free:

5CU39Ct

Thanks a lot! Here 5 more codes:

TCUPqzw

oCOSxwQ

pCICHAM

CCgSllp

sCjDCjt

Hi,

again, thx a lot for the review.

2 new codes:

DCVQMhJ

lCUaoYu

Regards,

Klaus

Hey,

Here are three new codes for VIAC:

– VCcLHSq

– 8CBeWC9

– bCFJKLo

Many thanks !

I also have one more referral code for VIAC:

cCdXQ40

Apply at the end of registration to use VIAC and have the management fees offered for your first 500.- for life.

Anymore codes pls?

Thanks!

Here are 4 new codes:

sCwxnr8

kCTAEti

JCTWJuT

3C41xCG

Regards.

A fresh code!

CCH3idl

Cheers! Ale

Thanks a lot for the article

Here, my referral code to save fees on the first 500chf

FCYcrjs

QC85zks

RCaVIHz

4CoYUAD

eCZCy9e

Best regards,

Ismael

Thanks for your great advice!

Here is a referal code for VIAC: JC505hq

Thank you for the report. Viac.ch is a great solution for the 3rd pillar.

Use one of the following codes and you will get 500Fr. managed for free:

nCYVZJW

yCkHYli

HCDxlRe

Here are three referral codes for VIAC:

– LCgN2jy

– nCjWwgZ

– rCDviWl

Here are my codes:

qCMhbti

8CkGrbs

rCZynjj

9C982WU

TCN9lP5

Best

Gian

Thanks for the quality info!

These are currently valid quotes to get 500chf taxes saved:

KCOHjEl

uCmK69M

SCvu0wx

sCbKz5h

Happy savings!

Thank you for the review. I am glad I chose VIAC.

For those who still need to create a VIAC account: use one of the codes posted here to save on fees.

Here are a couple new codes:

5CrefXD

cCRnlqB

BCO49wo

Hello

Opened an account with VIAC on Monday and sent in money yesterday. New referral codes to save mamangement fees on your first 500 CHF asset below:

rCuW2nQ

JCCSEiQ

Cheers

here some new referral codes to save management fees on your first 500 CHF asset:

5CWHIVy

2CB6DuT

qCRFRA4

pCUJE4

iCxGNub

Thank you for the detail write up! Very useful. 🙂

Here’re referral codes for saving management fees on your first 500CHF:

4CnEeL2

RCyZR4d

New code 🙂

1CtOd9s

Use the following code to register:

uCO2LD7

eC5r4Be

I moved my 3a savings to VIAC a few months ago and am happy about it.

To save the management fees for your first 500 CHF use the codes:

NCewCfr

yCT7Wlf

oC4fCmG

Fresh working codes as of Feb 22, 2021:

OCfgjv1

WCzMi4k

I have new codes available:

pCBifPy

kCocUhI

fCUZiZc

NCtm4Xb

lCq82RQ

In case you need some unused VIAC referral codes:

XCcloy4

4CNqI9x

dCIFIc7

uC5tlFz

QCvWwpg

More codes to save the management fees of your first 500chf with Viac3a

hCN605Q

aCamVYl

3C0ZphZ

tCX67J8

nCZQdZN

I can also highly recommend VIAC. I opened multiple portfolios with different strategies (Global 100, individual unhedged global 100, NASDAQ-focused).

I hope the following codes can be of help for those who are considering opening an account:

JCd3Yyb

HCfmg8O

sCusqlw

pCh3NIu

5CB43cX

Hi guys!

Some more codes to profit from:

2C5V8kB

kCzVzKO

GC9V6qC

1CU71vJ

4CMhnmz

Hello

New codes for you

cCChTVG

zCa05PV

aCm3mRH

lCcJ3Go

HCMFFS9

Hi all,

one more code for you:

VCTMro2

By the way, Viac just reduced some costs, too!

Regards,

Klaus

New codes:

wCJblat

dCrsVbB

XC0eT8s

More codes to save the management fees of your first 500chf with Viac3a

iCILQsm

3CqmQ4B

2Ce5nJg

Set up ur account now, best decision ive ever made!

Fresh codes to benefit:

rCSPkK5

ACGl6At

7CfvKbt

My last code for free management of your first 500 CHF:

xCcxgM9

Due to the volume of discount codes been added to the comments, I’ve pasted them into a single Google Sheet for you to grab them:

https://docs.google.com/spreadsheets/d/1Yh7C-9mwuQtRn9JpgTHU4jsPYb1LacLOlJ4ew2pUt5Q/edit?usp=sharing

Enjoy 🙂

Thanks for creating the google sheet.

If needed, new codes:

pCXoORK

FCXCb1Y

bClppfW

Hey,

Here are three new codes for VIAC:

– FCAWzjn

– MCVW2SE

– PCd36JZ

Many thanks !

Viac fits well into a minimalist life style.

– Incredibly efficient registration (takes around 10 minutes and when using the code 5CSAYB6 in the registration process, you pay no administration fee on your first 500 CHF pension assets)

– Great customer service (fast response)

– One app, no extra mumbo-jumbo

– Can be used for tax-returns if you pay standard tax or “Quellensteuer”

Very satisfied.

Use the following code to register:

zC54Z8z

Have fun!

Here are 3 new codes for your registration at VIAC 🙂

I’m glad if you use one of these.

With this code you will invest your first 1’000 CHF for free – for a lifetime.

cqb5TFF

mdfYjVi

46TpXLy