Selma Finance Review: Pros, Cons & How it Compares (2023)

This page is also available in:

![]() Deutsch

Deutsch

Overall rating of our Selma finance review:

4.7 ⭐⭐⭐⭐⭐ · 🏆 Best Allrounder ·

At Investing Hero, we aim to provide the best investing platform reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence our reviews. Our opinions are our own. The information provided on Investing Hero is for informational purposes only. Please read our disclaimer.

Right then, lets get started with this Selma finance review. Selma Finance, with it’s bold pastel rich branding, was founded in 2016 and claims to go beyond your standard roboadvisor platform by offering a more personal experience through ‘investing done right’ in order to ‘match your life’.

Sounds interesting, right? And potentially for Selma, a great way to standout from the competition and offer a more tailored and simplier experience for investing your money in Switzerland.

🐻 Beast Alert: This review totals over 3,000 words and took me 20+ hours to complete! Use the table of contents below to skip to a topic of interest. You can also download the PDF here.

🎁 Reader Bonus: If you are ready to try Selma for free, don’t forget to use this link when you register to reduce your management fees to zero for an entire year!

First impressions – I’m curious. But will it result in a basket of expensive & trendy ETFs cloaked under some marketing spin, or something a little different?

Before we dig into the details, let’s address the elephant in the room.

The elephant in this Selma Finance review?

…The emojis 😱

Selma Finance, I love what you are doing in fintech. And I’m no stranger to laying down the odd emoji myself from time to time. But honestly, your addiction to the emoji is a little too extreme, to the point of being a little, well.. weird.

There are just. So. Many. Emojis.

I get it – I’m not your ‘target market’, emojis have a ‘love hate relationship’, finance isn’t all ‘grey suits and ties’ etc etc.

And that’s cool. I get that.

But please, consider a monthly ‘emoji audit & compulsory culling’ on the weekly team meeting agenda. That’s every weekly team meeting agenda, please? 🤪

Ok good, at least we’ve cleared the air. I won’t mention the E word again.

Selma Finance has some seriously cool and far more interesting tech under the hood which I want to get stuck into.

Let’s move onto the good stuff.

Selma finance review: Pros and Cons

| Pros | Cons |

|

|

Account Opening

Selma has an extremely slick and technology driven approach to the account opening process.

From the homepage, you are guided through the process via a personal ‘chat’ with the Selma bot, the conversation of which later forms the basis of your investment profile, or ‘planet’ as Selma calls it.

This onboarding process is refreshing due to the lightweight nature compared to other investment platforms. No heavy forms or PDFs to scan.

Throughout this process, there is the reassurance of customer support via the live chat, almost annoyingly so with banners and popup chat windows. This reassurance of help on demand no doubt supports those on the fence with opening an account.

How to open an account with Selma Finance

This selma finance review will take you through the process step by step to opening and creating a new account, so lets get started!

Visit selmafinance.ch, and from the homepage Selma gets straight down to business with the call to action above the fold. Click ‘Start for free!’, as shown below:

Enter your email and hit ‘Let’s start’:

Unlike other platforms, once you complete the above steps you are transitioned immediately into the risk assessment process, email verification can be completed later enabling you to continue the process without getting blocked.

Another win for customer onboarding.

Chatting with the bot

After the above steps you are moved into a ‘chat’ with the Selma bot to evaluate your finances to create your financial plan.

You can’t say hello back, so just click ‘Start’:

The next slides will ask for your name, age and location, before getting onto the first meaty question about finance.

At any point you can hit the question mark (see screenshot above) to expand on the reasoning behind the ask:

Next they’ll see how much debt you have, so think back if you’ve had any visits from Intrum Justitia recently. No? Good.

Any other valuable assets (be modest here – most cars are liabilities, not assets) to factor into your overall wealth:

Next, give a ballpark on the value of other investments you have:

Then drill down into the specifics of that investment… pretty straight forward with the drop down menu:

First question here indicates Selma is providing more than just the standard roboadvisor services, by looking at some budget basics of building a cash buffer:

» Related reading: How to create a simple budget plan

Onto timeframe questions, and how soon you’ll likely need to cash out your investments.

The sooner you need it, the lower the risk your portfolio should be:

Similar questions follow around your financial stability and commitment to investing, enter your numbers and hit ‘Next’:

The relentless bot questions do go on a little while, a percentage completion gauge or similar would be nice.. but you are getting close to finishing:

Only four more questions.

The higher your risk tolerance, the less you (should) be freaked out by 10% market drops. Make your selection and hit Next:

Another gauge on your investment goals, what are you looking to achieve with all this? Maybe a modest return that beats inflation, or something a little more? Make your choice:

Remember if you are investing in stocks, these drops are not a case of “if it will happen” but “when it will happen”.

No amount of blog posts and chat bots will prepare you for that 40% market crash. Make your choice:

Final question.

Once you’ve sobered up after drinking that bottle of wine after a market crash, what do you do?

The investment platform

Having worked through the above steps you’ll be presented with your investor profile, essentially a dashboard interpretation of the data you just entered which gives a nice overview.

Hit ‘Get your investment plan’ to move along:

The calculation of how much to invest is presented next, which again sets Selma apart from other roboadvisors by showing a more holistic view toward having a monthly budget.

You can expand the accordion for more details, and hit ‘Next’ when ready:

And finally – you can now get your hands on your investment ‘planet’. Which is Selma speak for a portfolio.

Nice and simple for newcomers, and there are some details to explain the reasoning behind the selection. Pros can click ‘advanced’ and geek out in a little more detail on the ETFs listed.

From the dashboard you can see what your planet comprises of – equities, bonds and real estate in this example.

Considering the target audience for Selma, it’s fit for purpose and hides a lot of the more technical details around your investments.

When ready, click ‘Next’.

A little historical data to show you how your portfolio, sorry I mean planet, would have performed had you invested 4 years earlier. And that’s without any further contributions to bump up your compound interest.

Although personally, I’d like to see some 5-10 year time frames available. 4 years is generally regarded as quite a short timeframe for equities and long term investments.

Regardless, in the long term it’ll be looking pretty rosy!

Hit ‘Next’.

The next screen will give you some scenarios on what your planet will look like when the market dips, and when it really tanks, as it did in 2008 financial crisis:

💡 A nice addition here would be seeing how the planet would look 24mths after these worst-case scenarios. For example, if the investor had the guts to hang on during these declines, and keep investing each month.

Time heals all planets – and suddenly these doomsday scenarios don’t look as bad for the newcomers with long term investing in mind.

Click ‘See how to start investing’ to move on.

Opening an account

At this point, Selma has passed you straight onto the live account opening process.

After clicking ‘See your price & open account’ you’ll be given a breakdown of how the costs and fees are calculated based on your deposit, as shown below:

From here, you are only a few short steps away from opening a live account which will be verified online.

Keep in mind you need to deposit a minimum of 2K CHF to get started. This is straight forward and can be done via bank transfer to their custodian bank, which will take a couple of days.

Login & Security

As expected, SSL encryption and https connections are standard, with two factor authentication also available for added peace of mind. Like many other roboadvisors in Switzerland, your investments are not directly held with Selma – but with a custodian bank. With Selma, that’s Saxo Bank, a FINMA regulated Swiss bank.

Fees & Charges

As is typical in the roboadvisor space, compared to a bank Selma fees are very good. Robo advisors tend to avoid transaction costs, entry & exit fees, custody fees etc etc – and Selma is no different.

In 2021, Selma updated their fees to the above become more competitive. The management fee is between 0.47-0.68% (free however with our invitation link), depending on your account deposit amount, with product costs (e.g. ETFs which make up your portfolio) are on average 0.22%.

> Under 50K CHF = 0.68%

> 50-150K CHF = 0.55%

> 150K+ CHF = 0.47%

A few important points include:

> The amount includes your deposits and your earnings – this is a big one, and not always the case with other roboadvisors!

> Includes pillar 3A contributions – so if you invest 50K + 6.8K in a pilar 3A with Selma, you get the discounted (0.55%) rate.

It’s important to remember Selma pitch themselves slightly differently to other roboabvisors on the market by offering a more tailored personal experience for newcomers, which comes at a small premium compared to say, Truewealth.

Customer Support

Customer support is excellent at Selma and queries receive timely and accurate replies, even at the weekends.

There is also an extensive self-service support section (kudos to Selma for optimizing the content marketing to maximise search engine traffic) with a huge wealth or FAQs and common topics already covered.

Selma vs True wealth

You can read the full True Wealth review here, but let’s look at some of the data on Selma vs true wealth in this simple comparison table:

| Selma | True wealth | |

| Investing Hero Score | 4.7 | 4.5 |

| Investing Hero Rating | Best Allrounder | Best Allrounder |

| Management fee | 0.47-0.68%* | 0.5% |

| Product costs | 0.22% avg. | From 0.17% |

| Account min. | 2K CHF | 8.5K CHF |

| Custodian bank | Saxo Bank Schweiz | Saxo Bank Schweiz, BLKB |

| Sustainable & impact investing options | ✔️ | ✔️ |

| Personal budget features | ✔️ | ❌ |

| Pilar 3A support | ✔️ | ❌ |

| Free demo account | ✔️🔗 | ✔️ |

* This is reduced to free for an entire year when using the Selma finance invitation link.

Selma vs Inyova (Yova)

You can read the full Yova review here, but some of the top level metrics are shown below:

| Selma | Yova | |

| Investing Hero Score | 4.7 | 3.5 |

| Investing Hero Rating | Best Allrounder | Best Custom Impact Investing |

| Management fee | 0.47-0.68%* | 1..2% (lowers over 50K) |

| Product costs | 0.22% avg | Included in the above |

| Account min. | 2K CHF | 2K CHF |

| Custodian bank | Saxo Bank Schweiz | Saxo Bank Schweiz |

| Sustainable & impact investing options | ✔️ | ✔️ |

| Personal budget features | ✔️ | ❌ |

| Pilar 3A support | ✔️ | ❌ |

| Free demo account | ✔️🔗 | ✔️ |

Additional Resources

A nice feature with Selma is the openness around the future direction and development of the investing platform.

They share the roadmap via a trello board, reviews, and user feedback – treating the platform very much like a ‘Software as a service’ product which will evolve and improve over time, something not typically seen in the investing space. Have a browse through.

Sustainable investing with Selma Finance

According to the Selma website, the demand for sustainable investment options has increased significantly in the last 12months. Quesitons such as ‘Does Selma finance offer sustainable investing’ and ‘how to avoid investing with bad companies’ have made their way onto the roadmap.

You can simply enable sustainable and impact investing options in your account by switching the option ‘on’ from your blueprint page, as shown below:

The above setting will ensure you leave out companies dealing with weapons & firearms, tobacco & alcohol, gambling & porn, GMOs and thermal coal.

The sustainable investing option will also avoid companies facing scandals with environmental issues, customer protection, human rights & fraud.

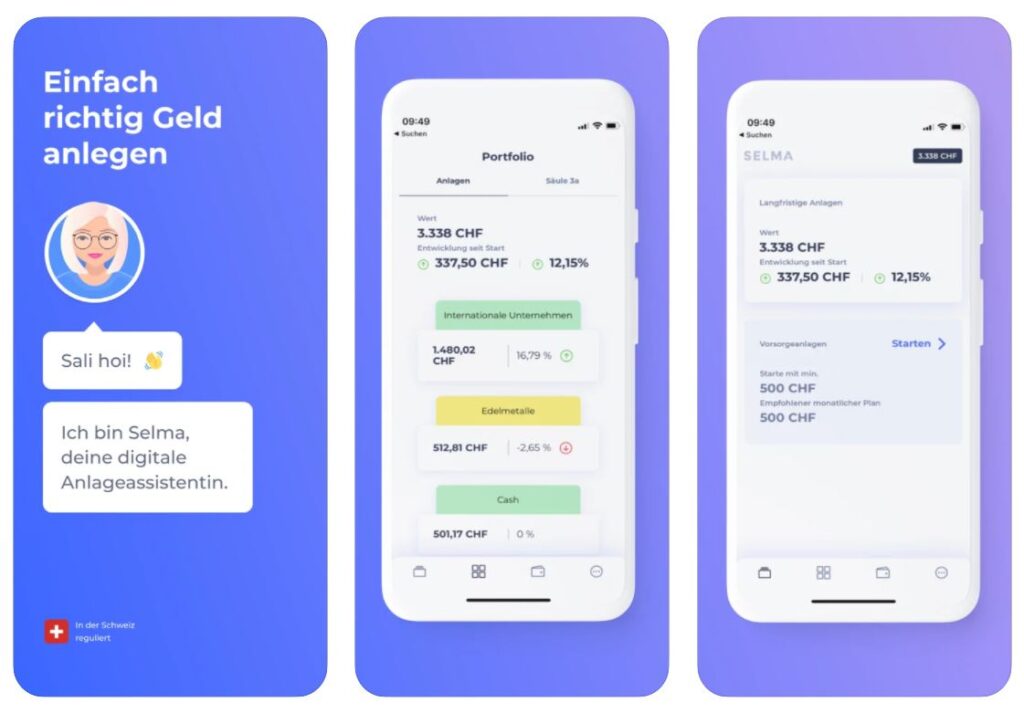

Selma mobile app

Just before summer 2021, Selma launched their all new mobile app for iOS users. The app has been a long time coming and a frequent request in the Selma public backlog, so it’s great to see it finally out in the wild.

Using the app is free and simple, and enables you to check your account details much faster than before. If you haven’t already, it’s worth checking out on the Apple app store. I guess the only negative here is Android users are left out (for now..).

Background info on Selma Finance

Selma Finance was founded in 2016 by a team comprising of four founders – Patrik Schär (CEO), Kevin Linser, Mikael Roos and Valeria Gasik. They also have a team of investors supporting the business, and have over 1000+ clients in Switzerland with double digital millions assets under management.

> Related reading: “Interview with the Boss: Selma Finance CEO Patrik Schär“

Headquarted in Rütli 9c 6415 Arth (also with an office in Zurich) the company has Swiss and Finnish roots, you can read more about their background on the about section.

Reader offers & deals

We’ve partnered with Selma to give our readers (that’s you!) a special offer when you open a live account. If you use the following invitation link you won’t have to pay ANY management fees upto 5K CHF for the first year.

That’s completely free portfolio management, for an entire year!

Selma Finance Reviews from around the web

I thought it would be useful to include some selma finance reviews from other parts of the web here so you don’t just see mine as the only voice.

Across Facebook and Google, they have a total of 94 reviews. The vast majority of which are very positive.

Here are the top 3 “highest rated’ five star Selma reviews at time of writing:

- “Rarely has it been so well advised as with selma. I have never had a financial advisor who has so comprehensively pointed out risks to me in easily understandable language. What are the implications of this and that in the context. This is how I imagine it to be. What’s more, the costs are unbeatable.” – Adrian August Wildenauer (Google review)

- “Friendly and attentive support, simple, modern and uncomplicated structure. That’s exactly how you want to be able to invest in the modern digital age, no reading through endless papers, no intrusive brokers and market criers – simply a need that is being met. Who still invests in banks probably still lives in the middle ages ;)” – Simon Adams (Google review)

- “Simple and transparent way to increase your money on the stock markets. The Selma team is very helpful and answers questions in the live chat very quickly and competently.” – Beda Diggelmann (Google review)

On the flip side, here are the top 3 negative reviews:

- “Annoying ads. Without knowing the company their ads already make you dislike them.” – Leonardo Brandenberger (Google review)

- “Most aggressive marketing. Have absolutely zero interest on their solution.” – Bryan Coupy (Google review)

- “Very spammy Reddit ads. Not a chance in the world I will ever do business with them.” – Vlad Dogaru (Google review)

As you can see, the negative reviews relate to an old marketing campaign. Selma annoyed a few users on Reddit and Facebook with their advertising. Opps.

Filtering out these negative marketing comments, I couldn’t find any negative reviews related to the Selma platform itself.

Interview with Patrik Schär, CEO Selma Finance

IH: Welcome Patrik! To get started, could you tell the InvestingHero audience a little about your background, and how you got to being CEO at Selma Finance?

PS: “Sure! I’m a former banker and financial analyst and have worked in various positions in Swiss banking for a bit over 10 years

Then I became kinda uncertain if this is what I wanna do for the rest of my life. I ended up moving to Copenhagen to do my Master’s degree where I got in touch with the vibrant startup environment.

I was impressed by how close to the customer all those companies were. How could the banking industry operate so far from the customer while it’s about such a personal topic?

One thing led to another: met my co-founders, Kevin, Mikael and Valeria, in the Nordics, we discussed how in-transparent, overpriced, impersonal and unexciting personal finance was and started our mission to change that with Selma.”

> Continue reading the full interview

Closing thoughts on our Selma Finance review

Hopefully this Selma finance review gives you plenty to think about.

Selma do a great job at making investing accessible to newcomers and holistically looking at the bigger picture to building wealth. By factoring in budgeting, pension planning and an investment plan into a single platform, they differ from the competition and are more than ‘just another’ roboadvisor.

This added value comes at an extra premium, with prices slightly above the competition by a few dozen basis points which will turn away some – but their core audience will likely see the additional value, slick user experience and tailored budget planning worth the extra premium.

Thanks for reading our Selma finance review! 🙂

Selma Finance FAQs

Between 0.47%-0.68% management fee and product costs of 0.22%. However, using this link gets you free management.

Yes – just contact Selma directly and they’ll close the account and transfer the funds. The process can take a week and there is no additional fee.

Yes. Use this link and you’ll get free management for an entire year.

Yes, visit the following link to read more.

Selma finance reviews your entire financial picture, from gauging your risk appetitie to understanding your assests and how much you can afford to invest. From this information (and much more, see the full review above) Selma Finance will build an investment portfolio to fit your profile.

Your investments are in your name and you are the owner. In the event Selma Finance go bust, you can transfer them to another roboadvisor.

Yes.

Not yet. But Selma say its coming, so watch this space.

Not yet, but Selma are looking into it closely and more updates will come. You can view the current topics here: https://www.selma.io/topics

Yes. Dividends which are generated from your portfolio are automatically added to your account.

Approx 15K CHF, however some accounts run into the hundreds of thousands. The account minimum is 2K CHF.

Selma uses the Cape Ratio to work this out. The Cape Ratio is the price divided by the avg. 10 years of earnings adjusted for inflation. You can see more about CAPE here.

Comments are closed.

Comments: 5

Thanks for the great review!

Thanks Niklas! Glad you liked it 👊

Hey very nice blog!

Any cost if withdrawing balances from the investment account in Selma?

No – no costs there.