5 Simple Budget Tips to Try in 2022

At Investing Hero, we aim to provide the best investing basics. To support this, some of the products featured in articles will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence our evaluations. Our opinions are our own. The information provided on Investing Hero is for informational purposes only. Please read our disclaimer for more. The information on Zak is intended exclusively for persons domiciled in Switzerland. A Zak account can only be opened with domicile in Switzerland.

It’s coming to the time of the year where you might be starting to think about New Year’s resolution, or maybe just planning for holidays next year.

With Christmas round the corner and New Year celebrations in site, it is the perfect time to be thinking about how you’re going to budget for 2022 and beyond.

Have you got your short, medium and long term budget set? Don’t worry, most people haven’t. But that’s why Investing Hero is here to help. With some simple tips you can get yourself a really straight forward budget in place, pretty quickly.

Just follow these quick and easy steps to a successful budget.

🎁 Reader Bonus: I’ve partnered with Zak to bring Investing Hero readers (that’s you!) a 50CHF welcome bonus when you open a free account. No strings attached and no BS. Just use the code HEROCH to claim your 50 bucks.

Lets get started.

Here are 5 simple tips to help you with setting up your budget.

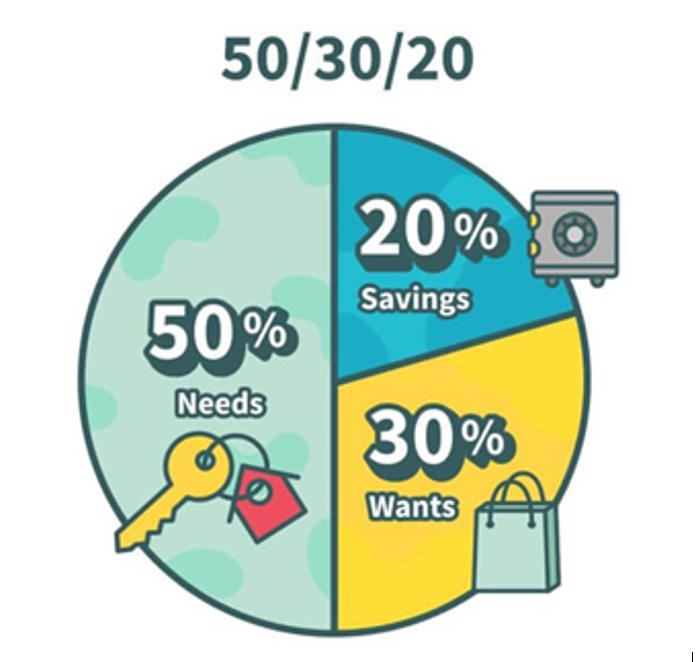

You might have heard of techniques like the 50-30-20 budget rule. That’s where you take 50% of your paycheck for the essentials, 30% for wants and 20% for savings.

Regardless of what method you choose, you should be logging the basics. So that’s the first tip:

1. Track it!

Logging the basics is really important. Record what your monthly income is and list what your fixed expenses are each month.

Things like rent/mortgage, gas/electric, phone bills, broadband etc. you know what they are, but make sure you are tracking everything.

There’s no need to get really advanced with your budget, a simple spreadsheet will do the job for you. Remember this is your personal budget here, not a complex corporate one.

2. Categorise it!

This part does mean a bit more work as you start to populate your spreadsheet with all your expenses. But make it easier by breaking them down into categories (this will help later as you get more data you can start to see trends in where your money is going).

Your categories are up to you; things like taxes, communications, food etc. are a good place to start. Don’t forget your separate category for savings & investments, I am Mr Investing Hero after all.

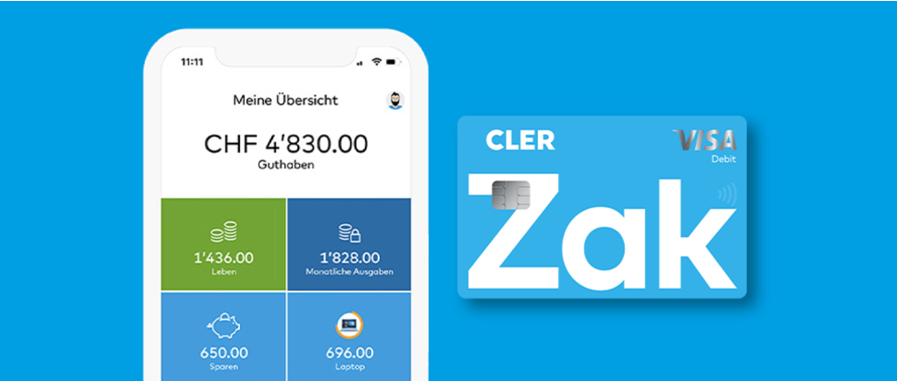

To categorise your expenses the pot system in the mobile banking app Zak by Bank Cler is great. The pots can be seen as your individual subaccounts within your account and make splitting up into categories very easy. So you can use the same categories you define in your spreadsheet in your actual bank account and have a perfectly organized budget right where your money is.

Also, if you have expenses split with friends you can enable the ‘common pot’ feature within the app. You can read more about that here. Worth checking out.

3. Detail time.

It might sound like hard work, but it isn’t. You’ve got your categories, now you need to go through your statements and add in every bit of detail you can. You’ll be amazed at those tiny amounts that come out of your bank account, how they all add and what you probably didn’t realise you were spending on.

So get all the details onto your spreadsheet.

4. Time to plan.

Yes, I promise it is fun! First, you should do the grown up stuff, like dealing with that credit card debt or car loan you’ve been meaning to pay off. Savings are important, but don’t save lots if you still have significant debt to deal with first. If you have a lot of credit card debt then I recommend a separate budget for that entirely.

The fun bit of planning is deciding what monthly amount you are setting aside for savings, investments and big purchases – like that holiday you’ve been dreaming of. If you start early with your budget it is easy to break down those big-ticket items; making the seemingly unachievable completely possible.

5. Trim and save.

This does sound less fun I know but will be worth it in the long run. Once you have done steps 1-4, trust me, you’ll want to do step 5. In analysing your expenses, you will quickly realise where you can start to make savings. All those quick and easy lunches out when you head into the office add up, and a year of those lunches add up to a lot.

That holiday you’ve been saving for?

Add all those lunches into that fund by taking your own sandwiches to the office.

Once you’ve completed this step and are managing your budget properly you can also start to get serious about your savings. You can read more about where to start your investments in my related article here.

Can you afford to ignore these 5 simple budget tips?

The truth is, you can’t.

We wouldn’t operate at work without a proper budget, so your own personal budget shouldn’t be any different. Follow these simple steps and you will be well on to your way of saving more, investing more and having more money to do those big things you have been dreaming of.

Swiss banking apps (such as Zak by Bank Cler) make this process easy – gone are the days of confusing paperwork and bulky PDFs – just open up the app and you can see the details you need.

Keep it simple and straight forward with a spreadsheet (there are plenty of free templates available online to download if you prefer). Commit to setting up the budget and then before you know it, you’ll enjoy adding in your monthly expenses so you can start to see where all of your money is going.

That’s when you can start to get creative with noting your category spending over time, set yourself targets or goals for particular saving pots, and if you’re really keen, then start setting yourself a longer term budget and making some long-term commitments on your saving and investments.

So as we approach the start of 2022, make these simple budget tips part of your new years resolution….a resolution that you’ll actually want to keep.

Thanks for reading!

Mr. IH

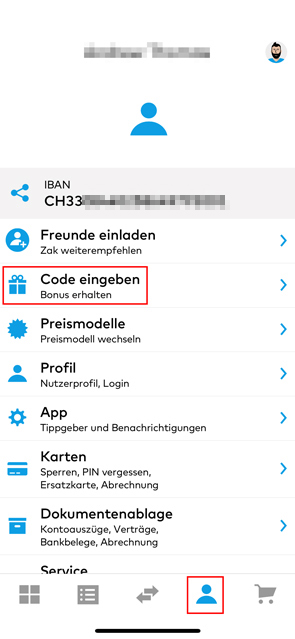

🎁 Reader Bonus: I’ve partnered with Zak to bring Investing Hero readers (that’s you!) a 50CHF welcome bonus when you open a free account. No strings attached and no BS. Just use the code HEROCH to claim your 50 bucks.

*Update December 2021

You can still use the zak promo code HEROCH to claim your welcome bonus.

1 – Wait for your account to be activated after registering. Takes 2-3 days.

2 – Go to your ‘Profile’ and tap ‘Code eingeben’ and enter the Zak code HEROCH

3 – That’s it! Enjoy 🙂

About me

I’m a British expat who’s been living in Switzerland for the last 10 years. I’m a digital marketing professional by day, and anonymous investing blogger by night. I cover investing basics, robo advisor reviews and epic how to guides. You can call me ‘Mr. IH’ for short, and read more about me here.