Neon Bank Review 2023 – The best Swiss Digital Bank?

This page is also available in:

Deutsch

Overall Rating of our Neon Bank Review:

4.8 ⭐⭐⭐⭐⭐ · 🏆 · Best Digital Bank ·

At Investing Hero, we aim to provide the best investing platform reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence our reviews. Our opinions are our own. The information provided on Investing Hero is for informational purposes only. Please read our disclaimer.

Since launching in 2019, Neon have quickly become established as a leading Swiss digital bank going head to head with the likes of Revoult and Bank Cler Zak. Recently, they’ve also refreshed their pricing even further and have announced a number of strategic partnerships with the likes of Transferwise and Selma Finance.

By offering a fast and intuitive app, they are able to quickly jump ahead of the slower moving traditional banks and offer fantastic pricing, user experience and digital account opening.

And if their advertising is anything to go by – they are enjoying taking on the big banks…

(They are proud of the fact Neon employees are not getting CHF 12.65 million or 14.1 million per year)

I’ll be recording the account opening process in this Neon Bank review with my regular step by step process to give you all the details, pros and cons and takeaways with using Neon.

I’ll also be highlighting some of the differences to the other digital challenger banks in the space such as Revolut and Zak.

Neon referral code: investinghero

🎁 Reader Bonus: I’ve partnered with Neon to bring Investing Hero readers (that’s you!) a 10CHF welcome bonus when you open a free account. No strings attached and no BS. Just use the code investinghero to claim your 10 bucks.

Right then – let’s get started on the Neon Bank review.

Neon Bank Review: Pros and Cons

Neon are at the cutting edge of fintech today in Switzerland. The entire product is slick, cool and a dream from a user experience standpoint. New account creation happens in minutes and the process is extremely simple and straight forward.

| Pros | Cons |

|

|

How to open an account with Neon Bank

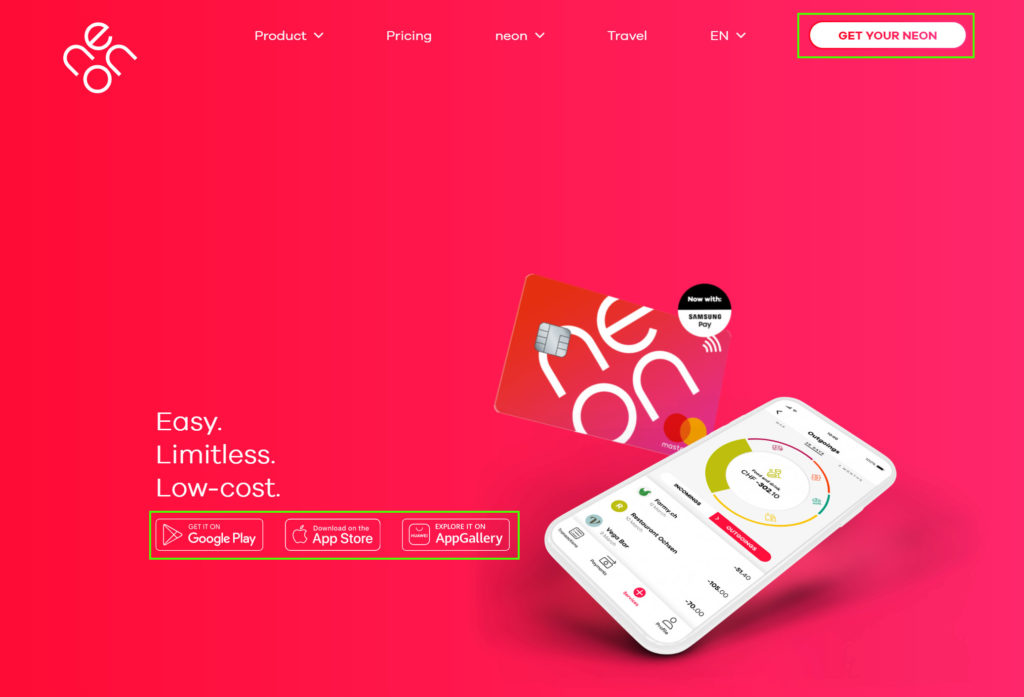

From the homepage, you can directly download the app of choice or click ‘Get your Neon’ in the top right:

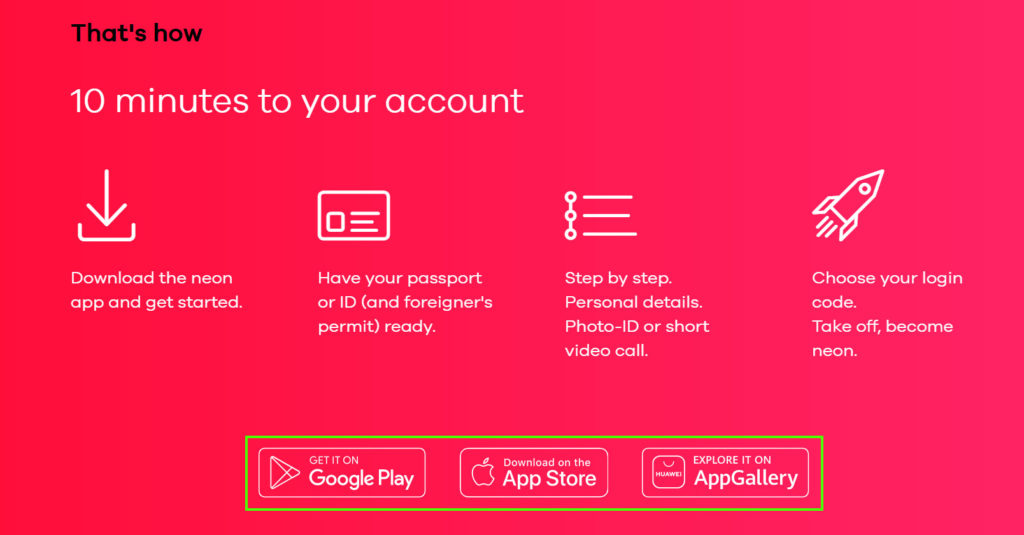

A quick overview of what you can expect – have your passport handy and select your app to download.

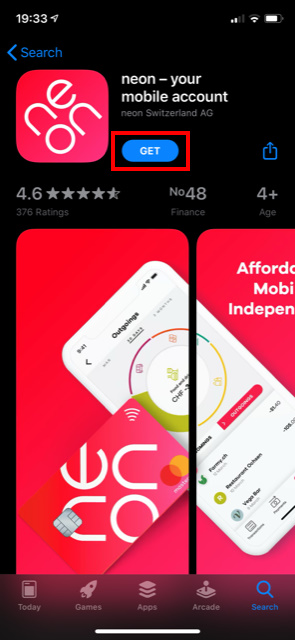

At this point in the process I switched from desktop to mobile to download the iPhone app:

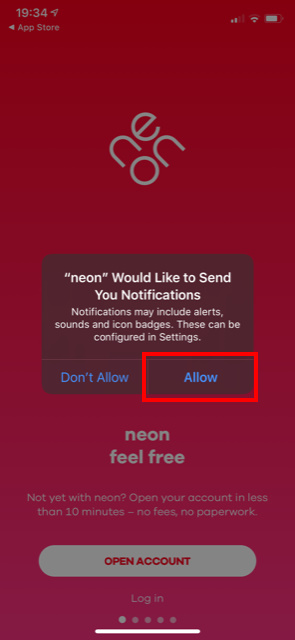

Once installed the first prompt when you open the app is to allow push notifications, for now I’ve selected ‘Allow’:

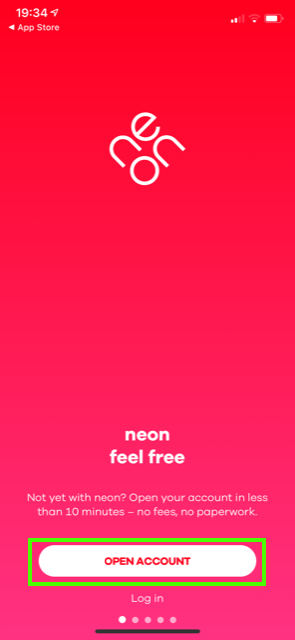

Now I’m ready to get started – tap ‘Open Account’

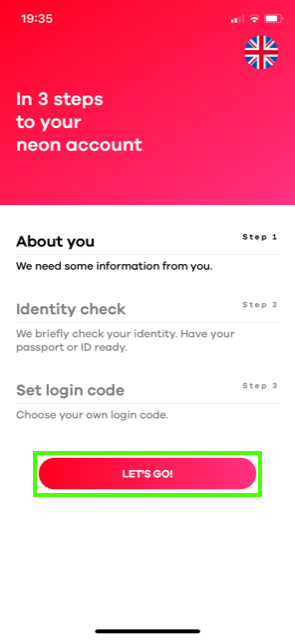

A brief overview of where you are in the process – step 1 of 3. You can change the language of the app by tapping the flag in the top right corner. Tap ‘Let’s Go!’ to move on.

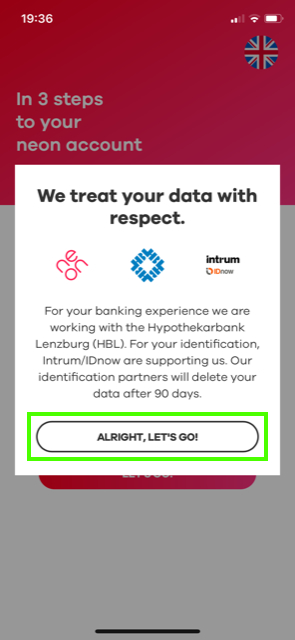

Next a quick disclaimer and reassurance on data privacy. Tap ‘Alright, Let’s Go’ again:

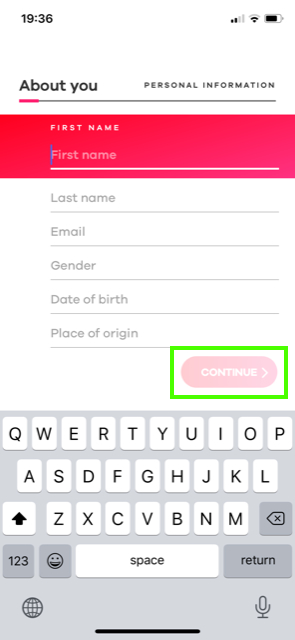

Enter your name, email, gender, DOB and your ‘place of origin’ (I think they mean nationality) and tap ‘Continue’:

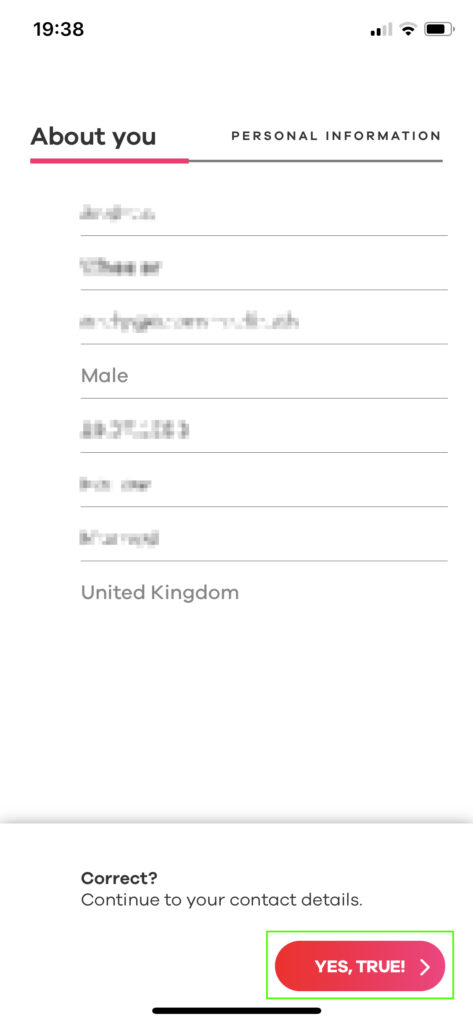

Done? Check over the details once more and tap ‘Yes, True’:

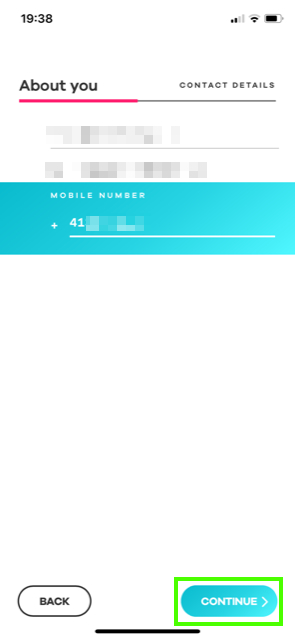

Now enter your mobile number on the next screen and tap ‘Continue’:

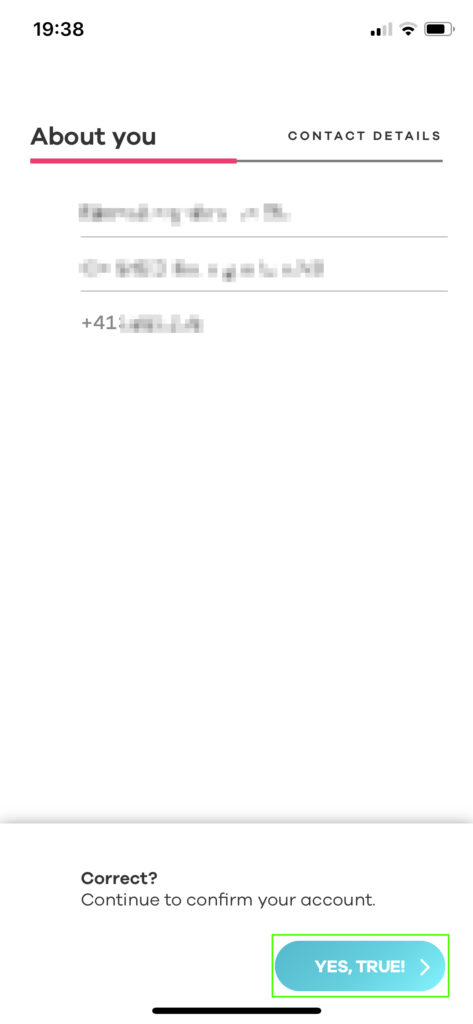

Double check again, and tap ‘Yes, True!”:

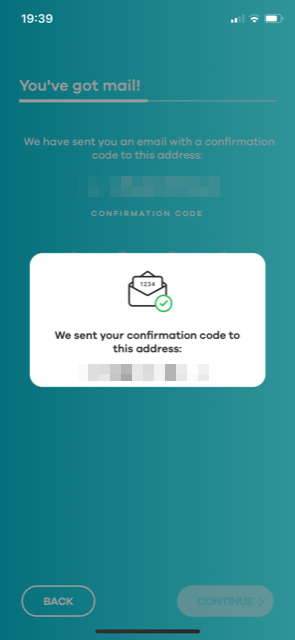

An email containing a verification code is then sent to your inbox, so lets switch…

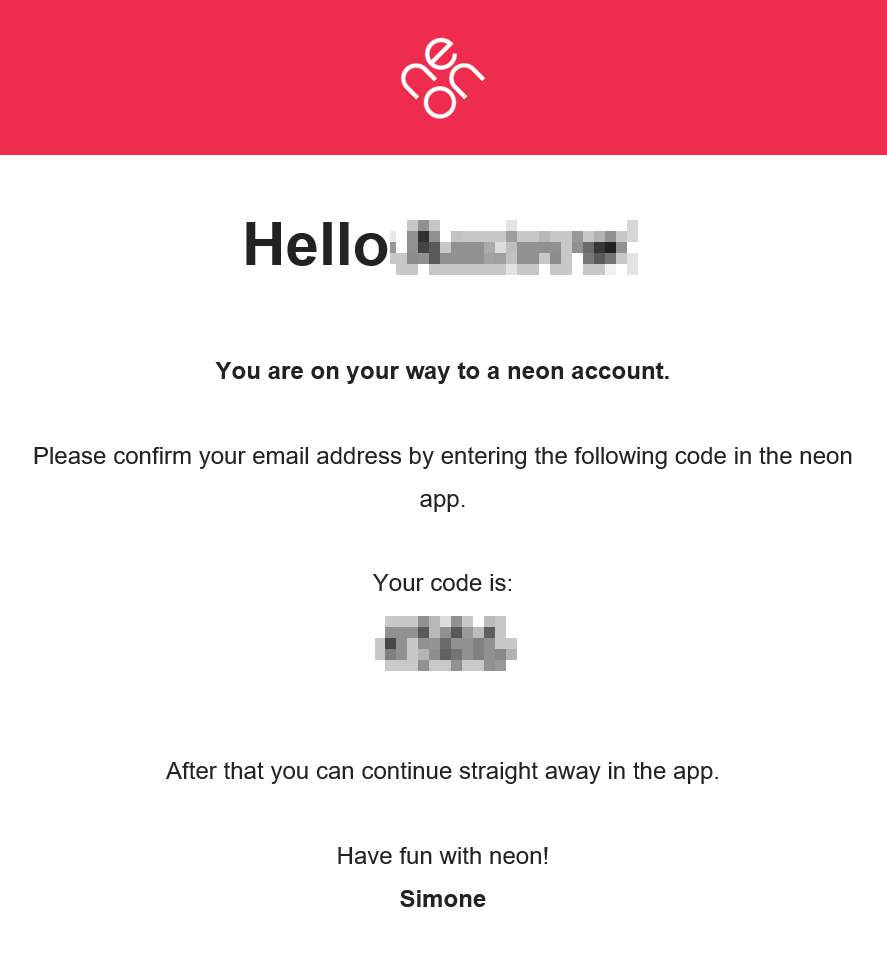

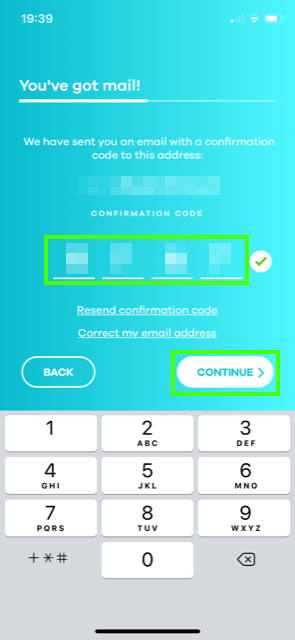

… Over to email, and remember the 4 digit code to enter in the Neon app:

You should get a little green tick, and then tap ‘Continue’

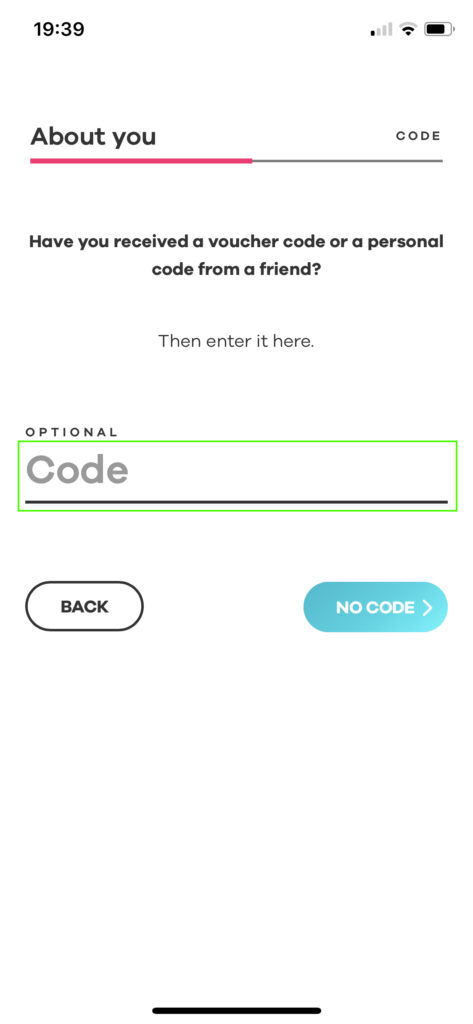

Now you can enter the bonus code investinghero here to claim a free 10CHF bonus:

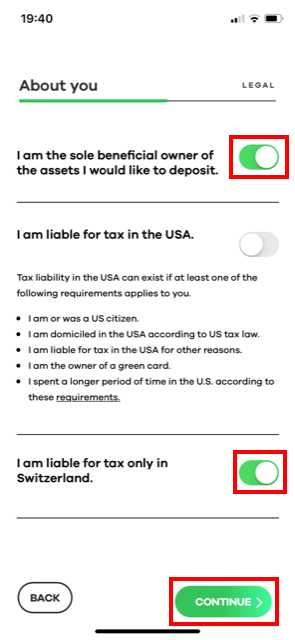

Now some standard legal questions – confirm you are the account owner and you’ll pay your taxes:

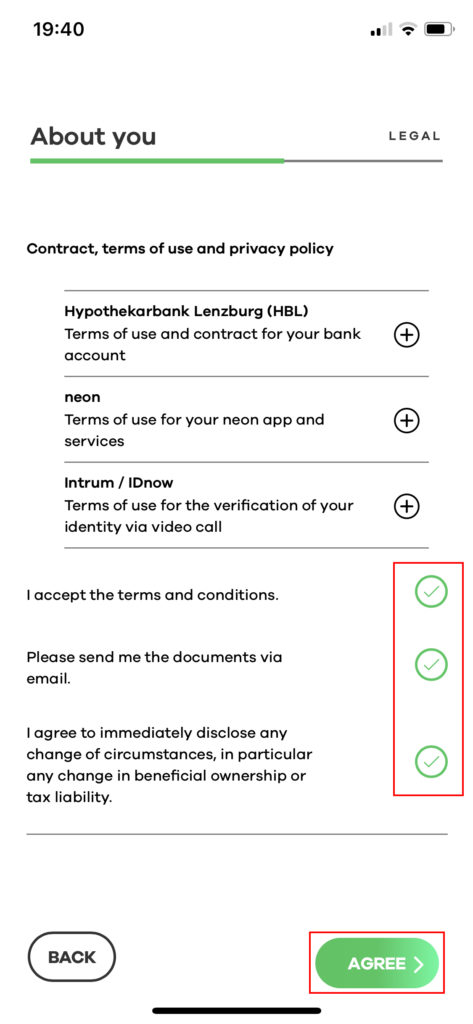

Read through the terms and conditions, and once you are ready mark the check boxes and tap ‘Agree’:

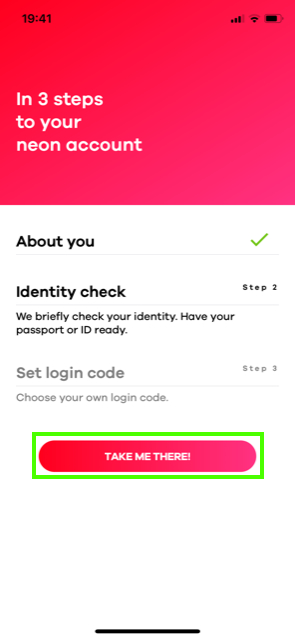

Ok cool – Step 1 complete. Now we move onto the ID checks:

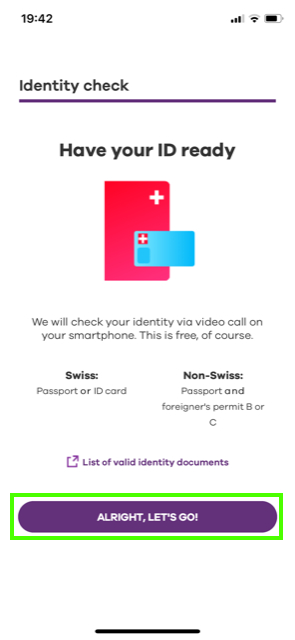

Have your passport and Swiss permit at hand for this step, and tap ‘Alright, lets go’

One thing to note here, if you have a Swiss ID card you won’t need to connect with a live agent. You’ll simply just need to take a photo of the card and you can skip the steps below.

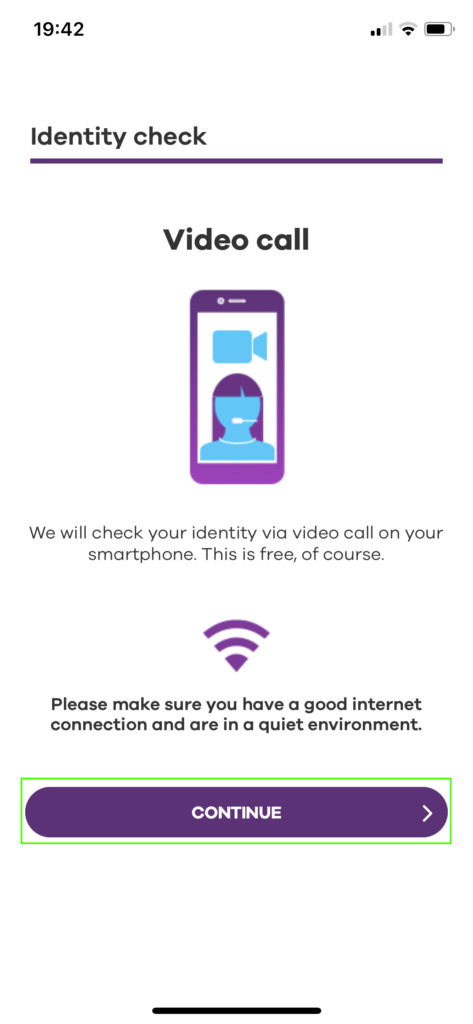

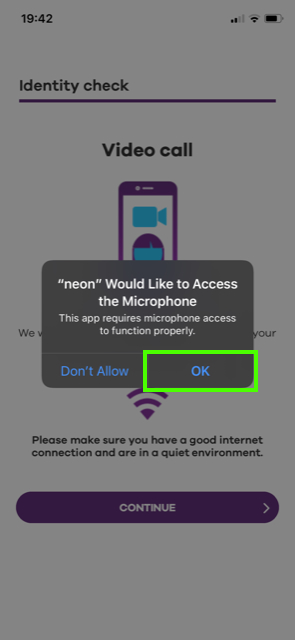

One final heads up – before connecting to a live agent. Have a good internet connection and tap ‘Continue’ to get connected:

Oh right, allow microphone and camera access:

I won’t show the full screenshots here for privacy reasons, but you’ll be connected to an operator who will talk you through the process. In a nutshell:

- Confirm your name and place of birth

- You have a picture taken

- They’ll flip the camera and take a photo of your passport, front and back covers, and also turn on the flashlight to check the hologram.

- They’ll then take a picture of your Swiss permit (e.g. B/C)

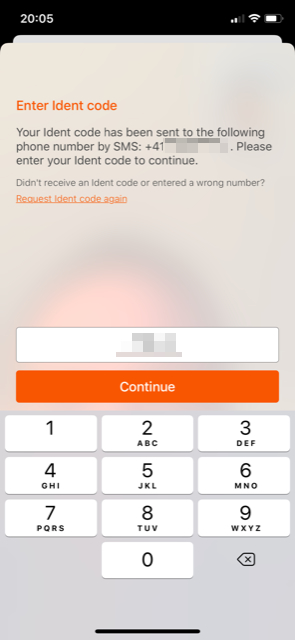

After that is completed, you’ll be asked to verify your mobile number and enter the code which arrives and tap ‘Continue’:

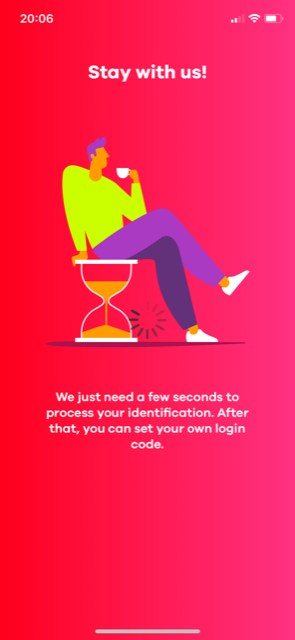

… The operator will confirm the account is verified and you’ll be disconnected, and then put back into the usual bright pink Neon ambience which explains your ID is in processing – which takes no more than a few seconds.

And here we are back at the home screen with a completed step 2.

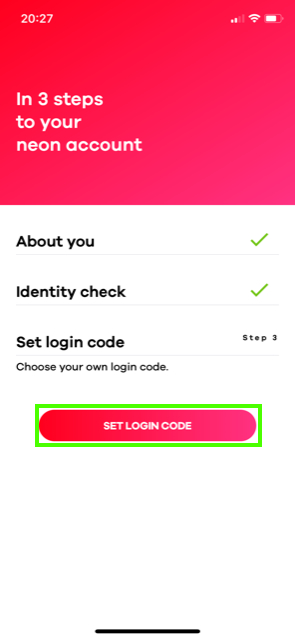

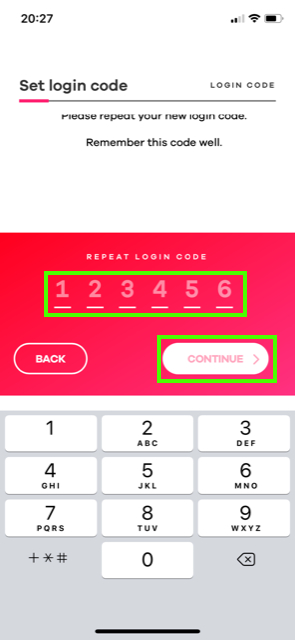

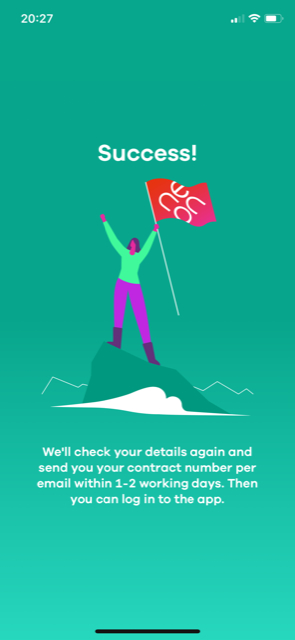

Now the final process, setting up a login code. Tap ‘Set login code’ to move on:

Think of a 6 digit code and enter here, tap ‘Continue’:

After verifying your code once more, you’ll then transferred to the final screen in the setup process – the success message.

At this point, we just have to wait. No more codes to enter, and the app remains blocked on this green screen until your account is up and running, which will take another day or two.

Sit tight and check back when you are ready 🙂

Funding the Neon account

Very straight forward – use your IBAN in the normal way and you’ll see the account deposits and withdrawals function as expected.

Login & Security

As with all regulated banking services in Switzerland, security is the no.1 priority and industry grade technology is used to protect your data – and Neon is no different. Through the app you can also enable two factor authentication for extra protection – although this remains only for SMS, which as a technology has long standing weak points.

Also, Neon are technically not a bank – your assets are held with Hypothekarbank Lenzburg who do have a banking license and are regulated by FINMA. This security is a big plus compared to the likes of Revolut and N26 – your money stays in the regulated Swiss environment and is insured up to 100K CHF.

Fees & Charges

Neon is fantastic value and with the recent updates of scraping charges abroad, it makes them the cheapest in digital bank in Switzerland.

Such pricing is refreshing and setting Neon apart from the crowd. I’ve picked a few highlights below, the full pricing detail is available here.

- Free to open an account

- Free domestic payments

- 0% exchange rate spread

- Welcome bonus (TBC)

Customer Support

Customer support is excellent and English is supported, however be aware that as with other digital banks ‘billing on the clock’ is used for special cases that can’t be easily solved, in the case of Neon this is 25CHF/per 15mins.

To be fair, I’d rather have that premium support inplace for when things really go wrong – compared to say, the Revolut strategy which appears to struggling with customer support looking through the comments.

There are a large number of FAQs on the website, in multiple languages, which cover the main topics well – from pricing to cards and common problems which users encounter.

Additional Resources

On the neon website they have a small but growing blog, which is mainly focused on company PR and media releases. Less so on personal finance tips/budgeting/money blog posts etc – maybe that will change in the future.

At the moment Neon are a bit ‘look at me! look at me!’ with their content marketing strategy.

Neon comparison table

Here’s a high-level breakdown of Neon vs Zak and Neon vs Revolut in the table below.

|  |  | |

| Investing Hero Rating | 4.8 | 4.7 | N/A |

| Welcome CHF bonus code | investinghero (for 10 CHF) | HEROCH (for 50 CHF) | None |

| Base fee | Free | Free | Free |

| Account country | CH | CH | UK |

| Swiss IBAN | Yes | Yes | Yes (domestic use only) |

| Card type | Mastercard | Mastercard, Visa, Maestro | Mastercard, Virtual |

| Domestic withdrawl in CHF at ATMs | 2x free/mth, then 2 CHF per withdrawal | Free at Bank Cler ATMs, 2 CHF at others | Free up to £200/mth, then 2% per withdrawal |

| Domestic withdrawl in EUR at ATMs | 1.5% on the amount | Free at Bank Cler ATMs, 5 CHF at others | Free up to £200/mth, then 2% per withdrawal |

| Domestic payments | 0 | 0 | 0 |

| International transaction fees | 0 | 2.5% | 0 up to 1000 CHF, then 0.5% (weekday) or 1% (weekend) |

| International transfer rates | 0.8-1.7% (Transferwise) | 1.5% approx (Corner Bank rate) | 1-6 CHF |

| Exchange rate surcharge | None | 1.7% | None |

| Replacement card | 20 CHF | 20 CHF | 10 GBP |

| Set a new pin code | 0 | 10 CHF | 0 |

| Special case administration | 25 CHF/15min | 0 | 0 |

… So in general, it looks like Neon has the edge. Of course there are many ways to skin a cat – especially with the different limits and personal use cases for the cards, for example here are 3 reasons why I’m still using Zak.

I also haven’t factored in the Transferwise card here for international currency conversions, which is another clear leader in the space and warrants a separate review. More to come on that front. Also, lets not forget using various credit cards different transactions which can generate you cash back/rewards.

I’ll expand the above with more entries in the future – In the meantime I hope the above Neon vs comparison helps your decision making process.

Background info on Neon Bank

Neon was launched a beta in 2018 by Co-Founder’s Simon Youssef & Michael Noorlander with a mission to shake up the traditional and expensive personal banking space. Today, they have over 30,000 customers in Switzerland supported by a team of 23.

Neon Bank do not have walk in offices you can visit in person, but the registered address is Badenerstrasse 557, 8048 Zürich

Closing thoughts

Neon rock. Plain and simple. They have steadily become the leading player in the Swiss digital banking space and continue to innovate and develop a best in class product that its starting to move ahead of the competition.

The customer on-boarding is fast, simple and puts the traditional banks to shame – even compared to other digital banks in Switzerland such as Revolut and Zak, Neon is even simpler and faster.

With the backing and security of a Swiss bank, you can be confident your money is well protected in Switzerland, and with a fully English user experience combined with the low fees its a great bank account to use for life in Switzerland.

Thanks for reading this Neon bank review!

🎁 Reader Bonus: I’ve partnered with Neon to bring Investing Hero readers (that’s you!) a 10CHF welcome bonus when you open a free account. No strings attached and no BS. Just use the code investinghero to claim your 10 bucks.

Neon Bank FAQ

Yes, use the promo code investinghero to claim your free cash!

You need to be a Swiss resident with an iOS, Android or Hauwei smartphone.

No, smartphone app only.

Neon are digital bank using a mobile app to offer its services with very low fees (basically free) which compared to the traditional Swiss banks cheaper, faster and easier to use.

The supporting bank for Neon is FINMA regulated Hypothekarbank Lenzburg who operate under strict Swiss regulation and have deposit insurance of 100K CHF.

About Investing Hero

I’m a British expat who’s been living in Switzerland for the last 10 years. I’m a digital marketing professional by day, and anonymous investing blogger by night. I cover investing basics, robo advisor reviews and epic how to guides. You can call me ‘Mr. IH’ for short, and read more about me here.