Plus500 Review Switzerland: Is the broker any good? (Updated 2023)

This page is also available in:

Deutsch

Overall rating of my Plus500 review:

3.0 ⭐⭐⭐ · 🏆 CFD Trading ·

At Investing Hero, I aim to provide the best investing platform reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence my reviews. My opinions are my own. The information provided on Investing Hero is for informational purposes only. Please read the disclaimer. 76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

In this post I’m going to be reviewing the online trading platform Plus500. They are another established broker founded in Israel who are regulated and licensed to operate in Europe, and serve us folks in Switzerland.

You may recognise the logo and branding – they are the current sponsors of the Swiss football team, BSC Young Boys. ⚽

The look and feel of the platform is simple, in a well designed way, and the addition of ‘Dark Mode’ makes it a very nice interface to trade in.

However, there are some red flags 🚩

Mainly, Plus500 offers only CFDs – which carry much higher risk and suitable for experienced traders only. We’ll get to the details in a sec.

As normal, I’ll be documenting the entire process with opening an account in this Plus500 review, and will go through all the pros and cons of the platform. Take a look for yourself and use my guide below to follow along.

I’ll be taking you through it all, step by step.

Make sure you also check out the FAQ’s at the end, which include a few questions I’ve seen unanswered on the web, so you can make the best decision if Plus500 is right for you.

🧠 Consider how much of your portfolio is invested in things such as day trading. It’s a risky business and you need to take care. Read more about my thoughts on risk here and here.

Plus500 Review: Pros and Cons

Before we dive into my full Plus500 review for Switzerland, I want to first show the main pros and cons.

In a nut shell – there are better alternatives such as eToro.

For those in Switzerland looking for an extremely fast and simple way to get started with day trading, then Plus500 are worth a look. However, the business model for Plus500 is based on offering CFD trading (‘contract for difference’) which can be leveraged and make it extremely easy to lose money.

CFD trading is highly risky and not something suitable for beginners. Legally, brokers providing CFDs have to plaster disclaimers on their websites such as ‘76.4% of retail investor accounts lose money’ – wait, what? 76%..?! Ignore these warnings at your peril.

🎁 If you are considering Plus500, check out my review on eToro who are the overall better alternative for day trading in my opinion. Try a free demo and see for yourself.

It’s important to mention Plus500 offers only CFD trading. This is an important point, as they should not be confused with traditional ‘stock trading’.

With CFDs you do not own the underlying asset, and you are just making a short term ‘bet’ on the price movement.

Also, if you want features such as Social Trading (like the offering from eToro) and rock bottom prices, you’ll have to look elsewhere.

| Pros | Cons |

|

|

How to open an account with Plus500

Head over to the homepage of Plus500 and click ‘Start Trading Now’ get going:

Enter your email, and make up a new password on the next screen and click ‘Create Account’:

And unbelievably… you’ve already created your account!

That was probably the fastest customer onboarding process I’ve ever experienced. Kudus Plus500 for removing all the barriers and letting users get straight down to business.

Ah.. but of course, there are a few more steps needed to actually start trading ‘for realz’.

Onwards we go then.

Click any link, it doesn’t really matter (they lead you to the same place) to start the process.

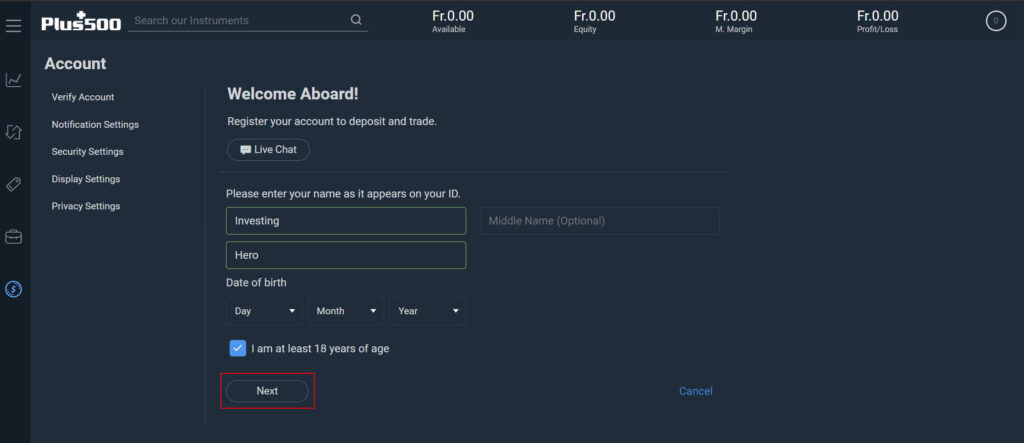

Enter your name, date of birth and confirm you are over the age of 18 and hit ‘Next’:

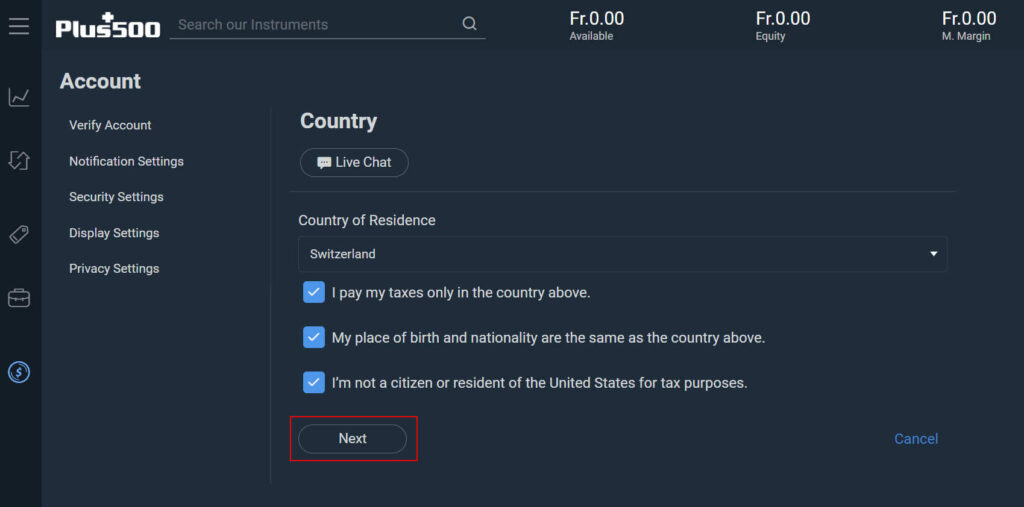

Confirm where you live, where you pay tax and your nationality: and hit ‘Next’:

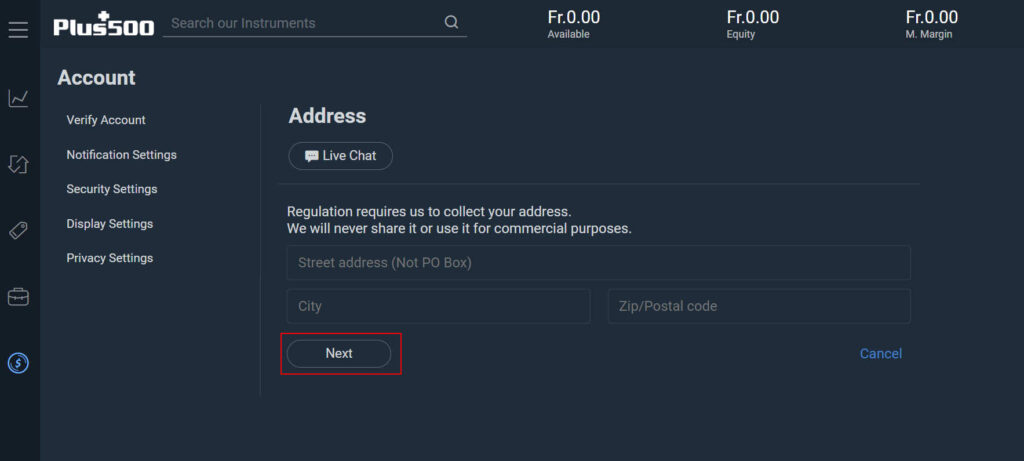

Next up enter your address – click ‘Next’ to move along:

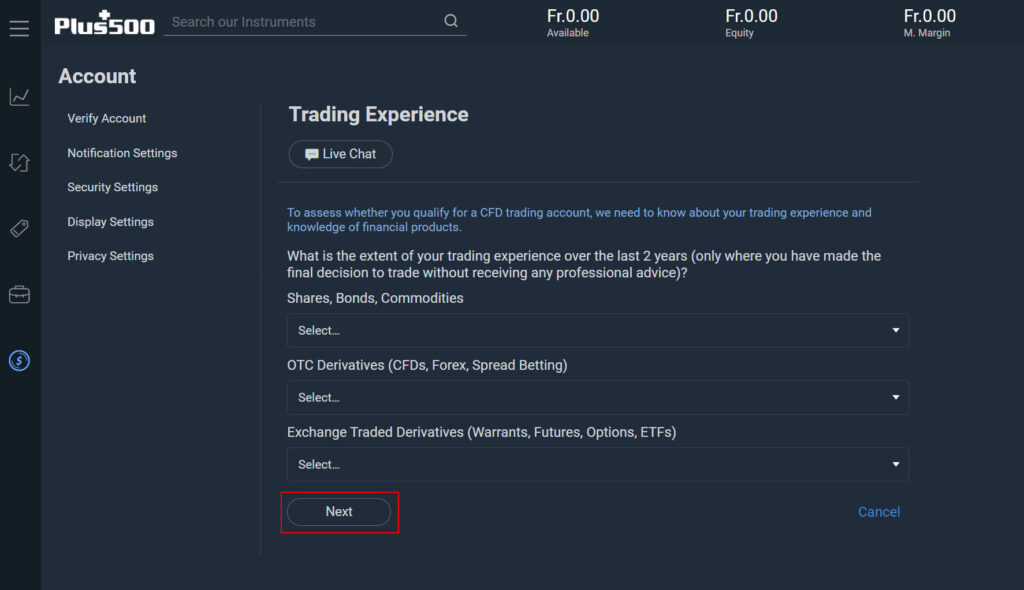

Now we move onto some industry standard ‘know your customer’ type questions – be honest with your experience and complete the three dropdown menus and click ‘Next’:

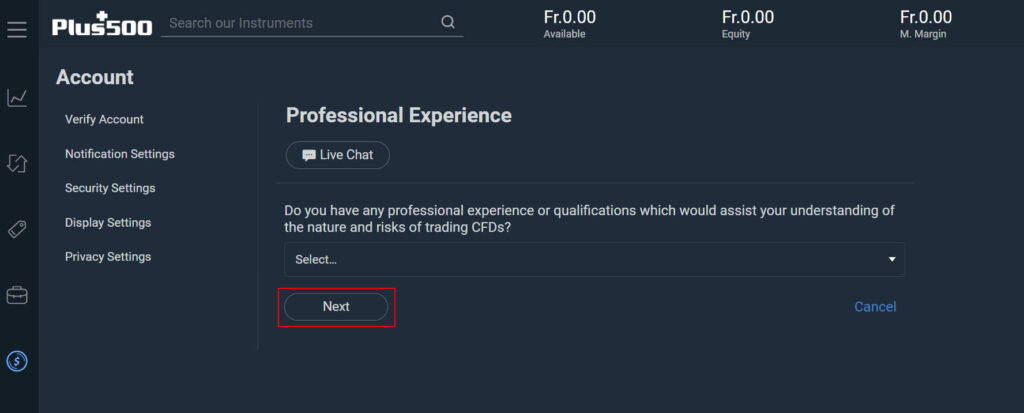

Now select the level of your professional experience with trading:

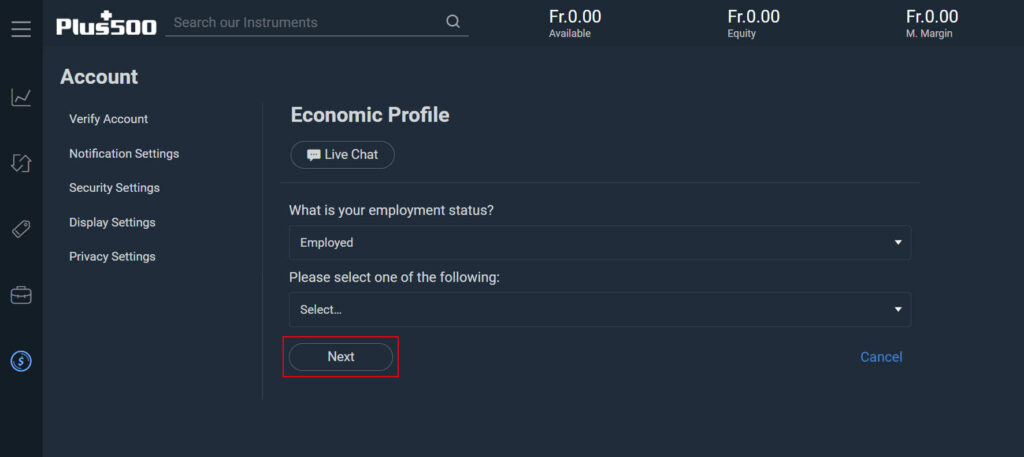

Select if you are employed or otherwise and which industry you work in and hit ‘Next’:

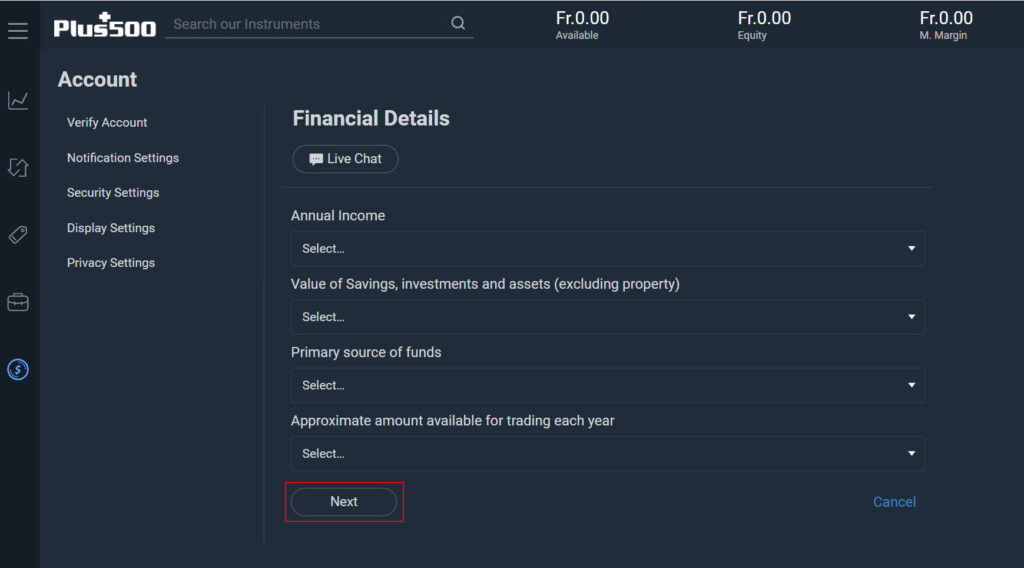

Now they need to understand a few financial details, you can select bands for each and aren’t required to give exact amounts:

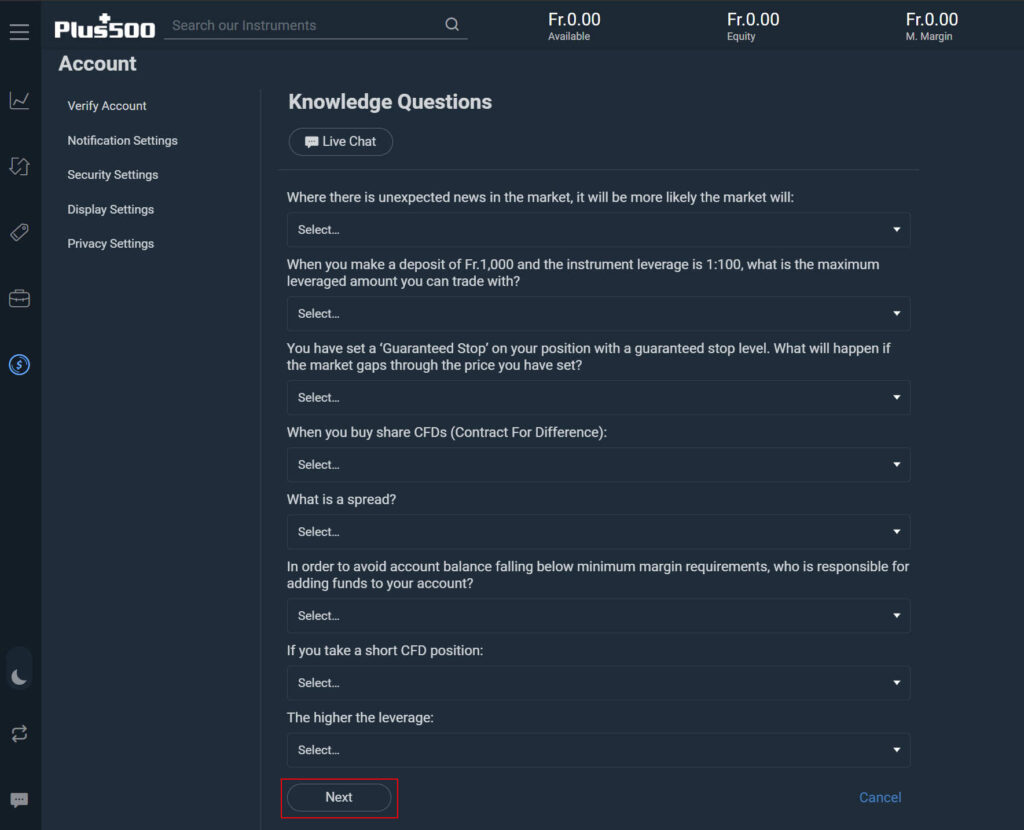

Next we have more standard regulation questions – I haven’t selected answers here for obvious reasons, but hopefully nothing too challenging:

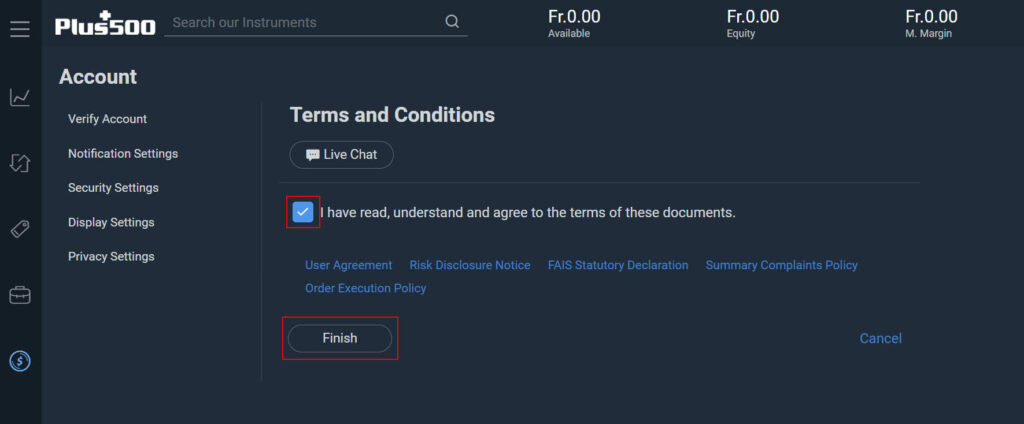

Check the Terms and Conditions and click ‘Finish’:

All done!

You will now be passed directly onto the next screen to fund your account, as shown below.

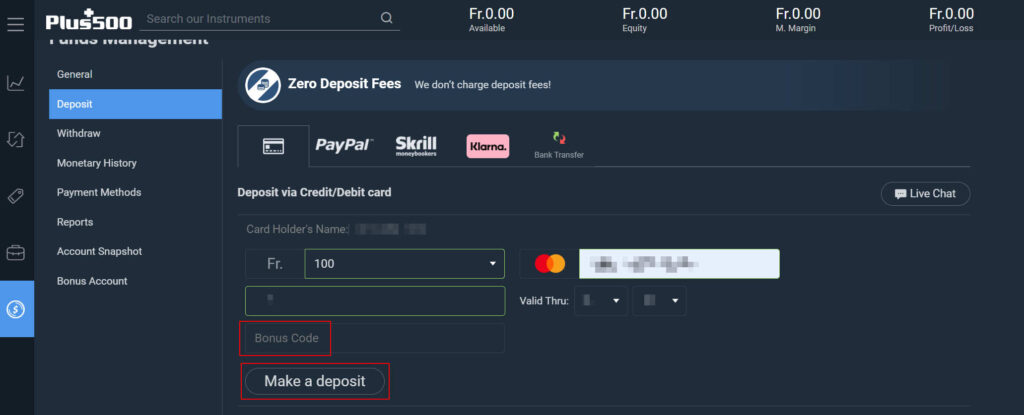

Simply enter your payment details (100 CHF min) and any bonus codes, and then hit ‘Make a deposit’:

Congrats! You are ready to go 🙂

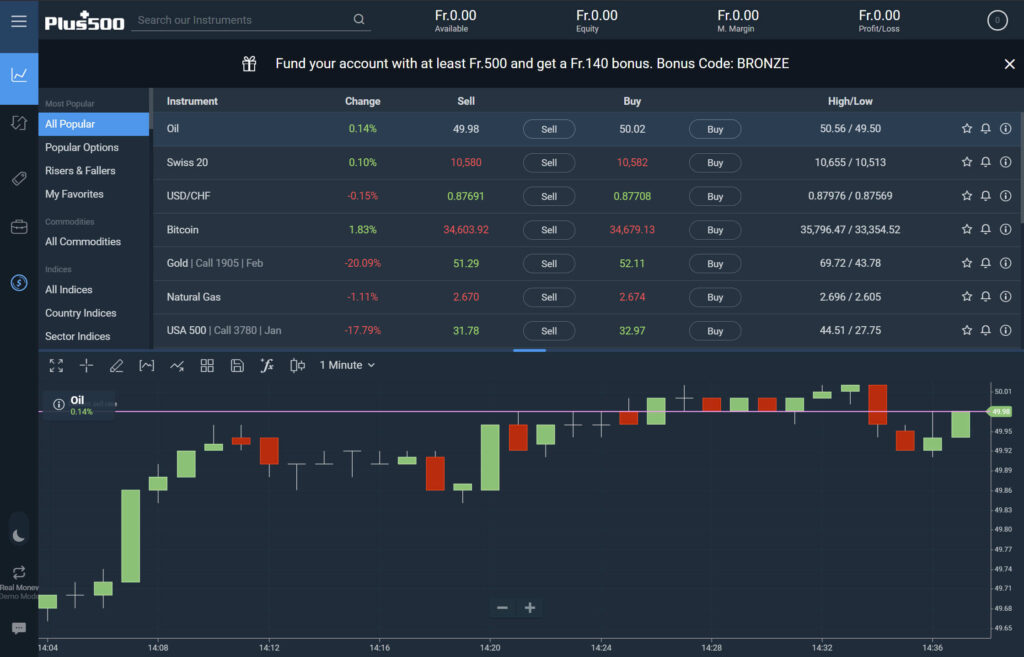

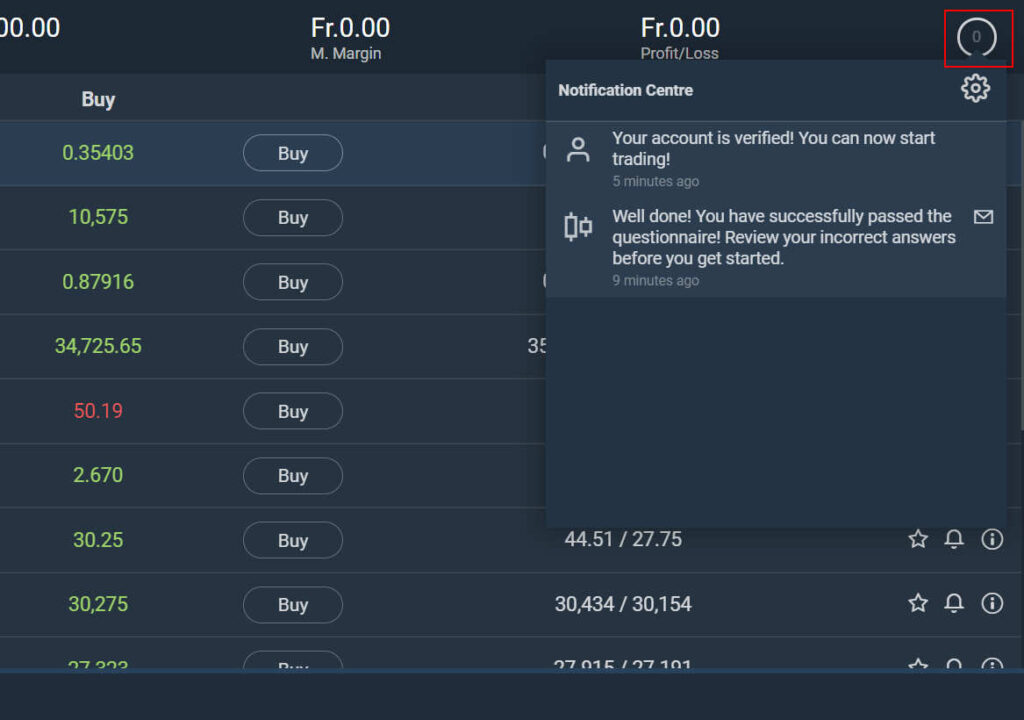

Logging in for the first time

Once you’ve funded the account, you’ll notice a notification icon top right of the screen – click it and read your messages:

Next, let’s search for a CFD to buy.

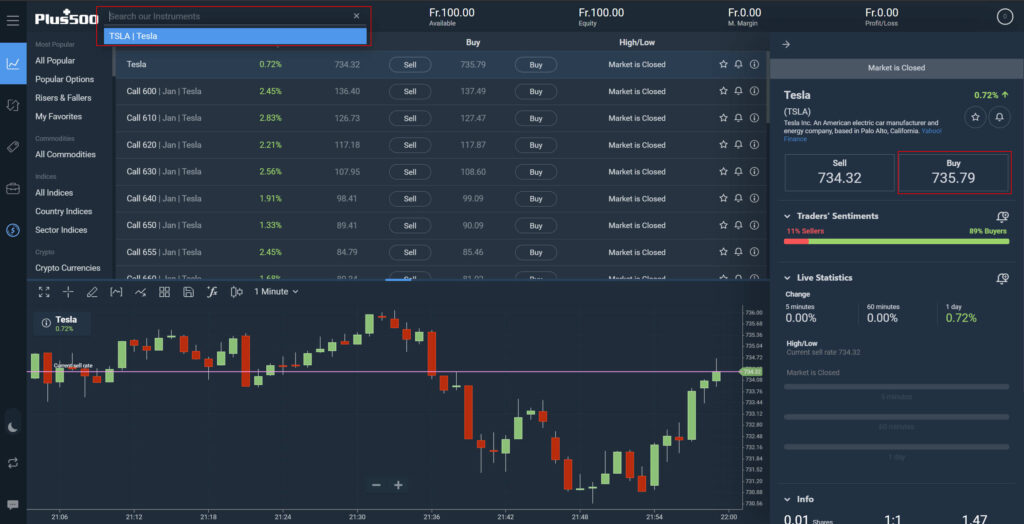

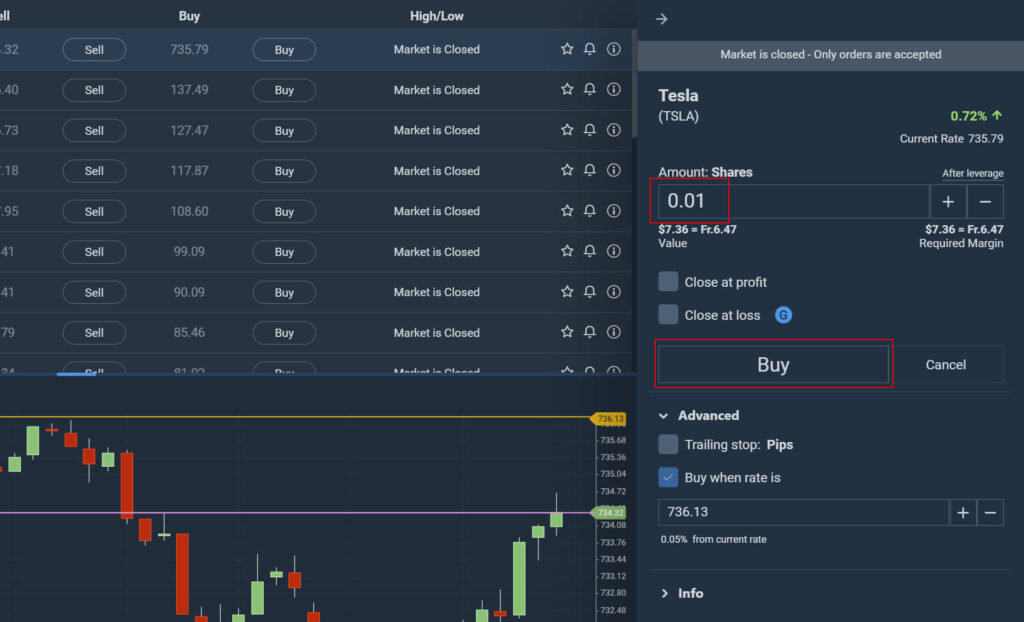

From the dashboard, enter ‘Tesla’ in the search bar and click the top result.

Next hit ‘Buy’ in the popout window on the right hand side:

You can then decide how much you want to trade, and then hit ‘Buy’.

You’ll notice the market was closed when I placed this trade, so it’ll be an order that will be executed when the markets open.

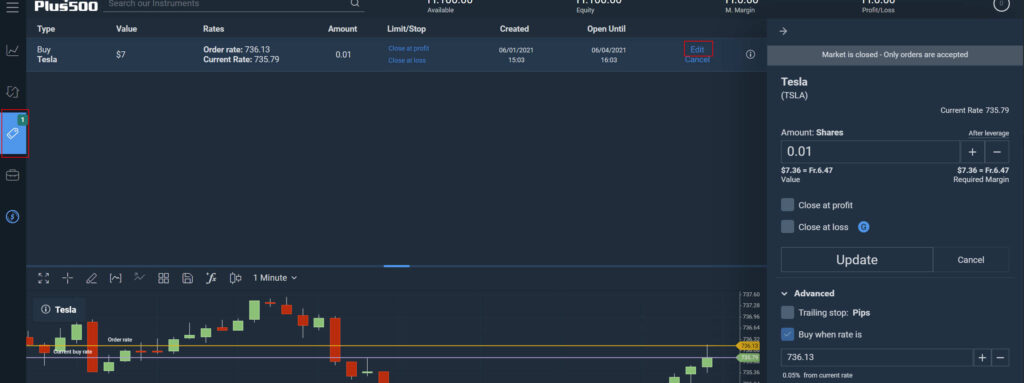

Let’s take a look at the order section to verify that.

Tap the icon in the left sidebar, and you’ll see my trade listed as shown below. I can change things simply by clicking ‘Edit’:

And that’s all there is to it.

Pretty straight forward. It’s refreshing to see such a no nonsense, ‘no fluff’ trading environment.

Can you trade cryptocurrency on Plus500?

Yes, but availability is subject to regulations. But remember these are CFDs, you don’t actually own any Bitcoin – just a contract on a price.

Just enter it via the search (e.g. Bitcoin) as shown above, or scroll down the list to ‘Crypto Currencies’ as shown below:

Plus500 Demo Account

Before you start trading in the live account, Plus500 also offer a demo trading account to try things out. It’s the same as the live account without the stress of real money, and Plus500 credit 50K virtual cash on the account to start experimenting with.

To switch to the demo mode, simply click the icon in the bottom left from the dashboard:

You can start buying and selling CFDs just as you would in the live account, so open a few trades to get comfortable with the platform.

You can navigate the account exactly as you would in the live environment.

Have fun getting used to the Plus500 demo environment!

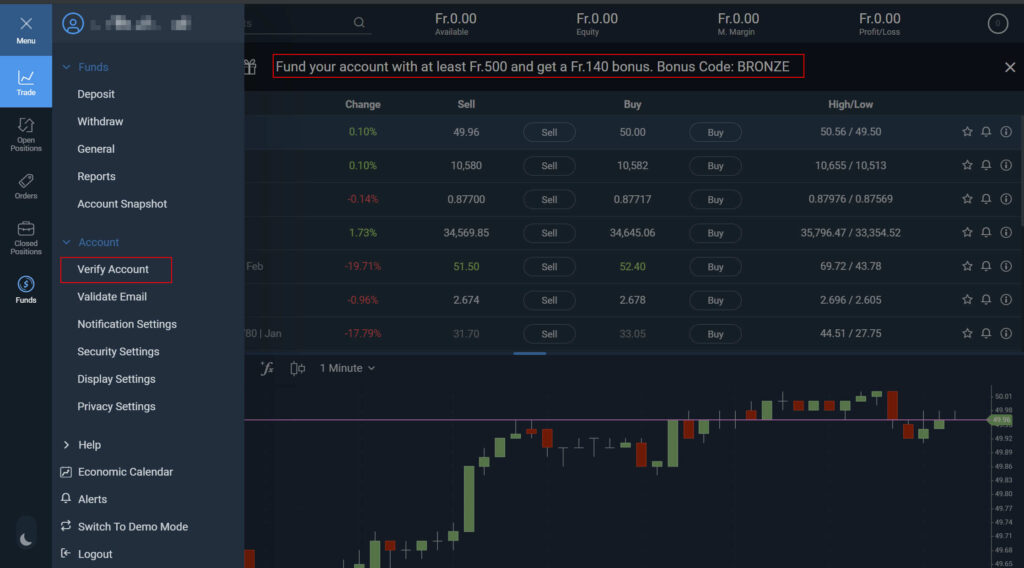

Funding the Plus500 account

If you haven’t already in the registration process shown above, funding the account is very simple. It’s also very quick and easy with a credit card, and will have you trading instantly.

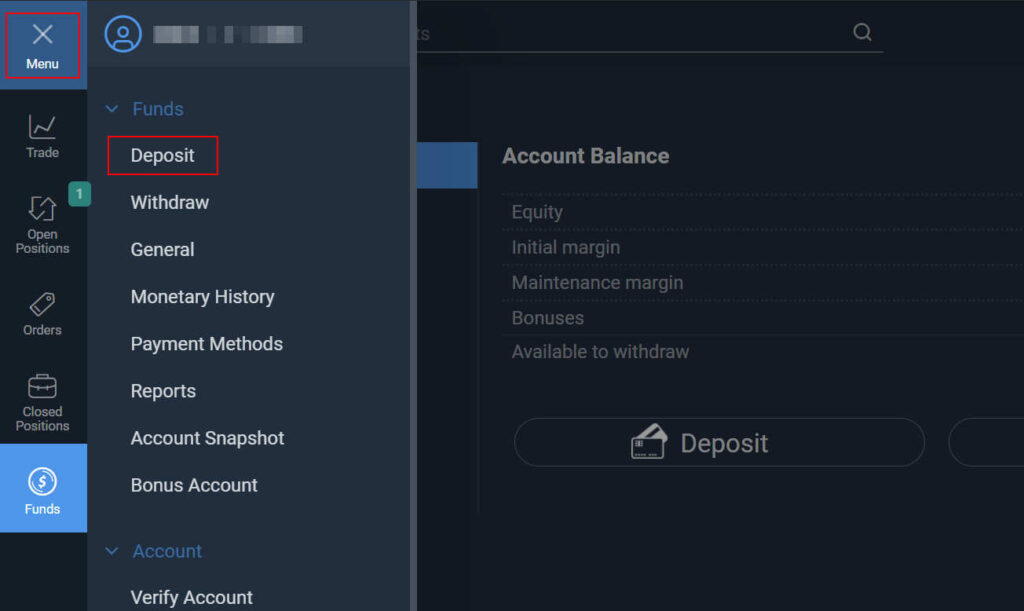

If you wish to top up your account later on, simply click the ‘Menu’ button in the sidebar navigation, and then ‘Deposit’ under the Account section:

As credit card payments are available instantly, you are enable to start trading CFDs straight away.

Login & Security

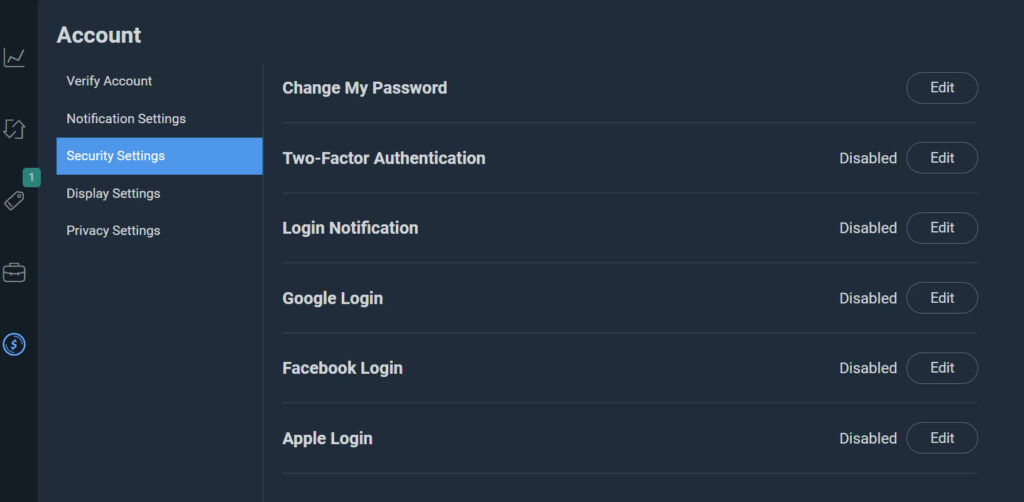

SSL encryption and https are used on the trading platform, and you can turn on two-factor authentication on from the security tab in your account settings.

In addition, you can also enable Login Notification which is also worth doing to increase the security of your account:

Like many online brokers, Plus500 are not regulated by Swiss authorities and Swiss finance regulators, such as FINMA.

However, they have a global footprint with offices around the world, with several regulatory licenses from the likes of CySEC (Cyprus), FCA (UK), ASIC (Australia), FMA (New Zealand), FSCA (South Africa), MAS (Singapore) and the ISA (Israel).

Having such licences to comply with regulation is important to ensure Plus500 will be held accountable if things go bad. You should only ever trade with brokers which are regulated and have the needed licenses.

As you see above, Plus500 have various entities around the world. For those of us in Switzerland, we fall under the Plus500CY Ltd holding, and regulation of the Cyprus Securities and Exchange Commission (CySEC) which offers an investor protection amount of 20K EUR.

Despite not having an office in Switzerland, Plus500 are a reputable and established player in the CFD trading space with a long track record – they are even listed on the London Stock Exchange, which brings even more confidence as they must submit financial statements and stay transparent.

Fees & Charges

It’s tricky to compare ‘like for like’ with other online brokers, however Plus500 are more expensive when compared to the likes of eToro for example. Not the cheapest, but not the most expensive.

They have an inactivity fee – so it’s important you login to your account every 3 months to avoid that 10 CHF charge.

On the plus side, there is no account fee – and withdrawals and deposits are completely free of charge. They also have a very low account opening minimum – just 100 CHF to get started trading CFDs.

🎁 If you are considering Plus500, check out my review on eToro who are the overall better alternative for day trading in my opinion. Try a free demo and see for yourself.

Customer Support

Customer support at Plus500 is generally pretty good. Within your account you have quick links to the support, and live chat is available throughout the account around the clock, so you can speak to a live agent in most cases.

Multi-language support is also available, although there is no direct phone number or public/walk in offices.

Additional Resources

There isn’t a huge amount of additional material or educational content, however under the ‘Tools’ section of the website there are a few useful items to take a look at – most importantly is the price alert tool, which is pretty handy if you are interested in entering (e.g. Bitcoin) when it reaches a certain price point.

News, analysis, and a financial calendar are also available, in addition to an extensive FAQ section – all fully translated across multiple languages.

Background info on Plus500

Plus500 was founded in 2008, in Israel, by a team of 6. Since then, they have continued to expand the technology platform and offering with the web and mobile app trading, and the company continues to expand into emerging asset classes such as cryptocurrency and altcoins, and have served many millions of customers on a global scale.

They have reported strong market performance in 2020 and continue to grow, and are listed on the London Stock Exchange.

They are headquartered in MATAM, Building 25, Haifa, 31905, Israel.

Closing thoughts

Plus500 have one of the fastest and easiest customer onboarding experiences I have ever completed. You can basically be up and running in just 15minutes. It’s impressive.

There are cheaper options out there, and for more innovation and ‘bells and whistles’ you might want to check out eToro, however for speed of access and a ‘no nonsense’ CFD trading platform experience – Plus500 do the job very well.

However, please educate yourself on the risks of CFD trading. They are for experienced traders only and over 75% of people lose money with CFDs. The odds are against you, and you do not own any stocks/shares with CFDs.

Consider my thoughts on how much of your portfolio is invested in areas such as day trading (spoiler alert – it’s under 5%) and more risky assets likes P2P, Bitcoin and CFDs.

If you do decide CFD trading is something for you, Plus500 offer one of the fastest ways to get there, in a regulated and licensed environment, with a very low CHF deposit in order to get started.

Thanks for reading, and I hope this Plus500 review was useful!

🎁 If you are considering Plus500, check out my review on eToro who are the overall better alternative for day trading in my opinion. Try a free demo and see for yourself.

Plus500 FAQ

Yes, but Plus500 offers trading in CFDs only. You do not own the underlying asset. Plus500 have a huge list available to trade, you can use the search function and then browse through the list.

Plus500 are licensed and regulated to operate around the world, and for those in Switzerland have investor deposit protection of upto 20K EUR. Plus500 have been established since 2008, have served many millions of customers and trades and are listed on the London Stock Exchange.

They both have their pros and cons. For speed of access, low account deposit and simple interface Plus500 have the edge, however they only offer CFDs which carry more risk. For more innovative features such as Social Trading & Copy Trading, eToro are worth considering. Both offer free demo accounts to see which is best suited for you.

The normal disclaimers apply 🙂 You can make (and lose) money with any online broker, however 76.4% of traders lose money trading CFDs. Trading on any platform, not just Plus500, is a risky business and you need to be very careful with assets like Crypto, CFDs and using any leverage. You can read a little more about that here or here.

100 CHF is the minimum deposit to open an account on plus500.

From any screen within your account, you can simply click the ‘Deposit’ link and enter your payment details. Using a credit card is the fastest way to get trading in a matter of minutes.

Yes. Withdrawing money from Plus500 is free, simple and takes a couple of days to process.

Plus500 is a quick and easy way to get familiar with CFD trading, however CFDs are not good for beginners as they are complex instruments and carry a lot of risk. The fast onboarding process and low account opening deposit (108 CHF) make it easy to test the waters and experiment with a few trades, however beginners shouldn’t ignore the fact over 76% of people lose money trading CFDs.

If Plus500 goes bankrupt your account could be at risk and you could loose access to your funds. That said, Plus500 are part of the Investor Compensation Fund for Customers of Cypriot Investment Firms which covers investors up to 20K EUR.

You are responsible for ensuring you submit your taxes, not Plus500. You can easily export your account statements for your tax documents.

Yes. Plus500 is available for people living in Switzerland.