Swissquote Review 2023: The best in Switzerland? (inc. 100CHF bonus)

This page is also available in:

Deutsch

Overall rating of my Swissquote review:

4.2 ⭐⭐⭐⭐ · 🏆 Top for Swiss Based Trading ·

At Investing Hero, I aim to provide the best investing platform reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence my reviews. My opinions are my own. The information provided on Investing Hero is for informational purposes only. Please read the disclaimer.

In this blog post I’m going to be reviewing the Swiss online trading platform, Swissquote.

Swissquote are an established and popular trading platform in Switzerland, and one of the select few ‘newer banks’ in Switzerland (est. 1996) which offer online trading, robo-advisory, cryptocurrency, and related products such as mortgages – all under one roof.

As I’ve done with my other reviews, I’ll be showing you the entire end to end process with opening an account in this Swissquote review, and give some of my personal pros and cons of the platform. Open up the homepage yourself and use my guide below to follow along if needed.

I’ll be taking you through it all in this Swissquote review, step by step.

Make sure you read the FAQ’s at the end of this review, which cover the main questions in more detail. Let’s find out if Swissquote is right for you.

Onwards.

🎁 Reader Bonus: If you are ready to try Swissquote, don’t forget to use the sponsorship code x5kbf3 to receive 100 CHF in trading credits – completely free with no strings attached!

Swissquote Review: Pros and Cons

Before we dive into the details on my Swissquote Review, let’s look at the top pros and cons.

In short – for those living in Switzerland looking for an established and Swiss regulated platform, Swissquote are a great choice. They separate themselves from the traditional Swiss banks with greater innovation and a wider offering, and yet have all the benefits and security of being licenced and regulated in Switzerland.

And that counts for something, even if you have to pay slightly more for that security.

The account opening process is really no hassle and pretty straight forward, in addition you can get started for free with 100 CHF in trading credits to really test the environment and see if it’s right for you.

However, be mindful there might be better deals in the market place if you don’t want to have everything all under one roof – e.g. a free bank account with Zak and the Robo advisor from Selma Finance are solid alternatives – which also carry the benefits of being regulated in Switzlerand.

🎁 Reader Bonus: If you are ready to try Swissquote, don’t forget to use the sponsorship code x5kbf3 to receive 100 CHF in bonus trading credits – completely free with no strings attached!

If you are looking for a Swiss regulated platform to house all your stock buying, in addition to some other banking related services then Swissquote are worth a look.

| Pros | Cons |

|

|

How to open an account with Swissquote

Head over to the Swissquote homepage to get started.

> Click here to open the homepage

Click ‘Start Trading’ get started:

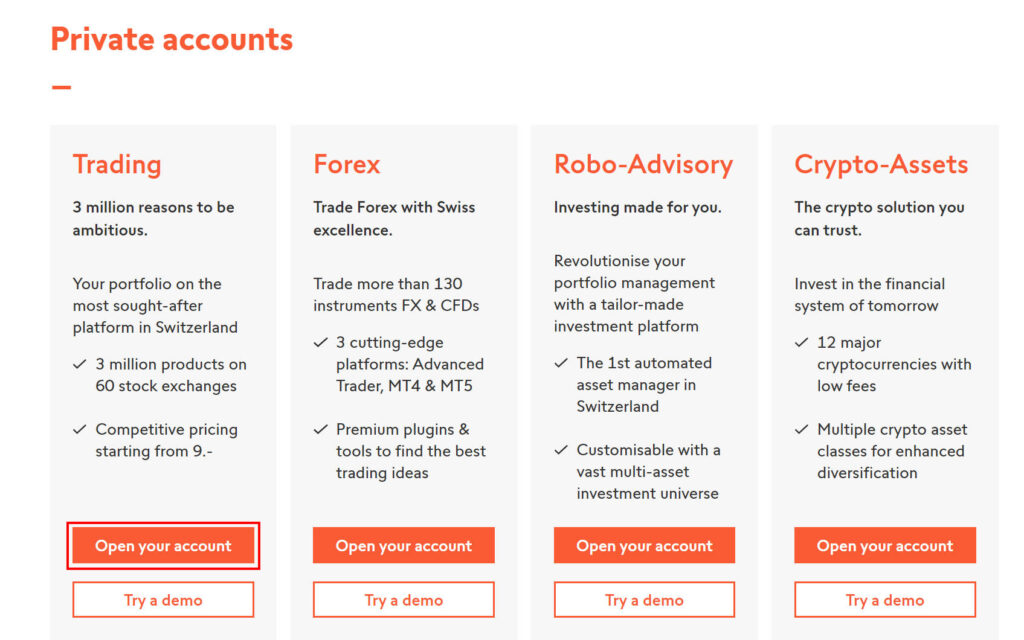

For this Swissquote review, we’ll be setting up a trading account. So hit ‘Open your account’ as shown below:

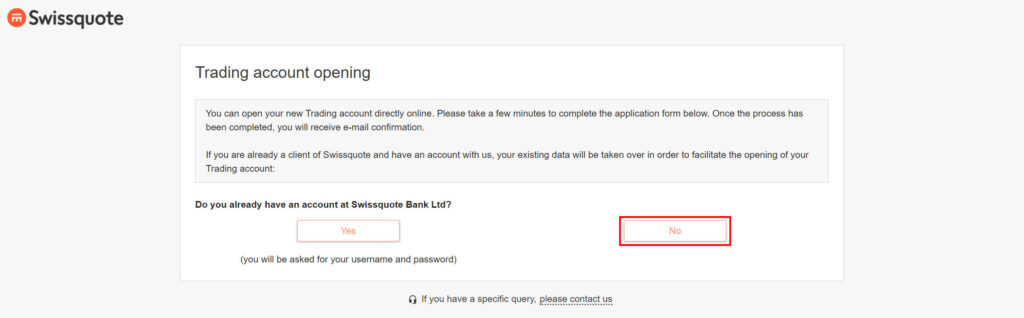

If you are new to Swissquote, select ‘No’ and we can move on:

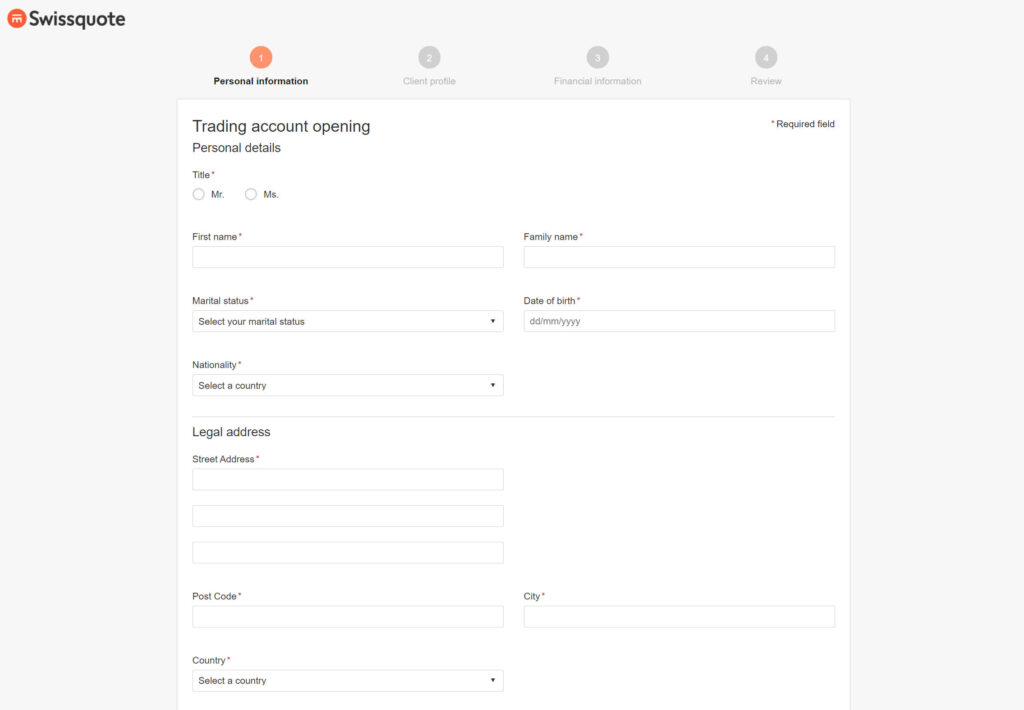

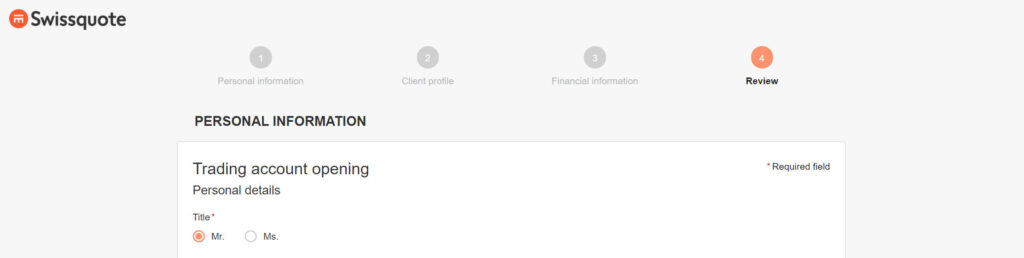

Drop in your personal details on step 1, no real surprises here:

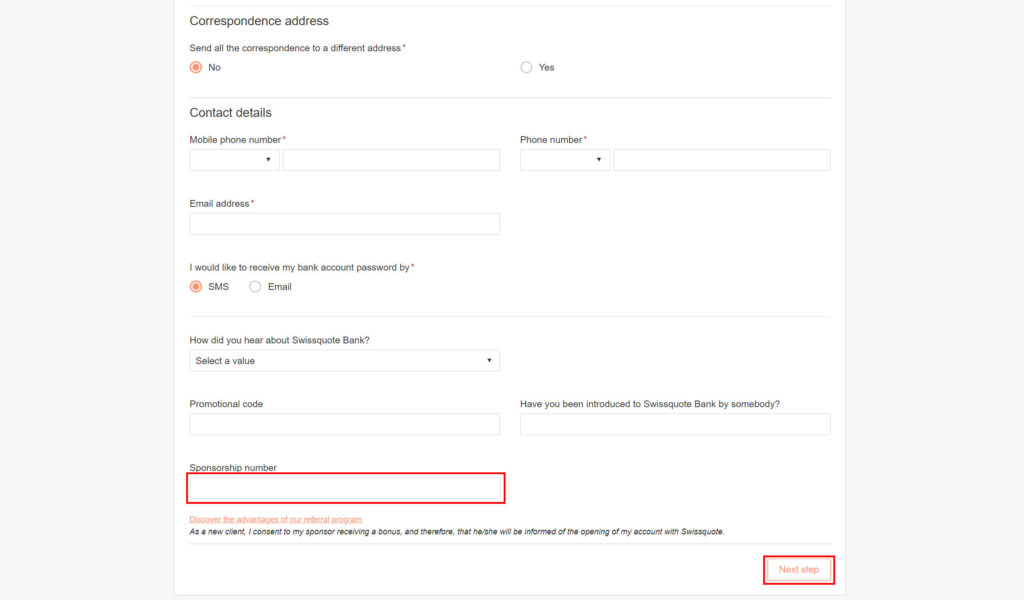

Scroll down and add the sponsorship number x5kbf3 in the box to receive your 100 CHF trading bonus and click ‘Next Step’:

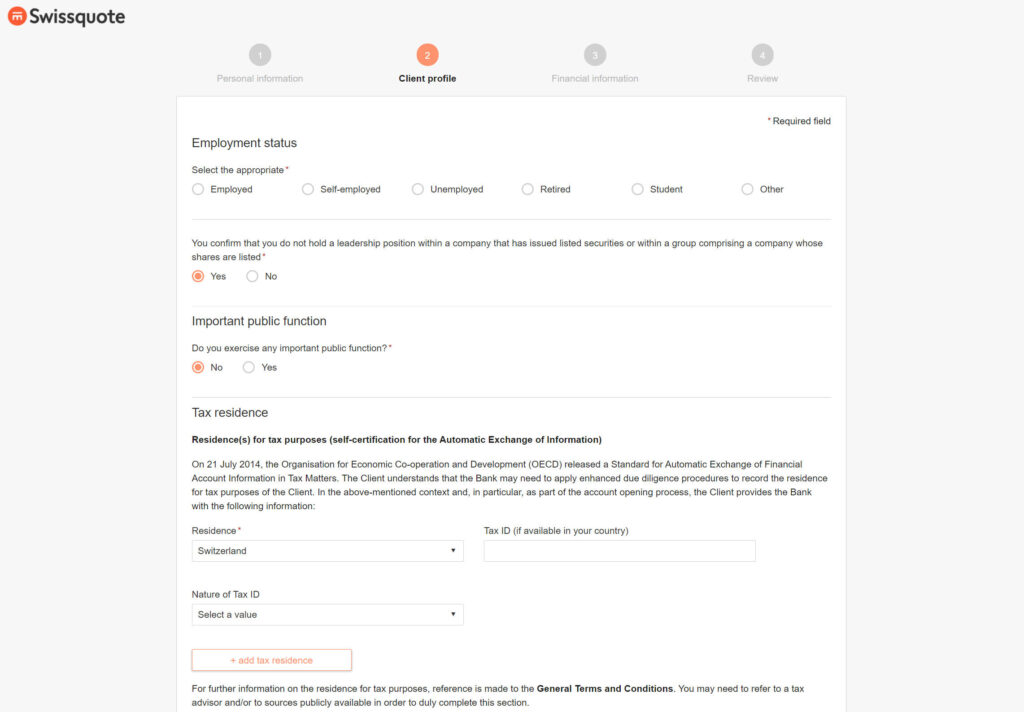

Next, add in your employment status and tax residence information:

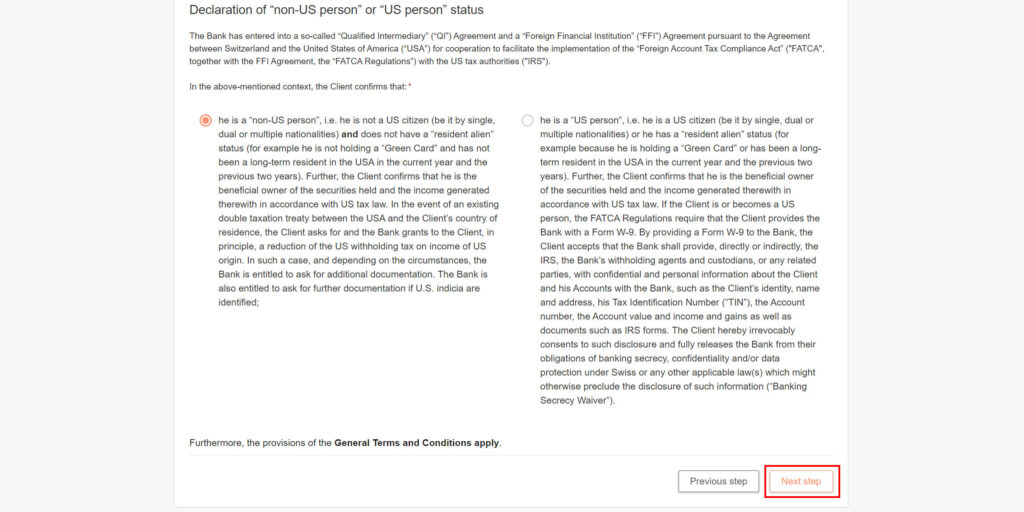

Declare your personal status as it relates to the US:

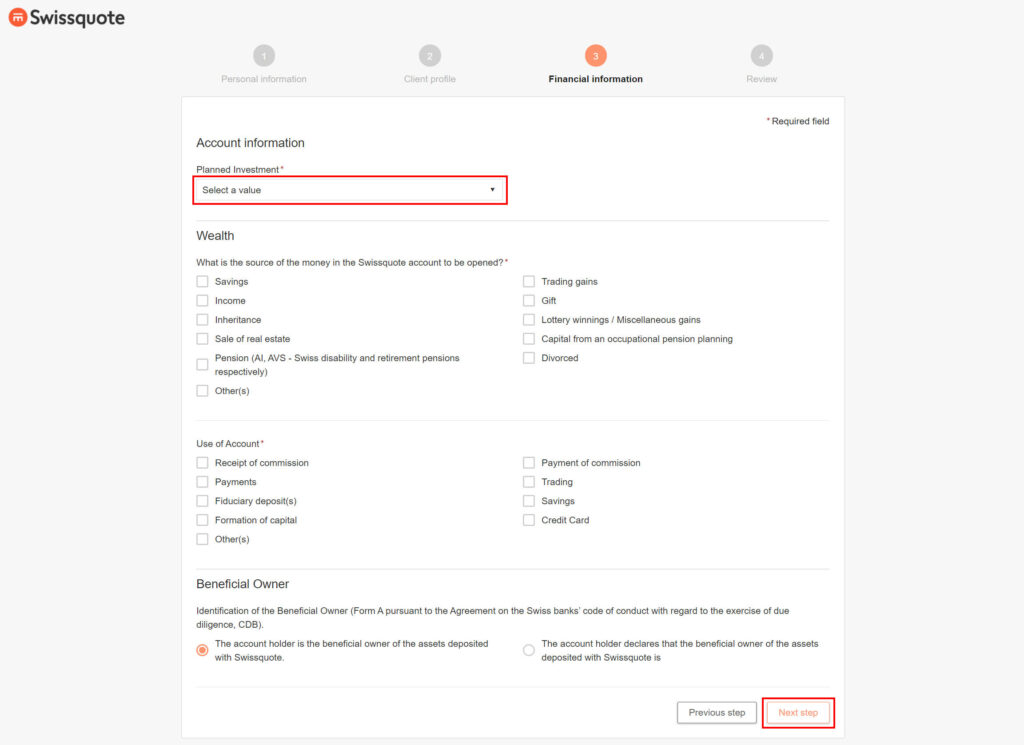

Now we move onto the ‘Financial Information’ section.

Populate the amount you plan to invest, and the source of the funds (e.g. savings) and hit ‘Next step’:

Now you get a chance to review all the information you’ve submitted…

…Scroll down to the bottom once you’ve checked everything and tick the box and hit ‘Submit’:

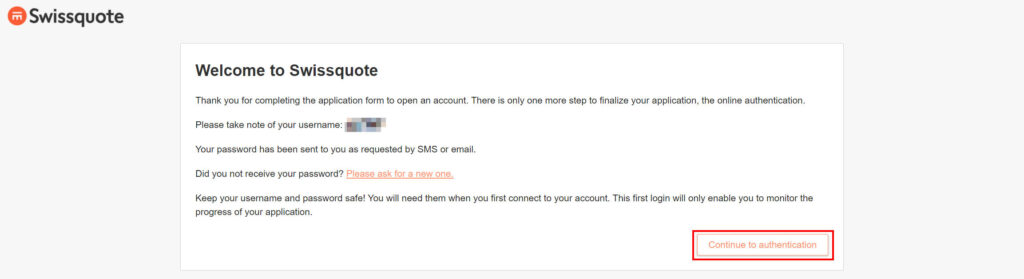

Ok! Now we can start the authentication process:

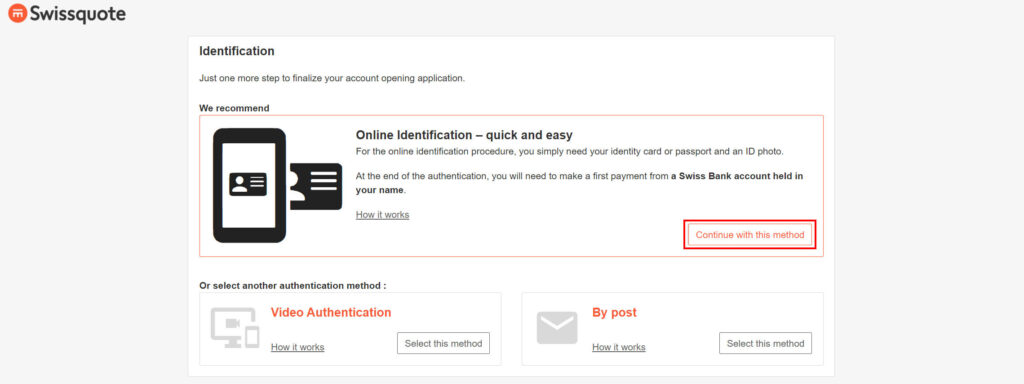

The ‘Online Identification’ was the the default method selected, so lets go with that:

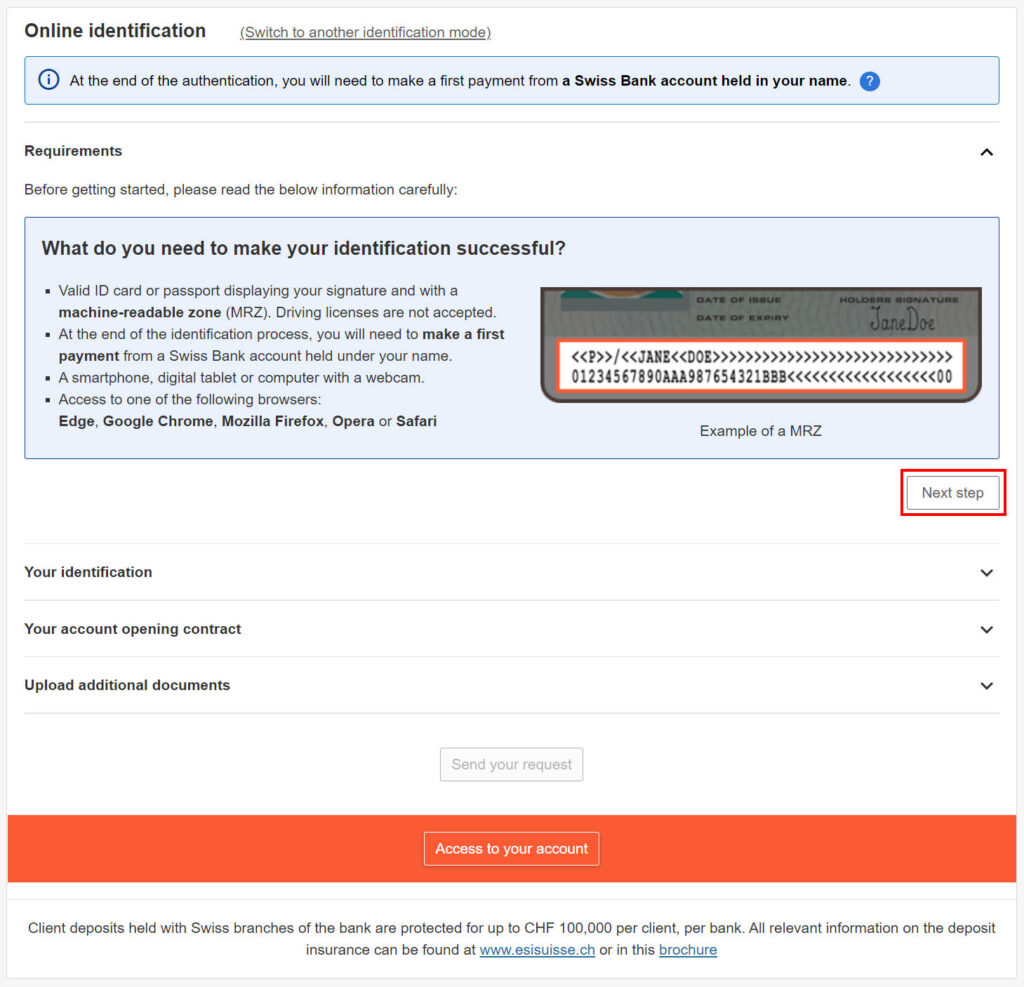

The menu will expand and you need click ‘Next step’ after checking the requirements:

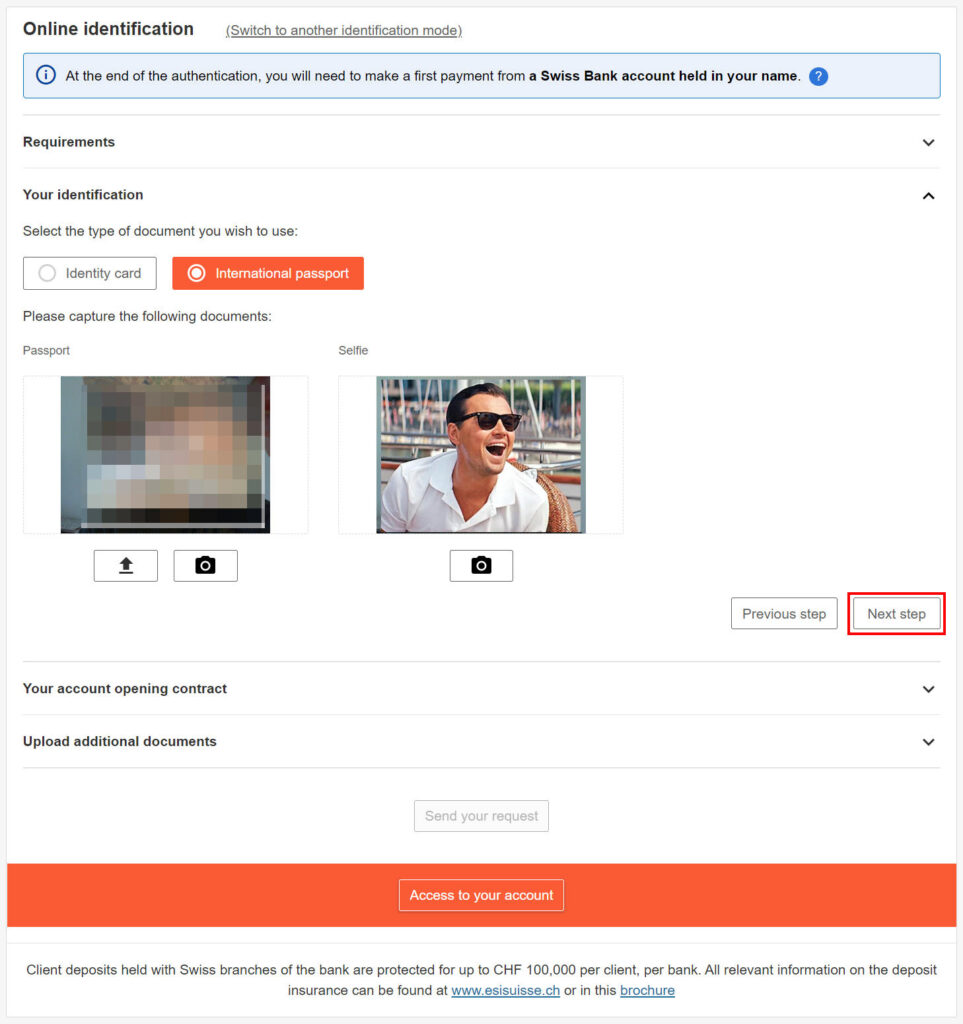

Select the type of ID document, and then upload or take a picture (clicking the camera icon) of the front and back. It’s a little bit tricky to align it, but the scan is quite fast. You’ll also need to take a selfie.

Click ‘Next step’ when you are done:

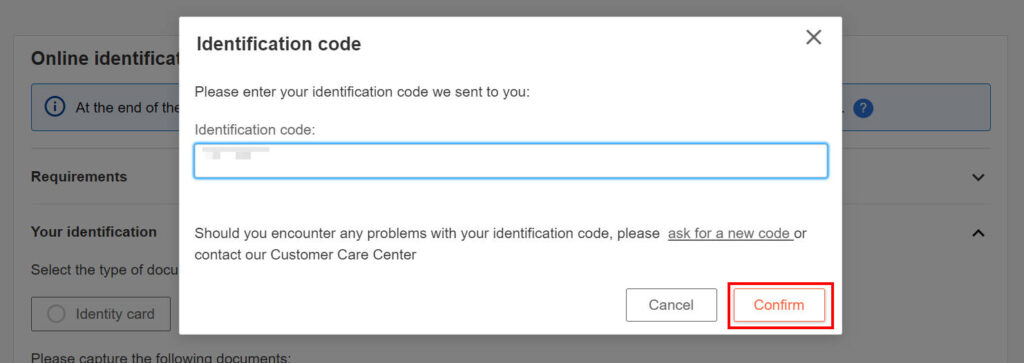

Now enter the SMS code they sent and click ‘Confirm’:

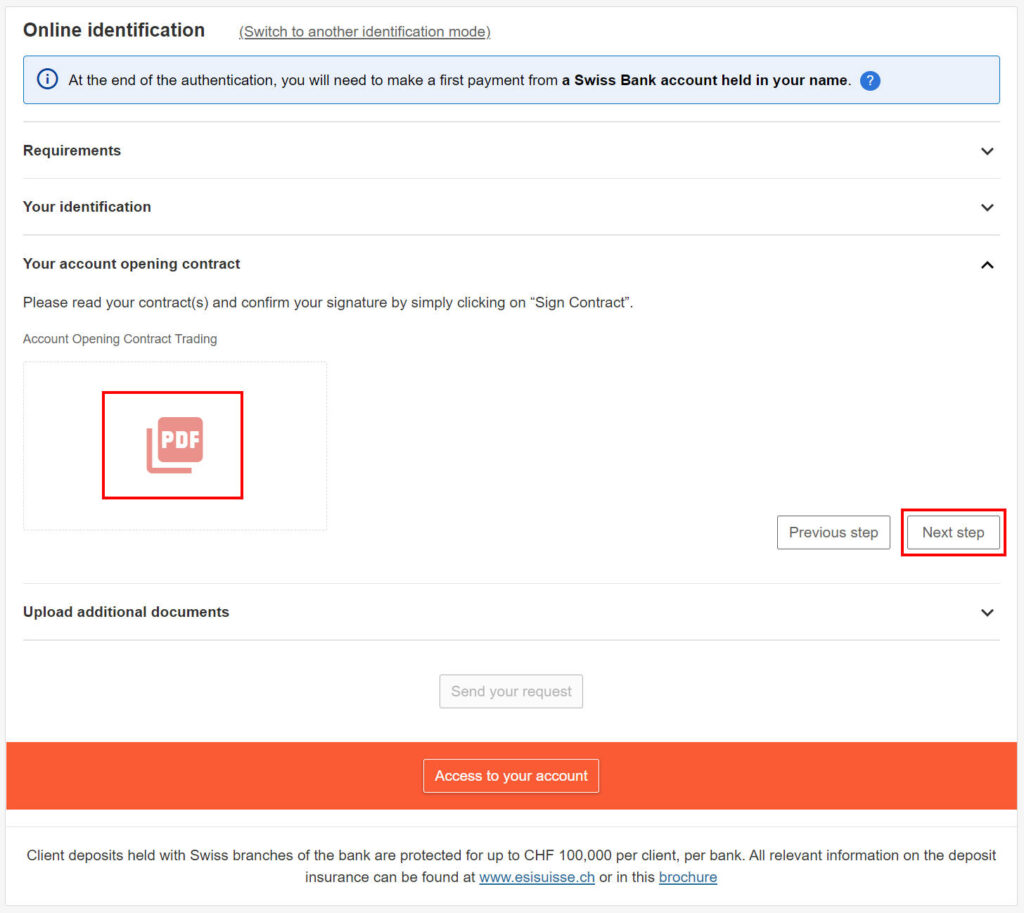

Now you can check the contract details via the PDF download and click ‘Next step’ to move on…

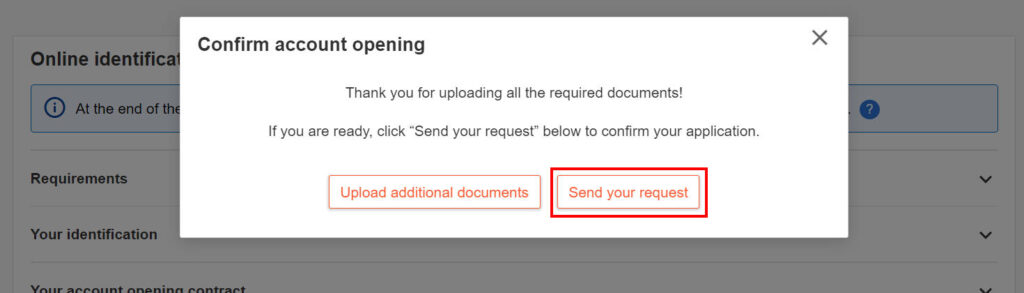

OK – all good? Click ‘Send you request’:

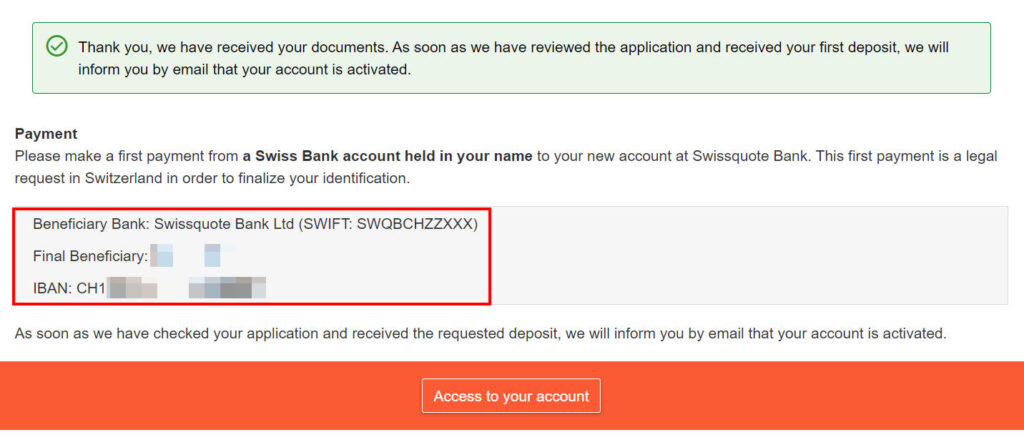

You should see the green confirmation message below – however remember you need to make a small deposit (e.g. 10 CHF) to your new account via the IBAN details below, so copy these and move over to your e-banking:

At this point, the steps with Swissquote end and you need wait for the account to be opened.

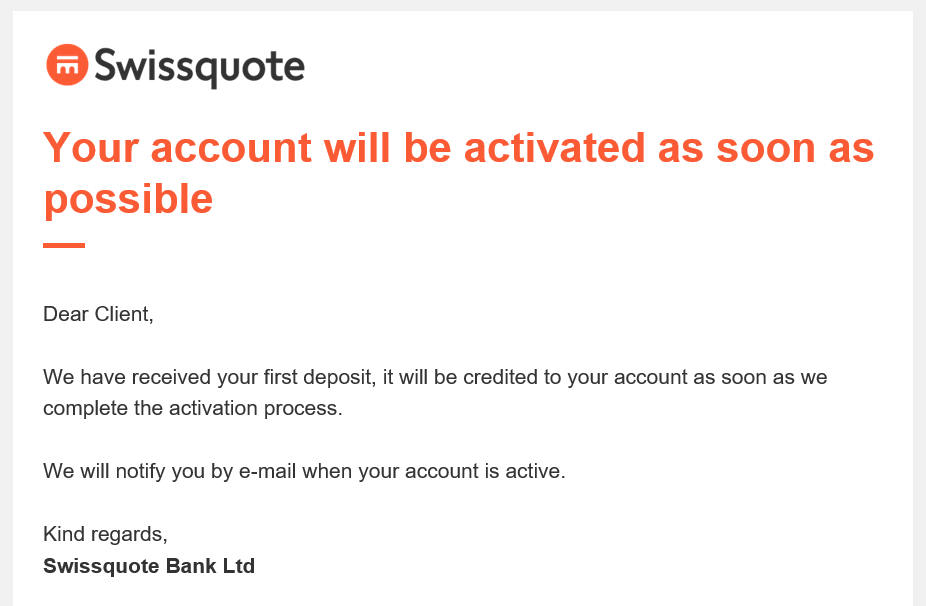

Once you submit the first deposit, you’ll also be notified (under 24hrs):

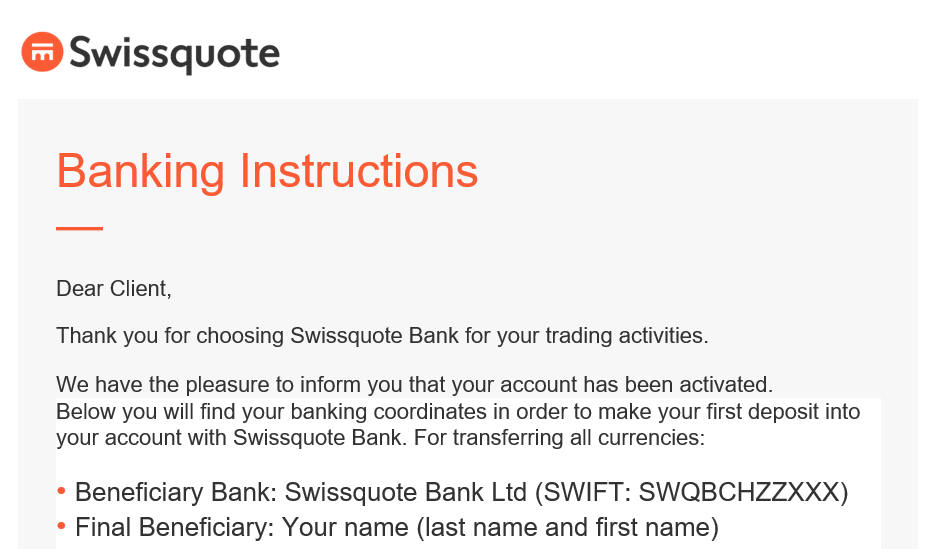

Two working days later, you’ll get another email informing you your account has been opened:

Logging in for the first time

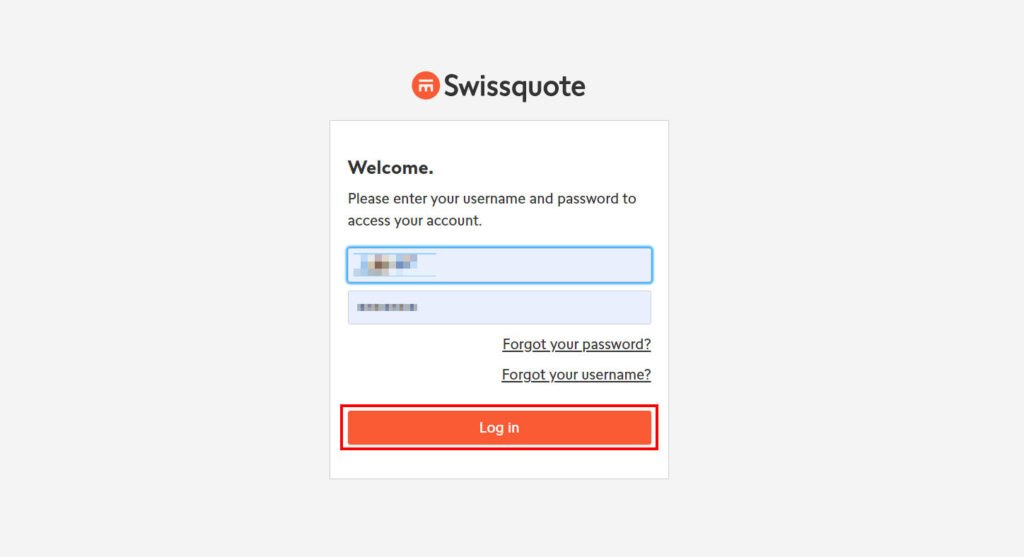

With the confirmation email received, you are ready to login. Enter your username and password, then hit ‘Log in’:

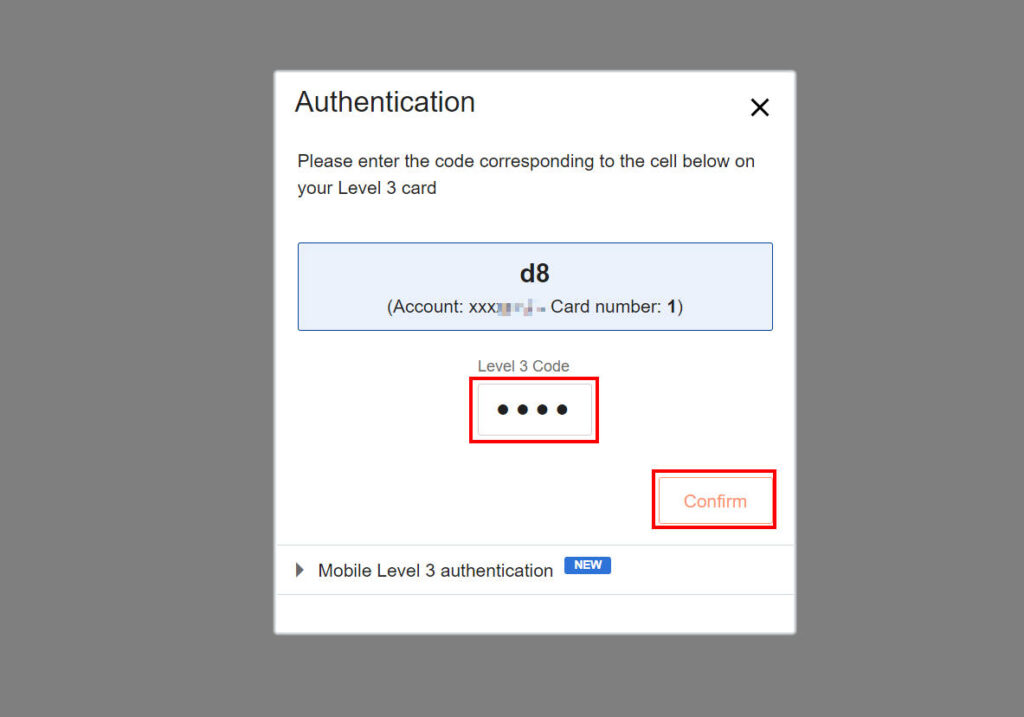

You’ll then need to verify the login with a two step authentication, in this case I have a PDF file with the code to enter for D8.

Old school, but it works (mobile auth. is also an option to setup).

Hit ‘Confirm’ when ready:

And wait a few moments while it loads…

…Then a few moments more.

Ok, we have now logged in!

For a true Swissquote test – lets buy something!

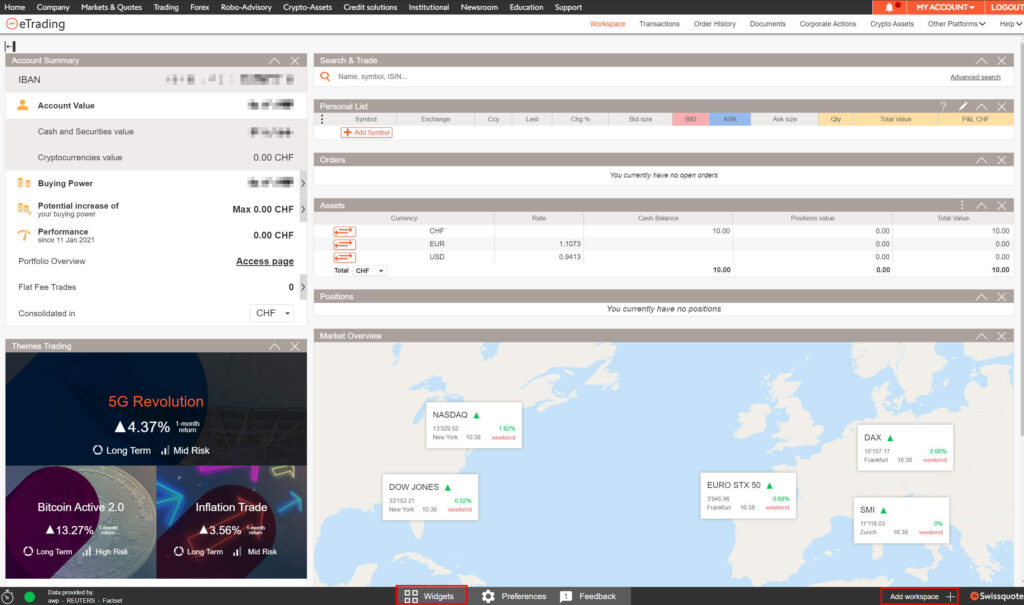

You’ll be presented with your dashboard, or a ‘workspace’ as Swissquote likes to call it. Not the most attractive user interface out there, but built for function, I guess.

You can customise the workspace with different widgets, and even build up completely new workspaces from scratch – which is a nice addition for those looking for increased customization.

To do so, you’ll see the links at the footer shown in red:

To buy a share and start trading, simply enter it into the search box and hit enter.

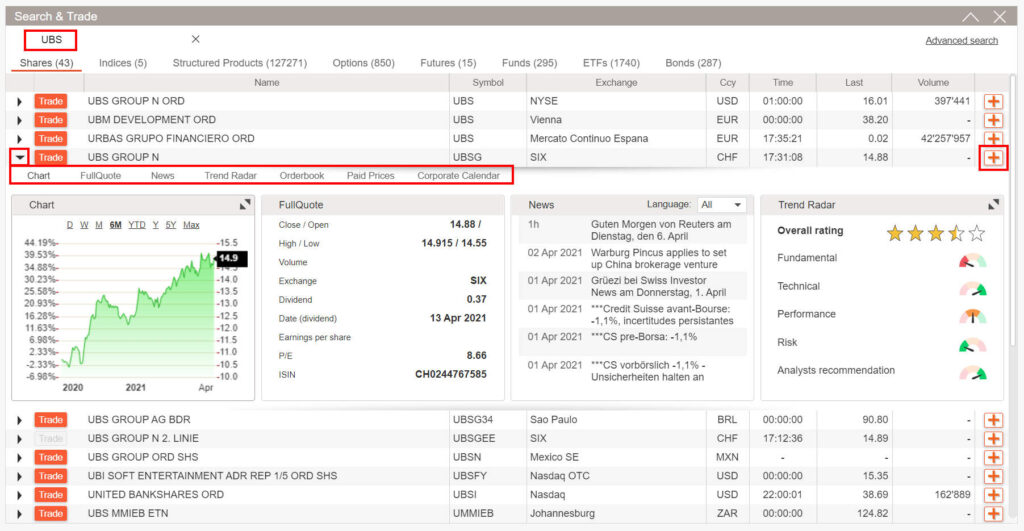

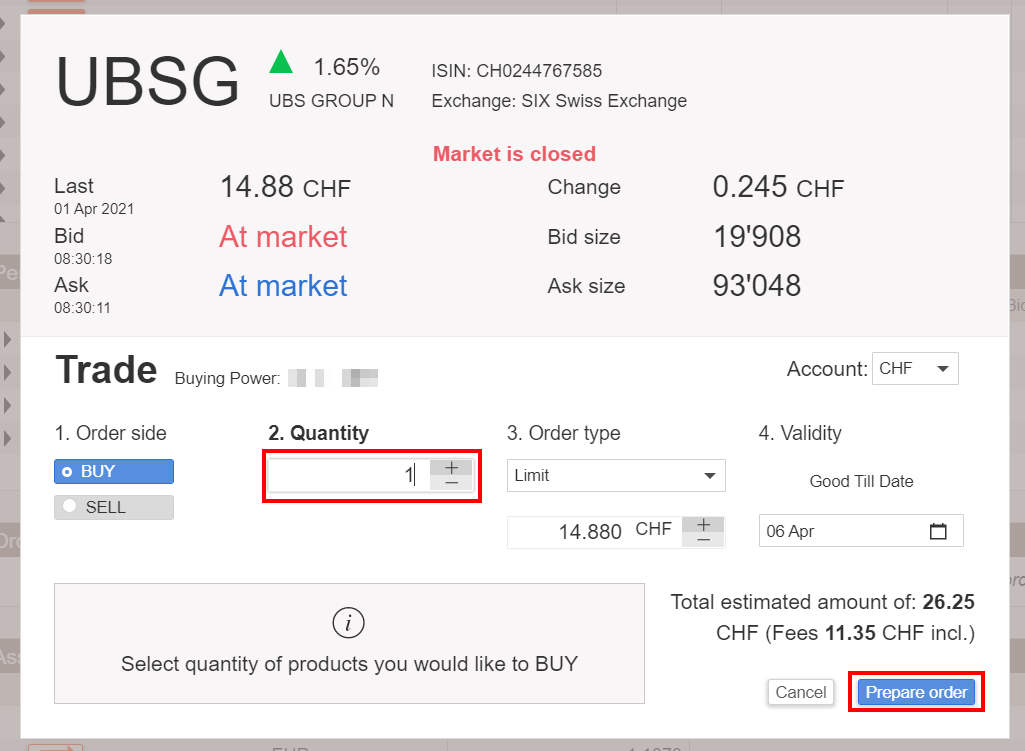

In this Swissquote test, I’ve used UBS:

You can toggle the listing to view more details, and use the sub tabs of ‘Chart’ ‘Full Quote’ and ‘News’ etc to dive deeper into the individual stock you have open.

The view here is pretty extensive and packed with information about the company, prices and trading trends.

The ‘plus’ icon on the right hand side enables you to the add the stock to your ‘Personal List’, which is basically a favourites list.

I’ve added a few example stocks and funds to the Personal List below:

To trade any of these, simply hit the orange ‘Trade’ button, and then another window will popup.

You can then enter the quantity and then prepare the order to make the purchase:

And that’s all there is to it.

Pretty straight forward and as you can see from this Swissquote test you can be trading in a few clicks.

Can you trade cryptocurrencies with Swissquote?

Yes, easily.

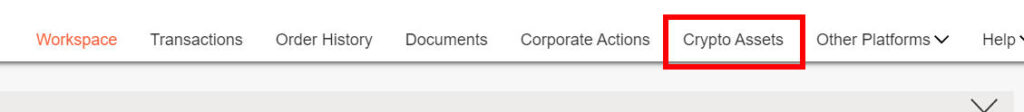

You access the dashboard directly from the eTrading dashboard by clicking ‘Crypto Assets’ in the main menu:

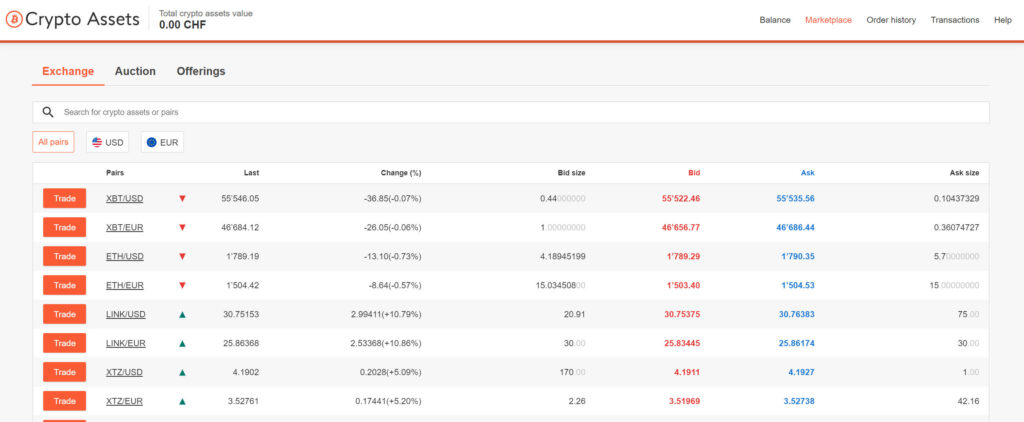

You’ll then be able to view the full list:

Swissquote Demo Account

Before you start trading with a live account, Swissquote also offer a demo trading account to test things out. It’s pretty much the same as the live account and offers a good intro to the trading environment, without having to use real money.

It’s a good option to start experimenting with Swissquote to see if it’s right for you.

Funding the Swissquote account

In the registration process you will have to deposit a small amount to fund the account, via bank transfer, which is straight forward and happens within a day or two.

Once you have a live account setup, it is also straight forward to top up the account.

There are a couple of routes in the navigation to do this, and you can choose bank transfer or credit card.

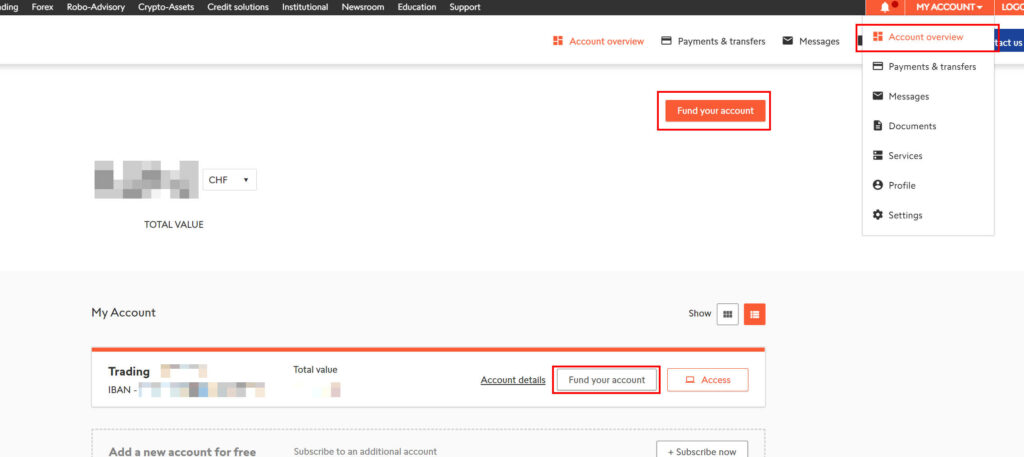

Under ‘My Account’ in the top right navigation bar, select ‘Account Overview’ as shown below, and then select ‘Fund your account’ from one of the two links (both are the same, pick one) as shown below:

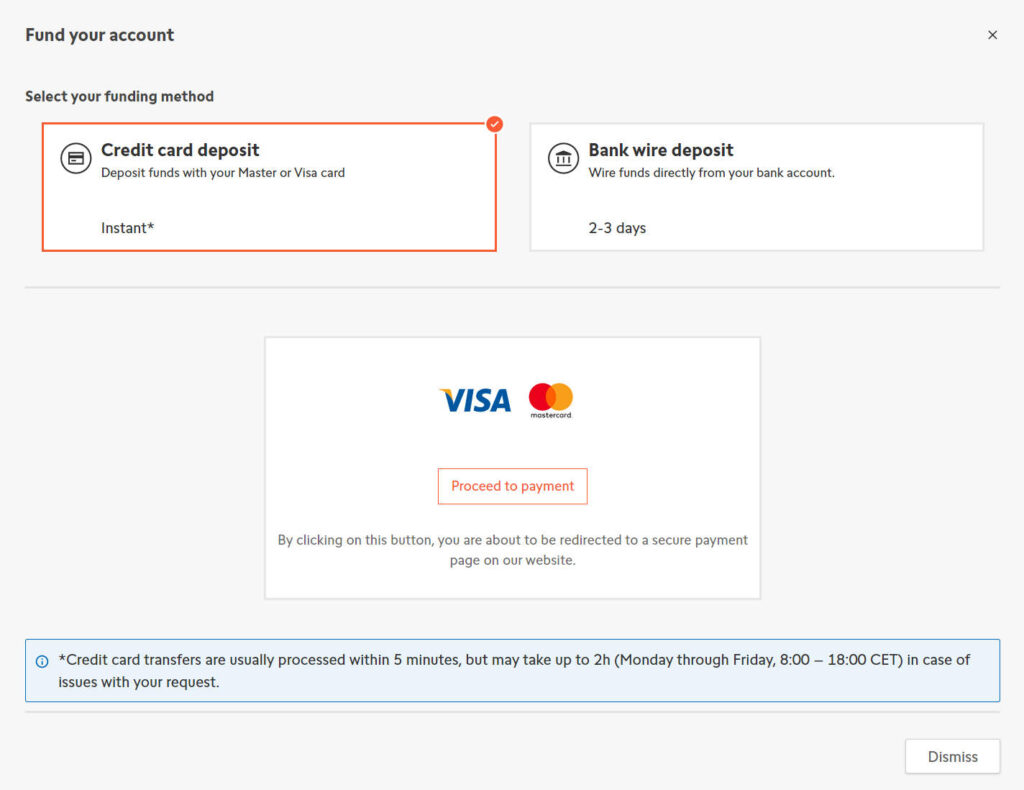

A popup will then appear for your to select your payment method, and you can then complete the process:

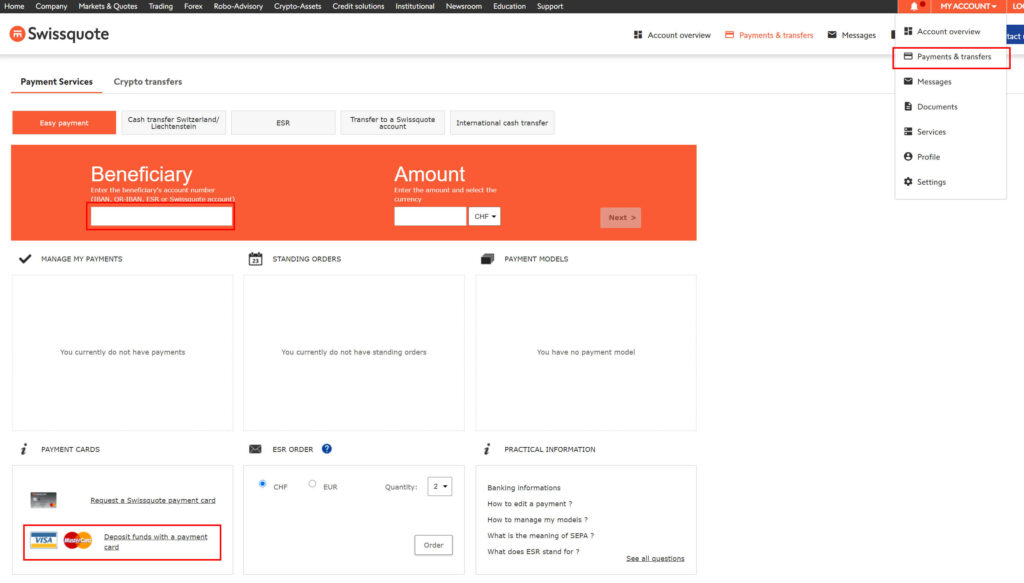

Another route to fund the account is by clicking the ‘Payments & transfers’ link under ‘My Account’.

This section gives me more options, particularly for cash and crypto transfers:

Login & Security

As you would expect from a regulated Swiss bank, security is industry grade with SSL encryption and https used on the etrading platform, with additional two-factor authentication (mobile or a paper code grid, named the ‘L3 card’) required when you login.

In addition, you also have an automatic logout timer like you would in traditional ebanking.

Technical security aside, let’s not forget one of the biggest draws for using Swissquote – they are Swiss and have a banking licence.

Swissquote are based in Switzerland, regulated by Swiss authorities and the Swiss finance regulators, FINMA. Swissquote are also listed on the Swiss stock exchange (SIX) which is another layer of security as they must disclose detailed financial records and statements.

This is a big selling point for Swiss investors who might otherwise not be comfortable trading with a broker who isn’t hosted and regulated in Switzerland.

Many of the competitors in the online trading space do not have Swiss offices and licences, and thus fall under EU regulation, typically the Cyprus Securities and Exchange Commission (CySEC), which has a more limited deposit protection (20K EUR) vs. those in Switzerland of 100K CHF should things go wrong.

With Swissquote, you are dealing with a Swiss bank – and you can’t get much more certainty than that.

Fees & Charges

With all that Swiss peace of mind, there comes some additional costs.

You simply can’t compare Swissquote in terms of pricing to one of the cheaper online brokers such as DEGIRO. Swissquote cost a lot more. If price is the most important factor to you, check out DEGIRO or Interactive Brokers (review coming soon) who are both much cheaper.

However for Swiss based trading platforms, Swissquote are not too bad – and far better than the mainstream Swiss banks.

For example:-

- 0.025% quarterly custody fee capped at 50 CHF (Decent compared to others in Switzerland, however CornerTarder have zero fees here)

- Zero activity fees (Again very good, CornerTrader for example charge 35CHF per quarter)

- 9 CHF flat fee for buying ETFs on the Swiss stock exchange (cheaper than other Swiss platforms)

- For EUR and USD Stocks and ETFs, CornerTrader are the better option compared to Swissquote

So while not the cheapest when compared to competitors outside of Switzerland, they are better than mainstream Swiss banks (e.g. Credit Suisse, Migros etc) and if going with Swissquote over no investing at all – it’s better to go with Swissquote.

CornerTrader are also a solid alternative – review for them is coming soon.

✍️ Remember – if you do decide to try Swissquote, use the code x5kbf3 to get yourself a free 100 CHF starting bonus. Every little helps 🙂

Customer Support

Customer support is good with Swissquote, and they have a full international and multi language customer support center for clients. You can typically get through to someone on the phone if you need to up to 10PM CET, and the email responses are generally pretty quick.

An added level of comfort is they have a brick and mortar office here in Switzerland, located in the Gland. Many of the competing online brokers don’t have this luxury and are setup outside of Switzerland. Swissquote even have an insider bar & lounge in Zurich – fancy.

Additional Resources

Swissquote have a tonne of additional resources and material. From webinars, ebooks and education documentation – the content here is extensive and compared to the competition – pretty awesome!

It’s refreshing to see such a wealth of material available for newcomers.

Financial news, analysis, and a dedicated newsletter are also available, in addition to an extensive FAQ section – translated for multiple languages.

Background info on Swissquote

Swissquote were founded in 1996 in Switzerland, and have since expanded globally with offices and licenses in the UK, Asia and beyond. They currently employ over 800 professionals and have been listed on the Swiss stock exchange since May 2000.

They continue to innovate and bring new products to the market – from roboadvisor services to bitcoin trading, and as they are a regulated Swiss bank offer products such as mortgages, savings accounts and credit cards.

They are headquartered in Switzerland at Chemin de la Crétaux 33, 1196 Gland.

Closing thoughts

For those looking for Swiss licensed and regulated broker, then Swissquote are an obvious choice. However as we explained above, this Swiss security comes at a slight premium compared to others. You’ll be paying more to trade compared to the other ‘non-Swiss’ brokers such as DEGIRO – but for some, the Swiss backbone will be a price worth paying for.

CornerTrader are another one to consider if you are set on trading within Switzerland, and I’ll be reviewing them soon.

But for now, combined with their extensive support, educational material and product offering – Swissquote are a solid choice to get started with Swiss based trading.

Thanks for reading and I hope you found with Swissquote review useful!

🎁 Reader Bonus: If you are ready to try Swissquote, don’t forget to use the sponsorship code x5kbf3 to receive 100 CHF in bonus trading credits – completely free with no strings attached!

Swissquote FAQ

Opening a Swissquote account is straight forward and takes around 15minutes. The step by step process is documented at the start of this review.

Swissquote are licensed and regulated in Switzerland and hold a Swiss banking licence. They are also listed on the Swiss stock exchange meaning they have to submit various financial and legal documentation to the authorities on a regular basis. These all support the case of Swissquote being a legitimate and regulated broker to trade with.

There isn’t one – however you need to transfer a few CHF to activate the account and complete the account verification process.

To buy bitcoin and other cryptocurrency with Swissquote, simply click the ‘Crypto Assets’ link in the top menu bar and you’ll be taken to a separate dashboard to buy and sell bitcoin.

To transfer money to Swissquote open the ‘My Account’ link in the top menu bar and select ‘Account Overview’ which then shows the ‘Fund your account’ link which enables you to select bank transfer of credit card as a means to credit the account.

Yes. They are a Swiss bank, licensed and regulated by FINMA (Swiss Financial Market Supervisory Authority).