Zak gets a Visa!

At Investing Hero, we aim to provide the best investing basics. To support this, some of the products featured in articles will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence our evaluations. Our opinions are our own. The information provided on Investing Hero is for informational purposes only. Please read our disclaimer for more. The information on Zak is intended exclusively for persons domiciled in Switzerland. A Zak account can only be opened with domicile in Switzerland.

I’ve been using my Zak bank account for over a year now, originally having reviewed it back in 2020. I rated the app highly for its ‘digital first’ approach. Coming from the traditional Swiss banking sector (Zak is a banking app by Bank Cler), this innovation was great to see.

Since then, a number of newcomers have joined the scene, from Neon to Yapeal and CSX by Credit Suisse – all with their pros and cons which I try to cover throughout this blog.

The space is getting ever more popular and competitive, which is great for us as consumers! More competition means the banking services continue to innovate to keep up with each other and offer us, the customers, better features and overall experiences.

When I first reviewed Zak, I rated it well for its quick customer onboarding, ease of use and genuinely offering a completely free Swiss bank account – with no strings attached.

This is still the case today, and in fact improved further with enhancements to the digital onboarding making things even easier and faster for newcomers.

As mentioned above, this space is competitive and constantly evolving with new features and updates from the likes of Zak. Zak still remains one of the top all-round choices for day to day banking needs.

Since my original review I’ve also covered related areas to the core banking offering, such as the greener climate change initiatives happening behind the Swiss bank – and how our day to day banking choices can impact the great Swiss outdoors in a positive way.

You can check out that article here for more on what Zak is doing in this space.

🎁 Reader Bonus: I’ve partnered with Zak to bring Investing Hero readers (that’s you!) a 50CHF welcome bonus when you open a free account. No strings attached and no BS. Just use the code HEROCH to claim your 50 bucks.

Looking back at my article on the 3 reasons I’m still using Zak, their public roadmap (among other things – you’ll have to read the article to see my other 2 favourites) showing what will be coming to Zak customers made my shortlist.

Why?

Having this visibility and transparency on what features have been requested, commented on and ultimately drafted for development is incredibly refreshing for a modern Swiss bank.

So, what’s come out of the roadmap in the last months?

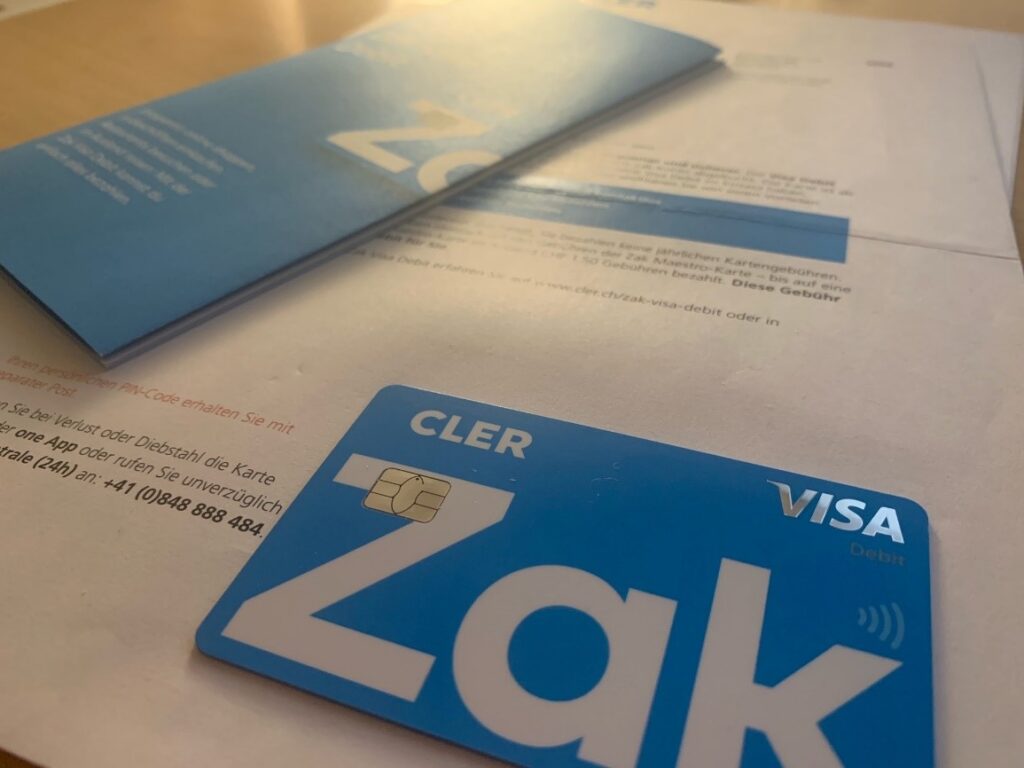

One of the most recent new updates from Zak is the introduction of the Visa Debit card for accounts.

For existing customers, you’ve likely already received the slick new card in the post like me:

Looking good!

There are a number of benefits for customers this brings, for example:

- It’s now simpler to manage your account – only one card to worry about!

- Being a Visa, you have more options, when buying stuff online.

- You can hook up Apple Pay/Google Pay/Samsung Pay very simply.

- And of course – the physical card is contactless for easy payments in-person.

The card is also completely free – no hidden fees or yearly costs for customers.

All round, a nice new addition to the Zak offering.

But what is a Visa Debit card?

While Debit cards are already very popular in Switzerland, Visa has only recently introduced the Visa Debit option. Let’s answer a few questions about Visa Debit in more detail.

Question 1: What’s the difference between a Visa Debit card and Visa credit card?

Answer: The Visa Debit card will deduct money from your account when you make a purchase, meaning if you have an empty bank account you can’t complete the transaction. A credit card on the other hand, allows you to purchase without having the money available and you are then sent a bill each month.

Question 2: Where can I use a Visa Debit card in Switzerland?

Answer: Pretty much everywhere. Anytime you see the Visa logo (which has a very high adoption in Switzerland) you can use your Visa Debit card.

Question 3: Can I buy things online with a Visa Debit card?

Answer: Yes absolutely, and this is a big benefit over other cards. As with physical shops, every time you see the Visa logo you can use your Visa Debit card for payments – and in the online world this level of adoption is extremely high, so you shouldn’t have any problems paying online.

As you can see, there are plenty of benefits with carrying a Visa Debit card in your wallet.

As I mentioned earlier, all existing Zak customers should have already received it in the post, if not you can ping them here for an update.

For those of you who have already received and activated your card, enjoy the new flexibility! Personally, I’m looking forward to exploring the upcoming features launched by the Zak team at Bank Cler in the coming months.

Thanks for reading!

Mr. IH

🎁 Reader Bonus: I’ve partnered with Zak to bring Investing Hero readers (that’s you!) a 50CHF welcome bonus when you open a free account. No strings attached and no BS. Just use the code HEROCH to claim your 50 bucks.

*Update September 2021

You can still use the zak promo code HEROCH to claim your welcome bonus.

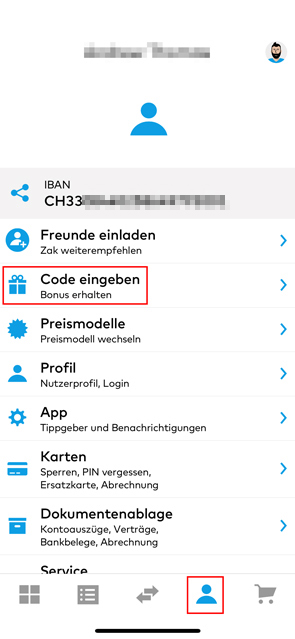

1 – Wait for your account to be activated after registering. Takes 2-3 days.

2 – Go to your ‘Profile’ and tap ‘Code eingeben’ and enter the Zak code HEROCH

3 – That’s it! Enjoy 🙂

About me

I’m a British expat who’s been living in Switzerland for the last 10 years. I’m a digital marketing professional by day, and anonymous investing blogger by night. I cover investing basics, robo advisor reviews and epic how to guides. You can call me ‘Mr. IH’ for short, and read more about me here.