Swiss Bank Account Opening Process: 10 Things to Look out For

At Investing Hero, we aim to provide the best investing basics. To support this, some of the products featured in articles will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence our evaluations. Our opinions are our own. The information provided on Investing Hero is for informational purposes only. Please read our disclaimer for more. The information on Zak is intended exclusively for persons domiciled in Switzerland. A Zak account can only be opened with domicile in Switzerland.

If you have recently relocated to Switzerland, or in the process of planning out a move, your ‘to-do list’ is no doubt already bulging with a huge list of items you need to get done.

And of course – the Swiss bank account opening process is a must have addition to your list if you are settling here.

In the very short term, you can use a service such as Wise to convert currency into CHF at great rates, but if you are staying here longer you’ll need to get setup with a dedicated Swiss bank account.

This article won’t talk you through the step-by-step process in opening a Swiss bank account (I already have plenty of those on the blog, such as this Zak Review) but it will give you some pointers on what to look for before you make the decision.

I’ve listed 10 points for you to consider that should make your to-do list a little easier.

🎁 Reader Bonus: I’ve partnered with Zak to bring Investing Hero readers (that’s you!) a 50CHF welcome bonus when you open a free account. No strings attached and no BS. Just use the code HEROCH to claim your 50 bucks.

Let’s jump in!

1. Do they offer digital account opening?

Gone are the days when you needed to sign paperwork or be onsite physically at a bank to open a Swiss bank account. You now have options to do it all from the comfort of your home via the providers smart phone app.

2. Is the bank account free to open?

You don’t need to pay high annual fees or other hidden charges (e.g. account opening admin fees)as there are free options on the market. So, don’t overpay, and put that saved CHF towards something else on your to-do list.

3. Are there any deposit and withdrawal limits?

The last thing you want are limitations or blocks on your new account as you shift CHF around to help your onboarding in Switzerland – so double check the small print for any unreasonable daily/weekly or monthly account deposit or withdrawal limits.

4. What cards do you get?

Be it Visa, Mastercard or Maestro – check which your bank provides (take note of any additional fees here) and decide which is best for you based on the type of purchases you make. The local village shop transactions might differ to online shopping, so check the acceptance. Side note – contactless payments (e.g. via Apple Pay) are also a great feature to look out for.

5. Are there any other fees?

I touched on one example above here (e.g. card fees) but are there any other hidden fees you need to consider? Check the small print and terms and conditions on their website before you commit to avoid any nasty surprises.

6. Is the bank regulated in Switzerland?

With all the fintech innovation and fast paced start-ups in this space it’s easy to overlook some of the basics – and significant benefits – of a Swiss based bank. Check if yours is licenced and regulated (by FINMA) in Switzerland to do business, and has offices here. This regulation will ensure your deposits are legally protected up to 100K CHF. Zak belongs to Bank Cler and therefore provides this security.

7. How established is the bank?

More for peace of mind and security, but check the history and background of the bank and for how long they’ve been operating in Switzerland. Many neo-banks have banking partners in the background, as setting up a new bank is a costly and lengthy process in Switzerland. In the case of Zak, there is no ‘secondary partner’ as this is the mobile banking app product of Bank Cler, a FINMA regulated Swiss bank.

8. What is the social impact of the bank?

While it might not be your number one priority, environmental, social governance (ESG) topics are becoming increasingly in focus for consumers, and banks also have a huge role to play. If these topics resonate with you, cross check to see what your potential bank is doing in the space.

9. Are there online reviews and customer feedback?

Read up on blogs, forums and Google reviews for your potential choice to see what independent reviewers (like me!) and customers are really saying about the platform you are considering. It only takes a couple of minutes to Google the ‘brand name + review’ and you’ll uncover real user experience. It’s worth also checking out the app store reviews, and note when the last app update was released. That said – remember to take individual complaints with a pinch of salt.

10. Are there any reader deals or promotions?

Let’s face it – a few extra CHF into your bank account is never a bad thing, and when you are opening an account there is no better chance to grab a deal. Banks would love to have you as a new customer and are often able to incentivise you to go with them.

Pros and cons of Swiss bank account

Below I’ve listed a few pros and cons of Swiss bank accounts for reference.

Pros:

- Stable & secure Swiss economic environment

- High standards of regulation and trust

- Swiss banks are globally accepted for payments

- Swiss bank account opening process very quick and straight forward

- High level of digital enabled services (e.g. mobile apps)

- Plenty of choice & competitive offers

Cons:

- The Swiss bank account opening process can be a longer process for US citizens

- Swiss canton banks can be more expensive than alternatives

- Negative interest rates are applied to cash deposits (depending on the bank and volume of CHF – typically over 100K CHF)

Closing thoughts

And there you have it – my top 10 points to look out for with the Swiss bank account opening process.

As you work through your checklist don’t forget to consider my points here to make the best-informed choice for your hard-earned CHF.

Which one did you find the most relevant to you? What else would you add to the list? Let me know in the comments below.

Thanks for reading & good luck!

Mr. IH

🎁 Reader Bonus: I’ve partnered with Zak to bring Investing Hero readers (that’s you!) a 50CHF welcome bonus when you open a free account. No strings attached and no BS. Just use the code HEROCH to claim your 50 bucks.

*Update April 2022

You can still use the zak promo code HEROCH to claim your 50 CHF welcome bonus.

1 – Wait for your account to be activated after registering. Takes 2-3 days.

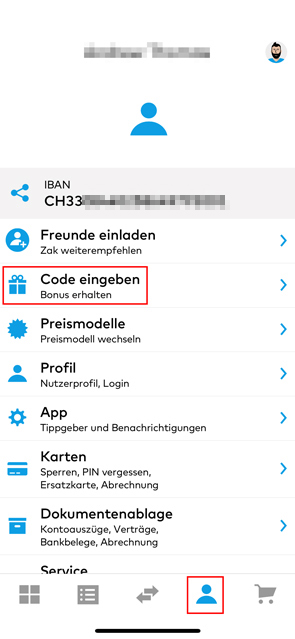

2 – Go to your ‘Profile’ and tap ‘Code eingeben’ and enter the Zak code HEROCH

3 – That’s it! Enjoy 🙂

About me

I’m a British expat who’s been living in Switzerland for the last 10 years. I’m a digital marketing professional by day, and anonymous investing blogger by night. I cover investing basics, robo advisor reviews and epic how to guides. You can call me ‘Mr. IH’ for short, and read more about me here.