The LUNA and UST Crash – My takeaways from the fallout

To say the last week has been rough for crypto would be an understatement. Even by crypto standards, the industry took a serious beating.

Not only did volatility rear it’s head – but a near 100% loss in value impacted LUNA coin holders, and the dollar de-pegging of the stablecoin UST plummeted to as low as 8 cents. At time of writing it was around 18 cents.

In all, that’s over $40 billion lost in a few days.

The past week has been horrific for thousands of people.

Suicide hotlines are pinned to Reddit and community forums – and most sadly, people have taken their lives as their entire savings have been wiped out.

It’s extremely depressing to read through all the comments about the fallout from the last week.

But how did this all happen?

A stablecoin is meant to be pegged to the price of the US dollar and is commonly used as a ‘savings’ vehicle within crypto portfolios. They act as a shelter against price swings and volatility. It’s like a safe haven of the crypto world.

The problem with UST however, is it’s an algorithmic stablecoin, and isn’t backed by real US dollars. It’s dependant on the price of the LUNA token. And so by definition, its actually not really that ‘stable’, despite being marketed as being so.

The technicalities of this are outside the scope of this blogpost, but in short, early last week a perfect storm of bad news around inflation rate hikes, stock and crypto market losses drove people to sell more and more – putting increasing pressure on the ability of UST to maintain a 1 to 1 comparison with the US dollar.

And well, it couldn’t.

The price of UST tanked as this negative effect compounded into a ‘death spiral’ and the price kept sliding.

Rumours of Blackrock and Citadel purchasing 100K Bitcoin and collaborating with LUNA founder Do Kwon (denied by all parties) also surfaced as the panic amplified and the selloff continued.

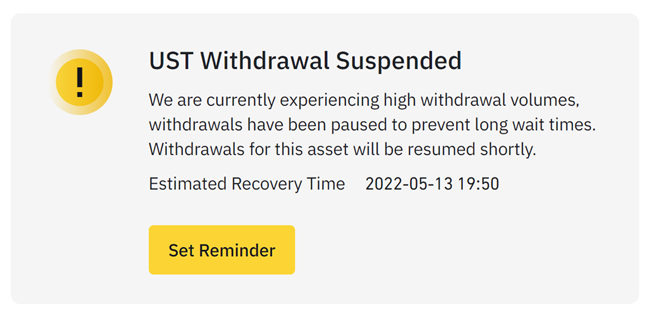

Holders of LUNA & UST couldn’t move anything due to network traffic, and had to watch their savings evaporate as the bank run continued. Brokers then restricted the trading of LUNA and UST, leaving their customers with no choice but to wait it out, and watch the prices slide further.

What happens next is still up in the air and under heavy discussion. Prices are unlikely to return to pre-crash levels, but there is hope as the Terra community discusses ways to support those who had invested in LUNA and UST before the crash.

There are thousands of messages and threads on this topic now – you can read and vote on some of those proposals here and here.

Time will tell if these plans come to fruition – keep updated via the official channels.

In the meantime, there have been many humbling lessons for people in the crypto space over the last 5 days.

Here are a few of my top takeaways:

- High interest APR is always a red flag. You can’t make money from nothing. Why and how can rates be so high? Follow the money in your research, and be sceptical of any ‘guaranteed’ interest rates.

There is a fine grey line between marketing unsustainable high interest rates for growth and establishing a community vs. an outright Ponzi scheme. - Algo based stable coins inherently carry more risk than they may first appear. How well do you really know what you are invested in? What dependencies does the project/network have? (e.g. in the case of UST – that was the LUNA price)

- Pay attention to the project founders & leaders. What is their attitude like? Are they arrogant, rude and aggressive to criticism? Do they have gambling traits and highly fuelled egos? Do they have any skeletons in the closet?

- The speed of crypto is fast paced, and in times of crisis this is amplified further. You have no time. Prepare ahead by only investing what you can afford to lose. No loans. No leverage. Only a small percentage of your portfolio in crypto that is diversified across different tokens and projects.

- ‘Sit tight’ and ‘plan coming’ style messages from the project leaders after 72hours is not a good sign. They could be removing liquidity while you hold onto devalued tokens. You cannot wait for them. Have your own ‘doomsday’ plan in place for times when you need it to avoid knee jerk reactions and panic selling. You can even go through in some stoic negative visualization to help you strategize. The plan should include removing a significant portion of your liquidity as fast as possible.

- Don’t trust crypto exchanges to serve your best interests. They can (and did for LUNA) remove the ability to trade when you need it most. Make sure you have accounts with multiple exchanges should you need to shift tokens to different wallets to work around restrictions. Be setup ahead of the next crisis.

- Don’t fall for the millions of Twitter followers and cult following of the community when deciding on crypto projects. Many of these followers are looking to simply drive up the price – and not for real world application and developing use cases for the technology.

- Disconnect from social media and stay open with those around you. It’s important in times of a market crisis to pause to reflect before making your next move. Stay healthy and put things into perspective.

Closing thoughts

The future around LUNA & UST isn’t over yet, and the situation is still developing. If you are a LUNA or UST holder, I urge you to take action and make your vote.

For those still recovering from last week I feel your pain. It’s times like these where it’s easy to feel deflated by the industry (I know I do) as yet another ‘failed experiment’ is excused with no accountability on the perpetrators.

That said, it’s important to remember to find the lessons from this experience in order to move on – and I hope the takeaways above help you through that.

Thanks for reading,

Mr. IH