Frankly ZKB 3a Review – The new pillar 3a offering from ZKB

This page is also available in:

Deutsch

Overall rating of our Frankly review:

4.0 ⭐⭐⭐⭐⭐ · 🏆 Best Customer Onboarding ·

At Investing Hero, we aim to provide the best investing platform reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence our reviews. Our opinions are our own. The information provided on Investing Hero is for informational purposes only. Please read our disclaimer.

In this post I’m going to be creating a frankly review, a brand-new digital pillar 3a (aka ‘säule 3a’) offering from Zürcher Kantonalbank (ZKB) launched on the 19th March 2020.

Frankly promises a digital account opening process in a few minutes, and the option to invest your pilar 3a pension fund into a portfolio of different asset classes to generate long term growth.

The move comes as players such as VIAC and Selma Finance continue to entice Swiss digital natives with fully online, frictionless and pain free account opening experiences – something the banks haven’t been able to compete with.

Until now.

Frankly code: INVESTINGHERO

🎁 Reader Bonus: I’ve partnered with Frankly to bring Investing Hero readers (that’s you!) a 35CHF discount on the yearly fee for new customers! No strings attached and no BS. Just use the code INVESTINGHERO in the app to claim your discount.

As always, I’ll be showing you the account opening process in this Frankly review through a simple format to show you all the pros and cons of the platform.

Make sure you read to the end, and the section on how Frankly compares to VIAC, so you can make the best decision for your private pension.

I’ll be taking you through everything, so you can follow every step.

Frankly review pros and cons

Before we get into the full frankly review, I want to quickly outline a few pros and cons.

Seeing a traditional bank move into this space is long overdue – and with UBS and Credit Suisse investing in the area will likely see more apps hitting the marketplace soon.

Firstly – Competition like this is a great win for us, the consumer! Regardless of the outcome of this review, having more fintech inspired apps and products in the marketplace is a win for innovation in Switzerland. Kudus to you ZKB for embracing the change!

For Swiss residents looking to start investing in Switzerland, Frankly is a great option for your pillar 3a. With competitive prices it goes head to head with the market leader VIAC, and does so with the trusted roots of a cantonal bank and established Swisscanto investment offering.

Onboarding is painless, support prompt and in English, and the mobile app slick and easy to use.

| Pros | Cons |

|

|

How to open an account with Frankly

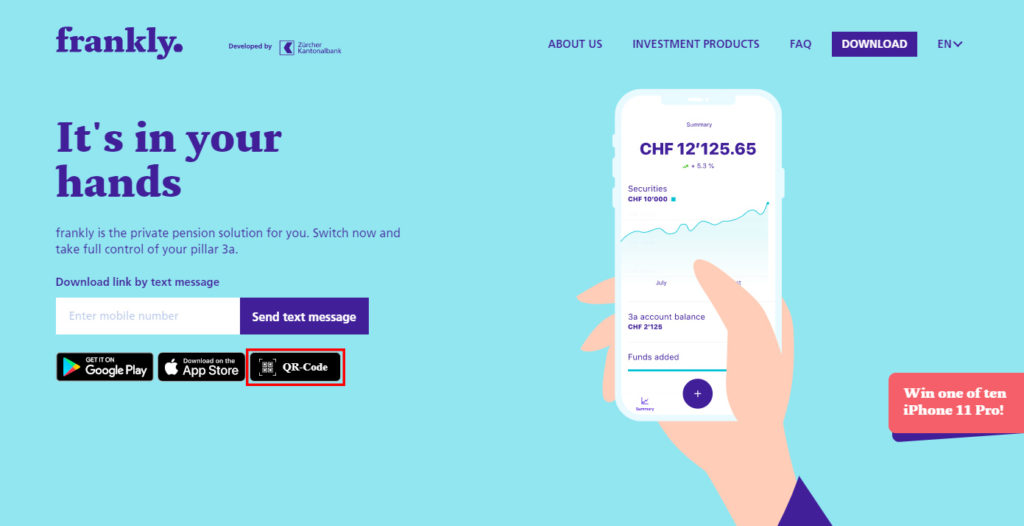

Head over to the homepage at frankly.ch to get started.

First impressions? I love the branding and slick look and feel. It’s a long way from the traditional ZKB style. Hopefully this carries through the entire customer experience.

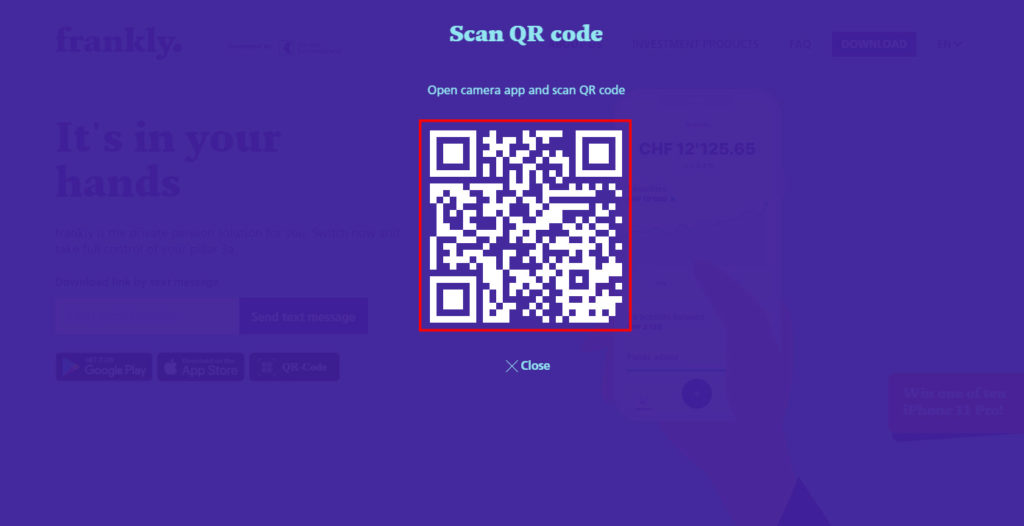

To save iTunes opening and causing havoc on my laptop, I’ve opted to scan the QR-Code with my smart phone:

Pretty cool. Makes you wonder why everyone isn’t already giving this option:

In this example I’ll be using iOS.

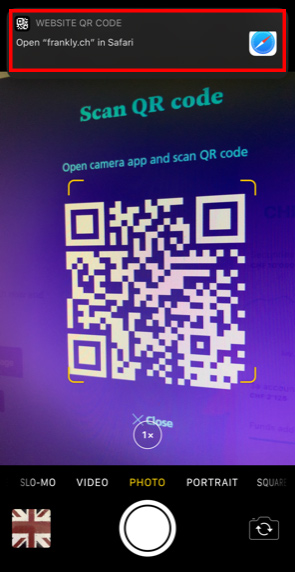

Scan the code and tap ‘Open frankly.ch in Safari’:

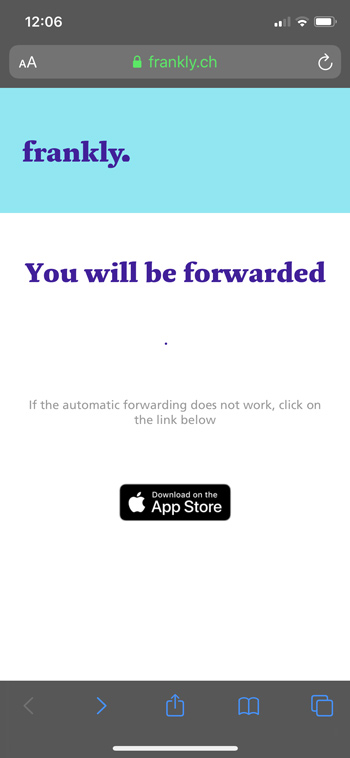

Frankly works out your device type and language, and will then redirect you automatically to the correct app to download:

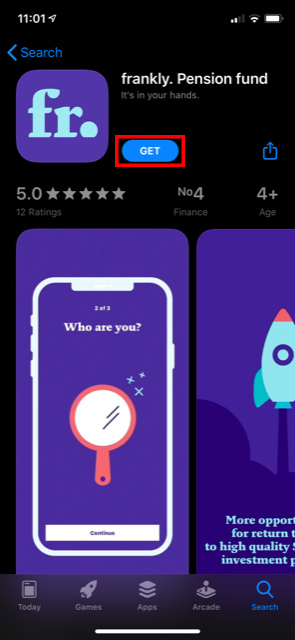

Once redirected to the app store, tap ‘Get’ to start the download. Be mindful the frankly app is 125MB, so consider doing this over wifi:

ZKB focusing on the details.

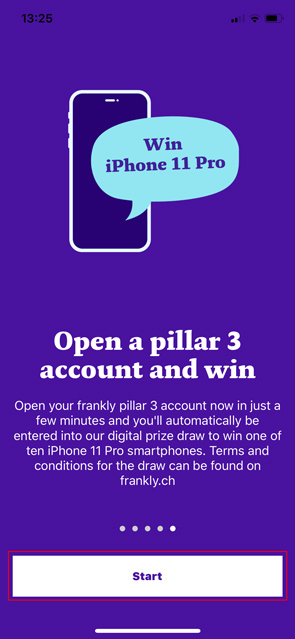

Once downloaded, you are ready to start the registration process. Open the app, and you have a few screens to swipe through:

Once you are done reading, tap ‘Start’ to move onto the next screen:

First you create a Frankly profile, tap ‘Continue’ on the next screen:

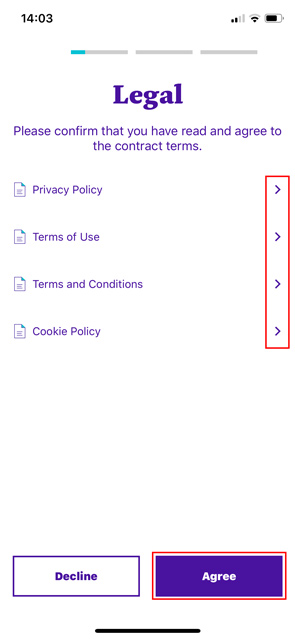

Frankly gets the paperwork out the way first. Review the docs and tap ‘Agree’ (assuming you do):

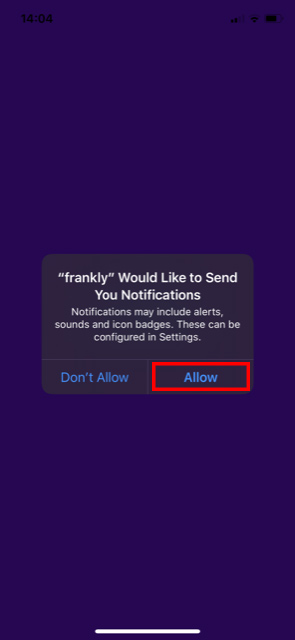

Next, allow Frankly to send you notifications:

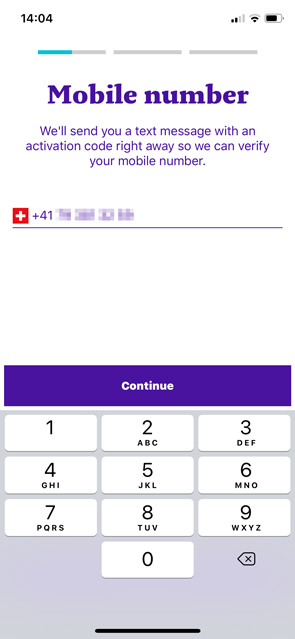

Now enter your mobile number, which is used to send you a SMS verification code:

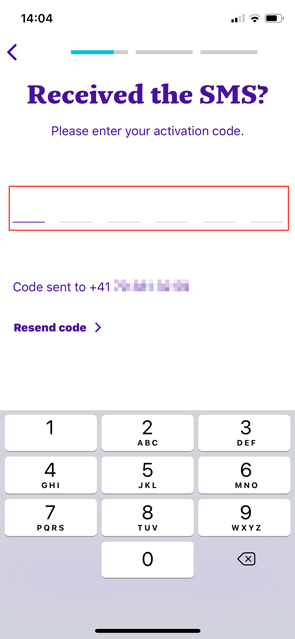

The SMS code should arrive straight away, enter it here:

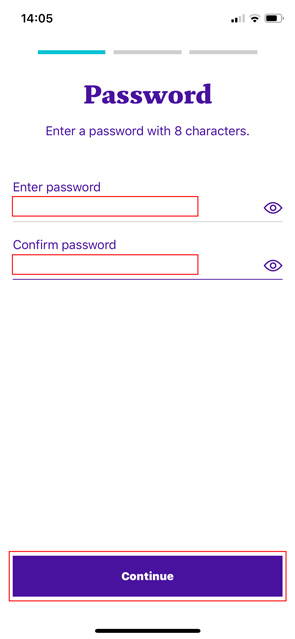

Now create a password and enter it here:

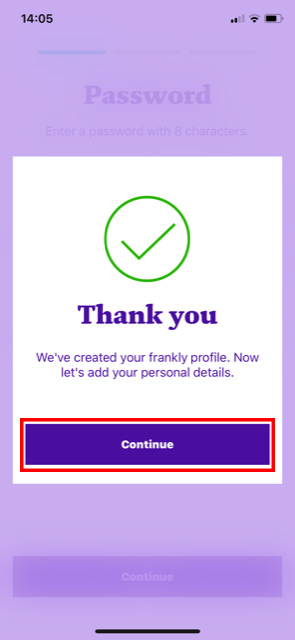

Phase one complete!

You now have a Frankly profile.

Alright – lets move onto part 2.

Hit continue:

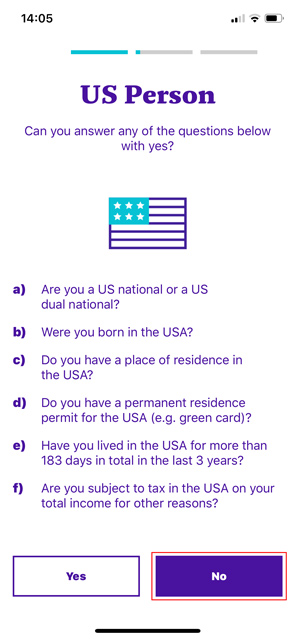

Confirm the standard US person questions here – if any of the below apply, select yes. Otherwise, ‘No’:

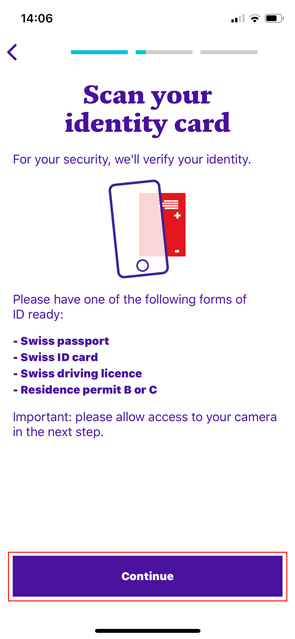

Now we can scan our ID documents, tap ‘Continue’ :

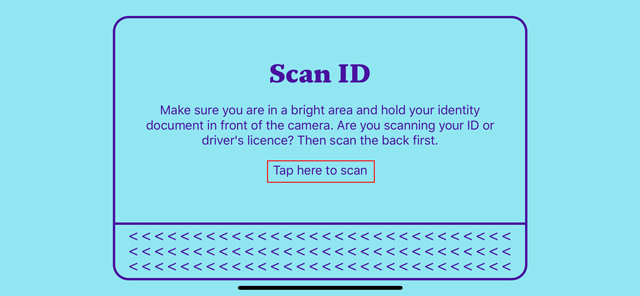

The view will flip to horizontal, note you have to scan the back of your drivers licence first – not the front.

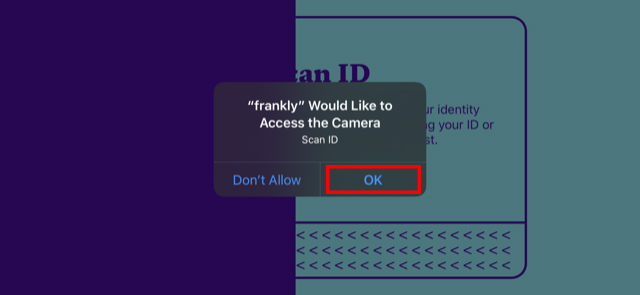

Then you’ll need to allow access to the camera. Tap ‘OK’:

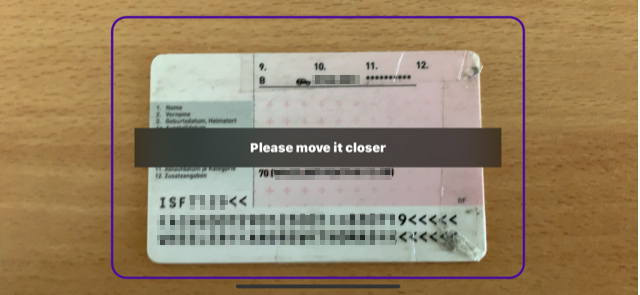

I used my drivers license in this example, follow the onscreen instructions:

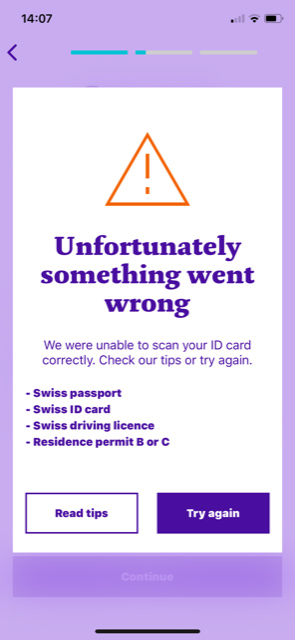

Move closer. A little closer. Hold the camera still. Have you been drinking? Please, hold the camera still. Wait more. Then fail.

Yeah. The scanning functionality is a complete pain in the back side.

I received the following error four times, even after reading the ‘tips’ which give you some guidance.

Maybe it’s a bug or just needs some tuning. But please ZKB, make the Document Scanning Lords a little easier to please.

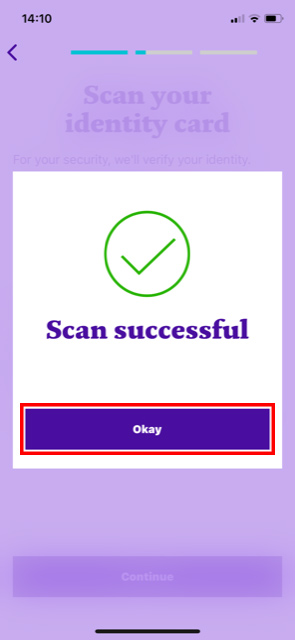

I kept persisting however, and eventually scanned my ID and got the beautiful green tick.

I opened the champagne, promptly got shit faced, and then tapped ‘Okay’:

Next up, confirm your nationality from the ID scan:

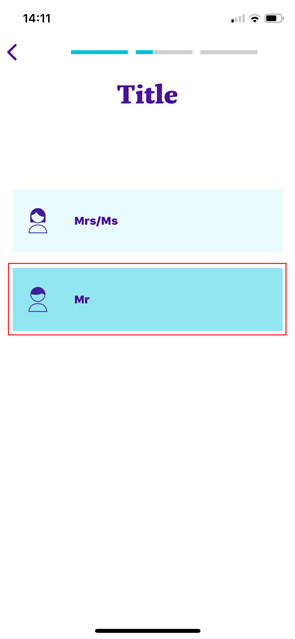

Your title..

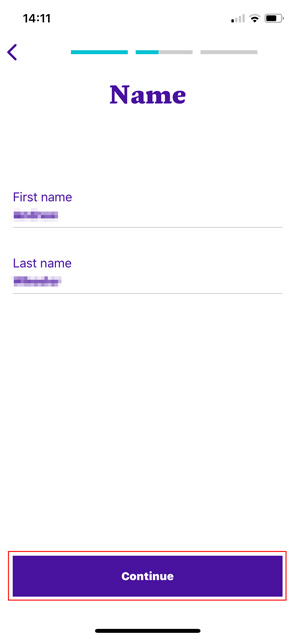

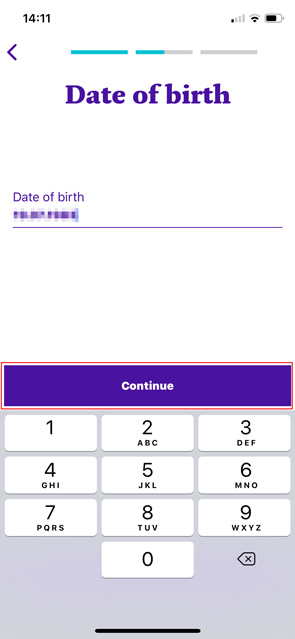

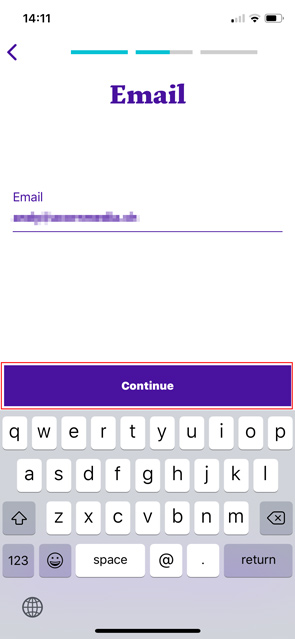

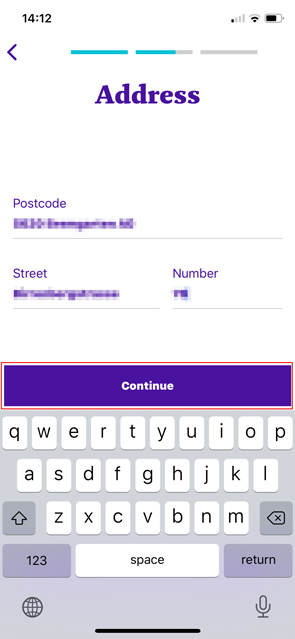

Confirm your name and tap ‘Continue’:

And then your date of birth. Moving along here…

Email. Continue.

Confirm your home address:

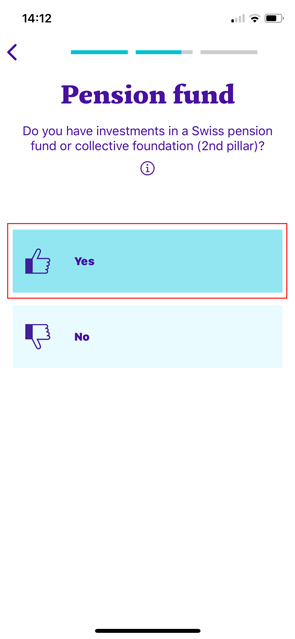

Select if you have a second pillar already – chances are you have, so tap ‘Yes’ if that’s the case, and move on:

Confirm the language you want your contracts to be created in:

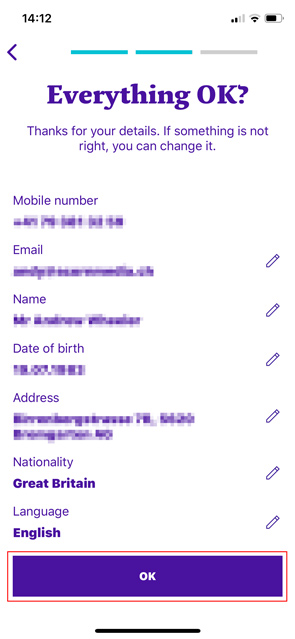

Final check!

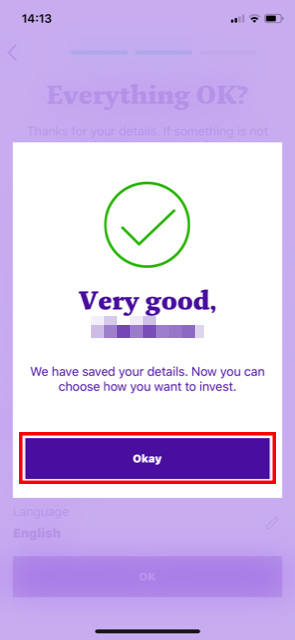

Job done. Phase 2 is completed.

Now we can move onto the juicy stuff. We can define how, and what, the pension will be invested in.

Let’s tap ‘Continue’ to set that up:

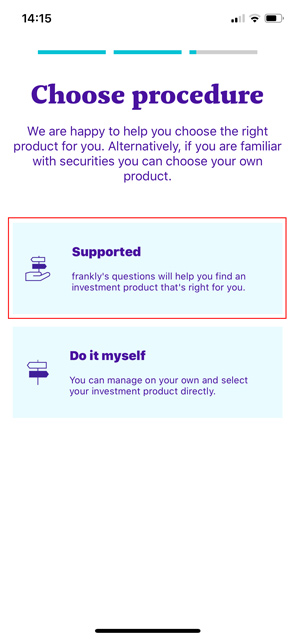

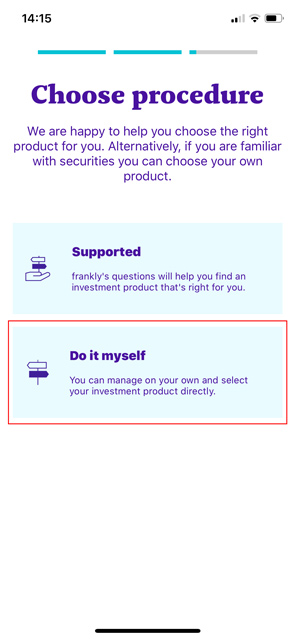

Now you can decide if you want Frankly to work out the best portfolio for you, or you can select it yourself.

I’ve tested both.

The ‘Supported’ route is actually pretty simple with just two questions, and gives quite a predictable outcome.

Let’s just that first my friends. Tap ‘Supported’:

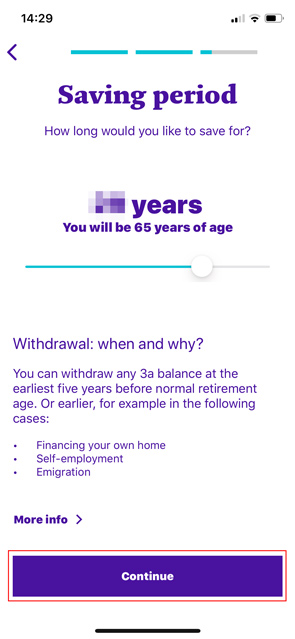

First you get asked your saving period. Generally, the longer the investment the more equities you should have:

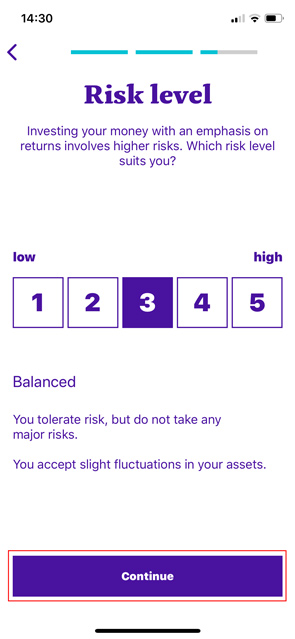

And then your risk rating:

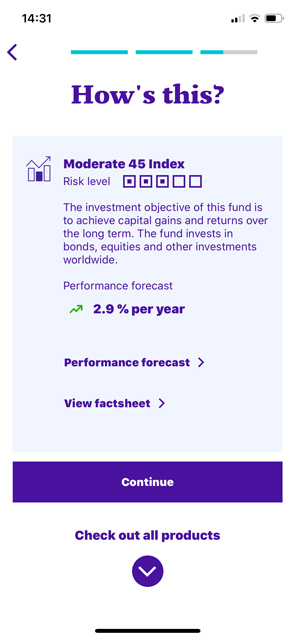

You’ll end up with a range of equities between 20-90% in your portfolio. For example, a ‘Medium’ risk of 3 gets 45%, higher risk at 6 gets 90%.

No suprises here, but a nice simple way to make a selection:

If you are happy with the above, you can hit continue and move on.

For this InvestingHero Frankly review, I’ll take a quick step back a few screens and show the other ‘Do it myself’ option:

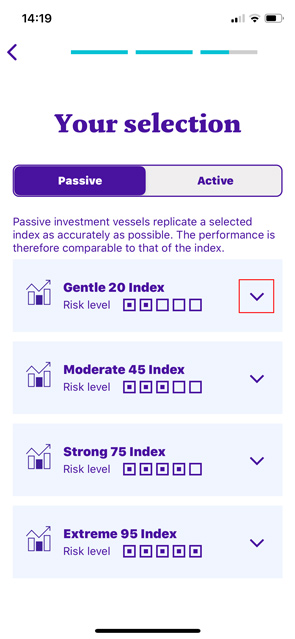

You are then presented with a list of funds you can select. The ’20’, ’45’, ’75’ & ’95’ relates to the amount of the portfolio invested in equities.

The higher the number the higher the risk (but also the higher the return..)

You can expand each to have a look at more detail. You’ll notice they are the same as per the ‘Supported’ route shown above.

Those that are familiar with Swisscanto, might recognise some of these:

What can you invest in with Frankly ZKB?

The list of Swisscanto funds you can invest in are listed as follows:

- “Gentle 20 Index” -> Swisscanto Vorsorge Fonds 20 Passiv QT CHF – CH0496463651

- “Moderate 45 Index” -> Swisscanto Fonds 45 Passiv NT CHF – CH0512157766

- “Strong 75 Index” -> Swisscanto Fonds 75 Passiv NT CHF – CH0512157774

- “Extreme 95 Index” -> Swisscanto Fonds 95 Passiv NT CHF – CH0512157782

Under ‘Active’ you have another list of 4 funds with a slightly different asset allocations:

- “Light 10 Active” -> Swisscanto BVG 3 Portfolio 10 NT CHF CH0497630977

- “Light 25 Active” -> Swisscanto BVG 3 Portfolio 25 NT CHF CH0497631082

- “Light 45 Active” -> Swisscanto BVG 3 Portfolio 45 NT CHF CH0497631165

- “Light 75 Active” -> Swisscanto BVG 3 Portfolio 75 NT CHF CH0497631454

What are the Frankly Swisscanto funds invested in?

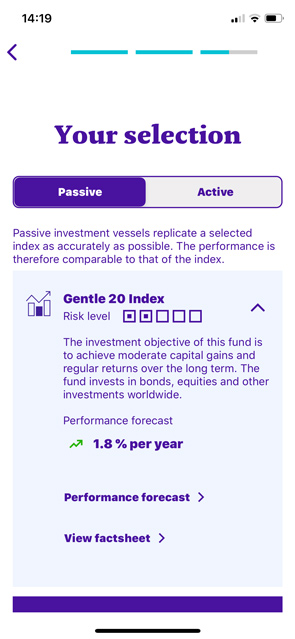

From the Frankly app, you need to select ‘View factsheet’ to see the details of what exactly you are invested in and the asset allocation for each fund.

Here’s the breakdown:

| Fund | Bonds CHF | Bonds Foreign | Swiss Equities | Foreign Equities | Swiss Real Estate | Commodities |

| Gentle 20 Index | 43.6% | 25.5% | 8.3% | 10% | 5% | 7.45% |

| Moderate 45 Index | 25% | 12% | 20% | 25% | 5% | 7.5% |

| Strong 75 Index | 6.5% | 6% | 27% | 48% | 5% | 7.5% |

| Extreme 95 Index | 0 | 0 | 30% | 65% | 2.5% | 2.5% |

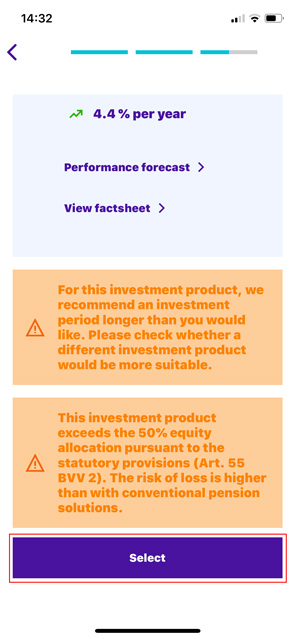

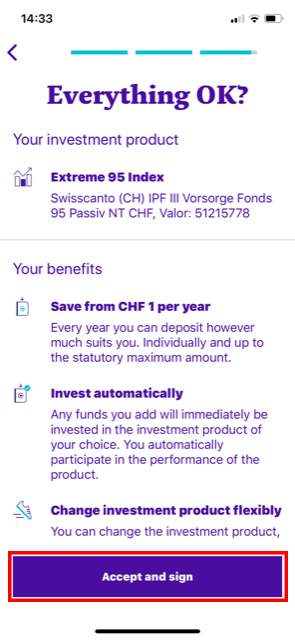

In this case, I’ve selected the ‘Extreme 95 Index’ and after reading the disclaimers, I’m ready to move on:

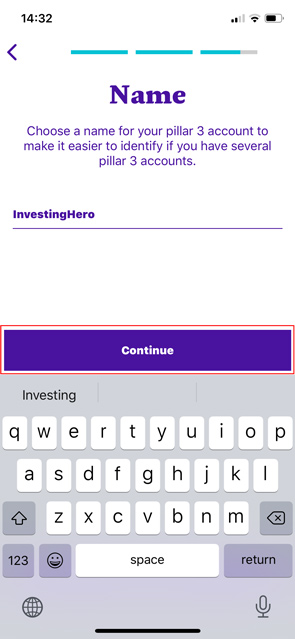

You can now give your pillar 3a account a name and tap ‘Continue’:

Double check the details and hit the button:

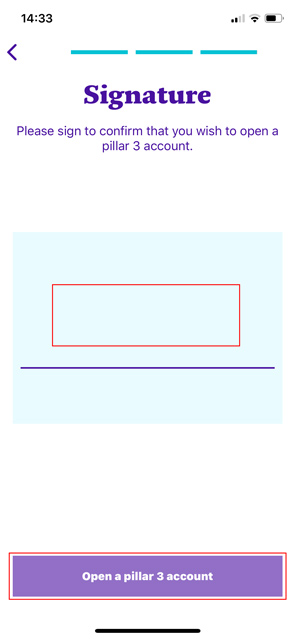

Give your digital signature here and then tap ‘Open a pillar 3 account’:

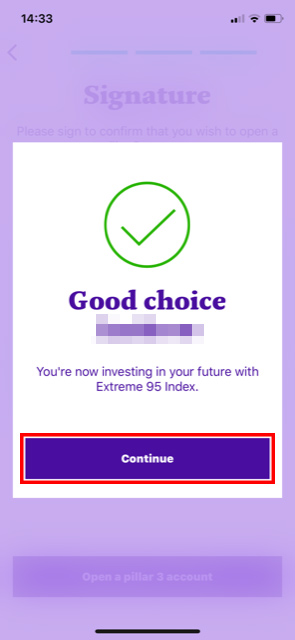

And that’s it! You have a new private pension invested in the stock market. Give yourself a pat on the back.

Tap ‘Continue’ and you’ll be taken to your account dashboard.

Logging into the Frankly platform

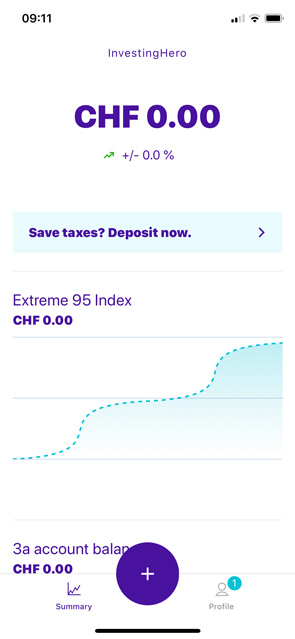

Having worked through the above account opening process above, you’ll be passed automatically to your account dashboard.

Clean and simple.

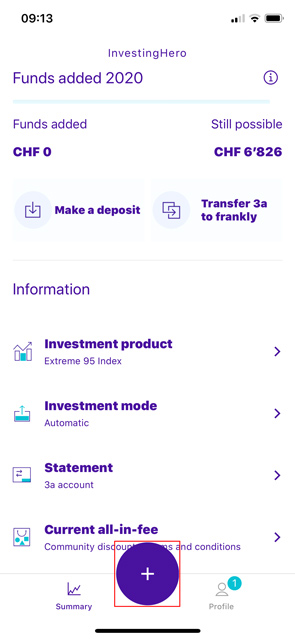

You are on the ‘Summary’ screen by default, the purple plus is for account funding/transfers, and the ‘Profile’ icon is the place for passwords and account documents. It’s pretty straight forward.

Scroll down and you’ll see more information on the specifics of your pillar 3a.

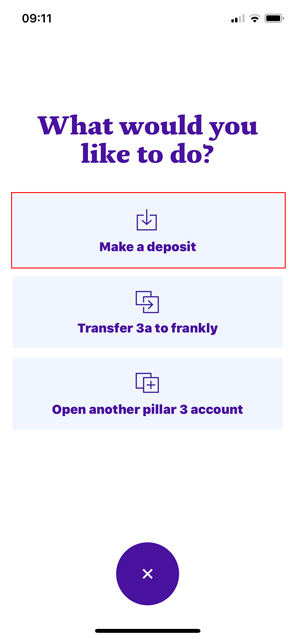

Tap the purple plus and we can move onto the next step:

Funding the pillar 3a account

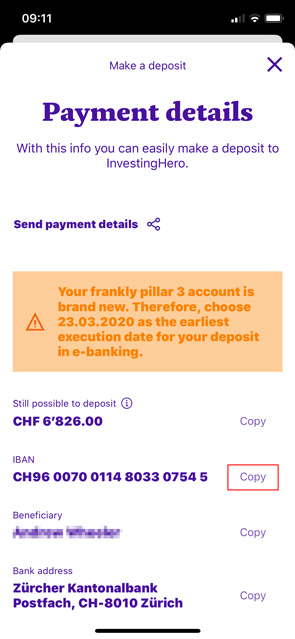

Very straight forward. After tapping the purple plus, simply tap the top ‘Make a deposit’ option on the next screen:

You can then view the IBAN details, hit copy to paste into your eBanking:

How do I transfer from VIAC to Frankly?

For the Frankly competition, the transfer process within the app is scary. Why? Because it’s seriously easy, fast and Frankly handles any costs.

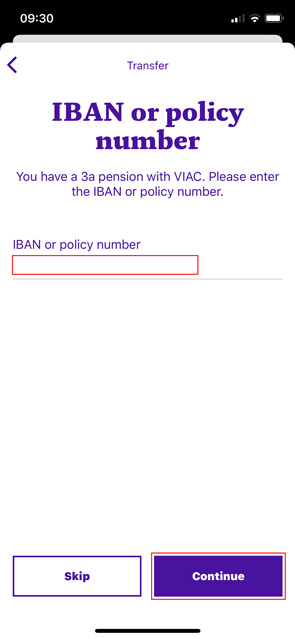

If you want to transfer your existing pillar 3a over to Frankly, after tapping the purple plus select the middle option ‘Transfer 3a to Frankly’, as shown below:

Next you need to select who your current 3a pension is with. In this example I’ve selected VIAC (not that you need to leave VIAC):

Enter your VIAC IBAN or policy number in the box and tap ‘Continue’:

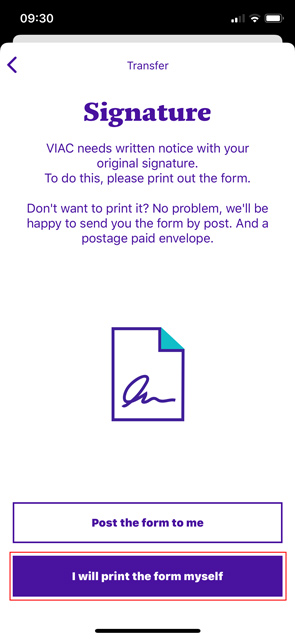

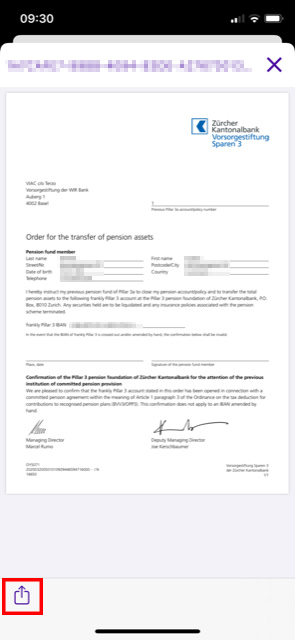

Now you just need to print and sign the transfer request. If you are too lazy to print it, ZKB will even do that for you.

Otherwise, tap ‘I will print the form myself’:

And there you have it. In just 5 taps Frankly has generated the PDF to print and post to VIAC (not that you should leave VIAC):

Login & Security

Standard banking grade security measures are in place when using the app itself.

Frankly is a product of the Swiss bank ZKB, so is FINMA regulated. This means your cash remains in Switzerland, and is insured up to 100k.

Another advantage Frankly has over the competition is that traditional bank foothold – you can walk into a branch of ZKB and speak to someone if that’s important for you.

Fees & Charges

This is where Frankly gets interesting. When I first heard the news ZKB was launching Frankly, with a ‘radical new pricing model’ I was very skeptical that it wasn’t just marketing hype.

The reality?

Frankly charges an ‘all in’ fee of just 0.48% 0.46% 0.45%. That’s seriously cheap, and on the surface goes head to head with VIAC.

🎁 Reader Bonus: I’ve partnered with Frankly to bring Investing Hero readers (that’s you!) a 35CHF discount on the yearly fee for new customers! No strings attached and no BS. Just use the code INVESTINGHERO in the app to claim your discount.

Is Frankly cheaper than VIAC?

VIAC has a max cost cap of 0.61% vs 0.45% on the surface for Frankly – but it’s hard to give an exact comparison as they offer different equity allocations, and it’ll depend on what type of portfolio you create with VIAC.

But of course – the devil is in the details 😈

Any cash you hold with Frankly, which isn’t invested, will be put into a sparkonto generating 0.05%. However, that cash will also have the same 0.45% blanket fee applied, leaving your CHF cash generating a negative -0.40%.

Frankly looks like the better deal if you want more than 60% equities in your portfolio. For example, a portfolio with 80% equities with VIAC costs 0.51%. But a portfolio with 95% equities will always be 0.45% with Frankly. In this case, as you are getting more equities, is arguably the better deal.

The Frankly portfolios are, rightly so, made up of not just equities. They allocate a portion to commodities (e.g. gold) and bonds, which is logical for a well diversified portfolio. For the gold, they use their own ZKB ETF, which has an expense ratio of 0.40%, which is more expensive than available elsewhere on the market.

On the other hand, VIAC portfolios using the more conservative ‘Global 20’ and ‘Global 40’ portfolios (which have 20% and 40% equities) cost 0.17% & 0.28% – vs. the flat fee of 0.45% from Frankly. More on the comparison between the two is below.

Customer Support

Customer support is good and full communication is available in English which makes life easier for those still learning German 😉

Following the standard set by other Fintech companies, there is a huge amount of FAQs on the website addressing all aspects of the product.

Additional Resources

Currently there is very little on the website – no blog, no educational material.. nada.

Banks are still getting their heads around the value of content marketing I guess, unlike say, Selma Finance.

Frankly vs VIAC

VIAC are known and established for being a market leader within the digital pillar 3a offering, and offer extremely competitive rates and fees, in addition to a slick onboarding and overall user experience.

Both are great products and it’s very hard to seperate the two. In some cases Frankly has the edge on fees with portfolios with higher equity allocation, however as mentioned above, there isn’t much in it.

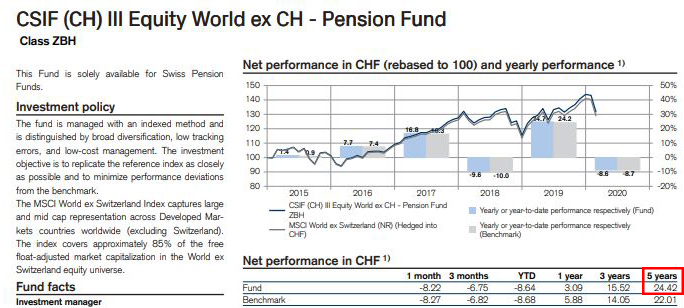

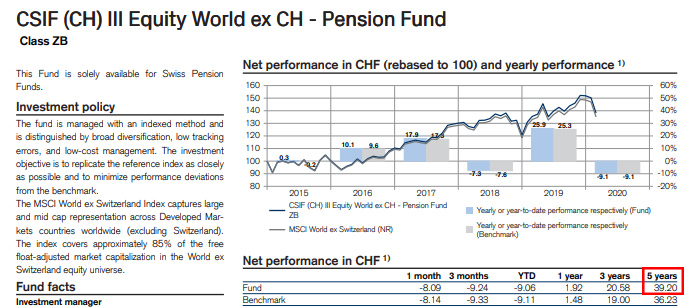

However, Frankly are hedging the Swiss Franc a lot more than VIAC. With the ‘Extreme 95’ around 60% of the overseas equity is hedged to CHF, which could have a significant long term impact on performance vs. the non-hedged version with VIAC.

Here’s an example comparision between the performance of a ‘hedged‘ & ‘non-hedged‘ version of the same fund:

As you can see, the long term effect of the hedged verison is quite significant.

One other point worth noting with both Frankly and VIAC. Both investment funds have a bias toward Swiss equities, which isn’t ideal for a global investment portfolio.

The ‘Extreme 95’ from Frankly for example, holds a 30% of your allocation in Switzerland. 11% of which is held with just three Swiss companies – Nestle, Roche and Novartis. And you can’t change that.

> Related reading: Read our full VIAC review

Is Frankly better than VIAC and Selma? I’ll be testing Frankly out over the coming months and be updating this section in due course.

Background info on Frankly

Frankly was launched in March 2020 to compete directly with the digital challengers in the private pension space.

Frankly is a product of the cantonal bank, ZKB. ZKB was founded in 1870, and recently celebrated 150 years in banking. They are the canton bank for Zurich, the biggest in Switzerland, and have a total of over 167billion CHF under management with 5.1K employees.

They are headquarted in Bahnhofstrasse 9 Zurich, 8010 Switzerland.

Frankly are on LinkedIn and Facebook, and there is a growing number of press articles (e.g. Finnews.ch, MoneyToday.ch) on the platform.

Reader offers & deals

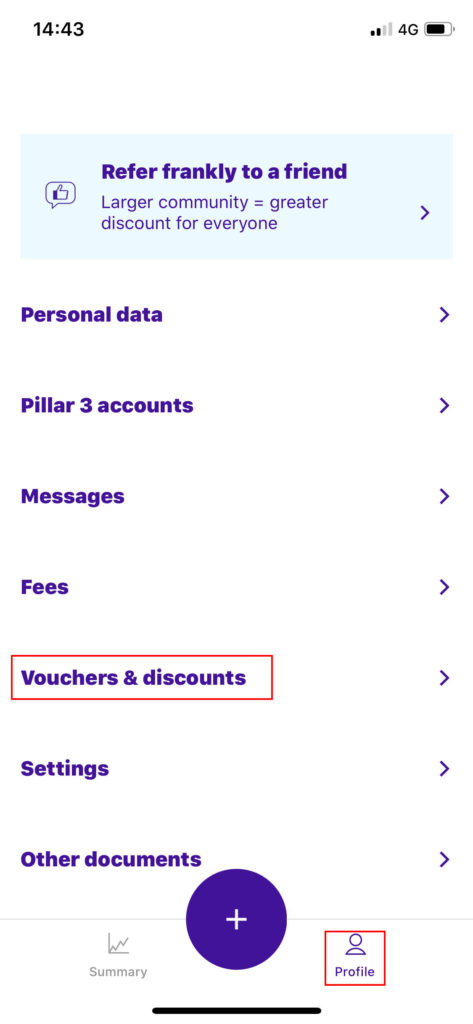

Investing Hero readers (that’s you!) can get a 35CHF discount on the yearly fee for new customers by entering the code INVESTINGHERO in the profile section of the app.

Just tap ‘Profile’ and then ‘Vouchers & discounts’:

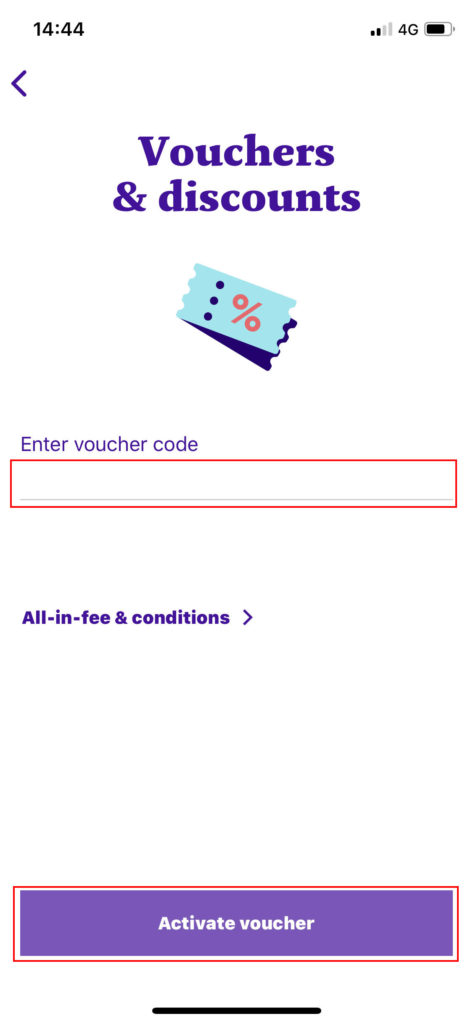

And then enter the frankly voucher code INVESTINGHERO here, and tap ‘Activate’:

Closing thoughts

Time to wrap up this Frankly review.

Frankly are a great option for a pillar 3a and offer a great user experience with very competitive pricing. The entire process for the user has been well thought through, and is very easy to get setup with a new account. The security and backing of ZKB is also a big value add for customers that are taking their first steps with investing their pillar 3a.

The other mainstream Swiss banks need to wake up, and fast.

🎁 Reader Bonus: I’ve partnered with Frankly to bring Investing Hero readers (that’s you!) a 35CHF discount on the yearly fee for new customers! No strings attached and no BS. Just use the code INVESTINGHERO in the app to claim your discount.

Further reading

Frankly FAQs

Yes. They are created automatically and included in the annual fee. You can find them under your profile, ‘My messages’.

Yes. Each account can have different CHF amounts deposited, and different investing strategies.

Yes, use code INVESTINGHERO to claim your 35 CHF discount bonus on the yearly fee for new customers.

No, smartphone app only for now.

No, they are separate accounts.

You have a range of options depending on your risk appetite based on the offering from Swisscanto. See the review above for the details.

Comments are closed.

Comments: 10

Very good job writing them in this blog article

Best regards,

Demir Henneberg

Thanks a lot for the review and intro.

I opened and launched my Frankly account last week. Received funds in the account today.

I find the lack of information, i.e. current price of the respective investment funds a con.

It would also be great to top up from other sources than IBAN, e.g. credit or debit cards, Twint, whatnot. Although it might be a bit overkill for a 3a.

I have opted for 95 extreme given the current market downturn. I will buy in and see what happens, also with respect to fees.

One problem I had during the sign up process was the signature. Tapping the signature field to activate would cause loops. Only after several attempts and turning my phone 853° would it work.

Hi Mathias – thanks for the comment, these are great points!

And thanks for sharing the tip on the signature 😉

They have a few bugs to iron out, but they released an update to the app 2 days ago titled ‘Minor bugfixes within the onboarding process’ – this might have solved it.

Thank you very much, I’m very interested. You say: “which could have a significant long term impact vs. the non-hedged version with VIAC”

Can you please explain in more details ?

Hi Denis – Thanks for reading. Take a look at the ‘Frankly vs VIAC’ section for more info on hedging.

Hey There. I discovered your blog using msn. That is an extremely neatly written article.

I’ll be sure to bookmark it and come back to learn extra of your useful info.

Thank you for the post. I will definitely return.

Amazing post! We’re linking to this terrific article on our website.

Keep up the great writing.

Best regards,

Balle Cannon

I wish I could just invest in whatever shares or funds I like like in a UK sipp or a US 401k. For such a well run country CH has a not so good pension System. Pillar 2 is even worse. Why not let me choose- it’s my money!

VIAC for me over frankly any day of the week, but unless I wasn’t buying a house within the next few years I wouldn’t invest my money in either.

Hi Joe! Thanks for the comment. For Pillar 2 it will depend on your employer, but check out the Valuepension review I made recently (you can select what you like)

https://investinghero.ch/valuepension-review/

Re. The house purchase & P3A – Well, maybe. It’s not black and white and very individual depending on your financial situation. Don’t discredit the tax benefits and low rates on the market today that can be leveraged.

This is a great blog.