Findependent Review – A new Swiss Roboadvisor enters the ring

Overall Rating of our Findependent Review:

Rating TBC in 2021 · 👀 · One to Watch ·

At Investing Hero, we aim to provide the best investing basics. To support this, some of the products featured in articles will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence our evaluations. Our opinions are our own. The information provided on Investing Hero is for informational purposes only. Please read our disclaimer for more.

This Findependent review will include updates and news from the latest entry into the Swiss roboadvisor space.

Findependent is an upcoming Swiss roboadvisor based in Aarau. Headed up by Matthias Bryner, the start-up has recently launched and are entering a rapidly competitive and evolving roboadvisor and financial advisory space.

For us as the consumer this is great – more innovation, options and companies in the market is a great thing for end users.

But how will Findependent stack up against the already established players, such as Selma Finance and Truewealth?

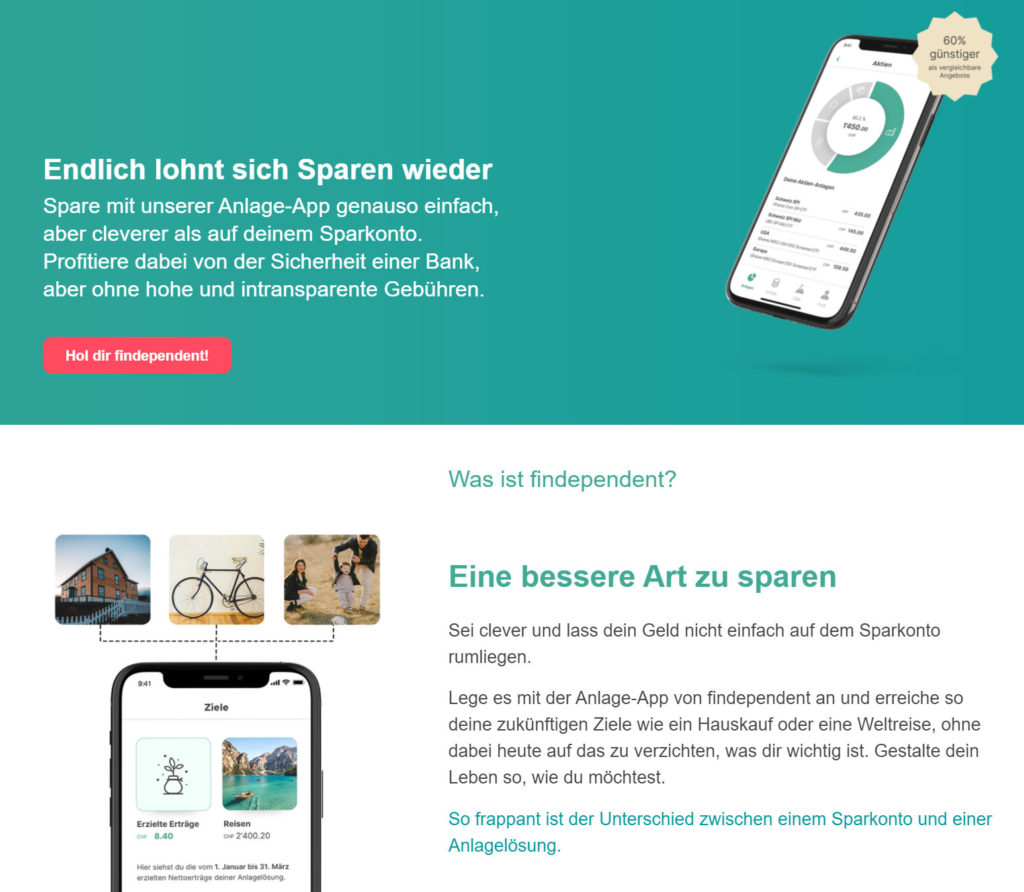

While the roboadvisor space is pretty dominated already in Switzerland, there is still space for innovation. Findependent appears to have found an angle with the financial planning, goal setting and budget approach to the investing platform. The low account opening deposit of 2K CHF is also quite attractive to newcomers.

This is a clear opportunity for Findependent to separate themselves from the traditional existing roboadvsiors, and it’ll be interesting to see how the offering develops in the coming months.

Login & Security

Findependent are not a bank, and like many financial startups (such as Neon) have partnered with a ‘traditional’ custodian bank in the background to hold client assets, in this case Hypothekarbank Lenzburg. Having a bank such as HBL in Switzerland, means your deposit is protected up to 100K CHF.

Hypothekarbank Lenzburg are a FINMA regulated bank, so expect industry grade standards and encryption as standard, with servers and accounts held in Switzerland.

Fees & Charges

Looking at the pricing page, Findependent charge a base fee of 0.6%/yr, however this excludes transaction costs. The final product costs also depend on your investment strategy, so it’s a little unclear at first glance what the final ‘all in’ fee is for investing. But expect it to be around 0.6%.

Findependent state in their marketing they are ‘60% cheaper’ than the competition, but as we’ve seen with Yova this isn’t a direct ‘apples to apples’ comparison on costs.

Yova for example, compare their ETF roboadvisor costs to one of the more expensive ETF platforms (0.94%), which isn’t available to Swiss investors (Scalable Capital), and not their direct competitors such as Selma Finance or Truewealth.

And similarly for Findependent, the ‘60% cheaper’ compares costs from a comparison study to ‘classic asset management’ providers such as UBS, and not the Swiss roboadvisors such as Selma Finance & Truewealth. Which in my view are a more realistic comparison.

That said, like many roboadvisors in the space, Findependent are using ETFs to drive down costs. Combined with a fully digital customer onboarding and mobile app experience, you have good transparency on your investment fees and cost involved. Which is way more than you get with a traditional bank.

Additional Resources

Currently not too much in terms of blog material or investing ‘how to’s’ for newcomers, however they have a solid FAQ which addresses plenty of the common questions.

For now, the website and supporting material is only available in German.

You can also follow them on Facebook and LinkedIn for news and updates.

Findependent vs… the competitors

Findependent are entering a competitive space with a mix of established roboadvisor competitors. I look forward to completing my findependent vs selma finance, truewealth and yova in the coming months.

For now, they are positioning themselves somewhere in the ‘middle of the pack’ in terms of pricing and functionality, and I look forward to diving into the details in more depth.

Background info on Findependent

As we mentioned at the start of this article, Findependent was founded in 2020 and is registered in Aarau (Bachstrasse 82, 5000 Aarau). They are young fast growing startup, headed up by Matthias Bryner.

Closing thoughts

I’m keen to see how Findependent takes shape over the coming months. With digital onboarding and English translations (fingers crossed) in the pipeline they could become a serious competitor in the busy digital investing space. At first look the UX is snappy and fresh, and with the backing of a FINMA regulated Swiss bank, they have everything inplace to start ramping up and onboarding customers.

I’ll be testing out the platform to see how things stack up – so watch this space for more details as I update this findependent review in the coming months.

More to come.

Mr. IH