Investing in Switzerland: The Beginners Guide [2023 Edition]

At Investing Hero, we aim to provide the best investing basics. To support this, some of the products featured in articles will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence our evaluations. Our opinions are our own. The information provided on Investing Hero is for informational purposes only. Please read our disclaimer for more.

This is my beginners guide to investing your money in Switzerland.

In this guide, you’ll learn what you need to get started investing, the options available in Switzerland and how to avoid the common pitfalls when you are starting out.

By the end of this guide you’ll have the knowledge, tools and a step by step check list needed to take the next steps in your investing journey.

I will provide plenty of additional tips throughout this guide too. We have a lot to cover here, so prepare your drink of choice, get comfy, and let’s get started.

🐻 Beast Alert: This is a huge 5000+ word guide. Make sure to use the table of contents below to find the topics relevant to you – we’ll start with some basics before moving onto the options available in Switzerland.

Who is this investing guide for?

As a British expat landing in Switzerland 10 years ago, learning about investing was hard.

Finding reliable, fact-based and unbiased investing information, in English, tailored to Switzerland was a challenge.

I’ve learnt the hard way – from thinking that bundling life insurance into a pillar 3a was a good idea, to buying individual stocks with a bank, I’ve made lots of mistakes.

But from those mistakes, I’ve also been able to make better and more informed decisions.

So this guide is for anyone that is looking to start investing, and can relate to the above.

Should I start investing?

Woah there. This guide isn’t about ‘the why’ on whether you should start investing or not.

You’ve likely landed on this page having searched Google for ‘how to start investing’ or ‘investing in Switzerland’ – so you are probably aware of the benefits of investing.

You already understand the powers of compound interest over the long term, which even Albert Einstein described as being ‘the eighth wonder of the world’.

If you need a quick refresh, here’s a few links below to recap:

- Video: The Power of Compound Interest (4mins)

- Calculator: Compound Interest (use a 7% estimated interest rate)

- Investing Hero: Investing basics & investing guides

Remember, the best time to invest was 20 years ago. The second-best time is right now.

But if you haven’t already, spend some time working out your ‘why’ to doing all of this in the first place. What’s your ‘north star’ in investing your money?

Why do you really want to have X CHF in Y years’ time?… And Why should you answer that?

Because investing can get real. Gut wrenching ‘wtf am I doing’ type real, and quickly.

As I’m writing this, the market is down over 30% from the start of the year, with the most of that drop happening in under 3 weeks.

Picture that for a second.

You’ve transferred 100K CHF from your life savings into an investment account, and next month the account value is at 70K CHF. How would that make you feel?

You might panic and do something crazy, like closing your investing account and stomaching the loss. And you don’t ever want to do that.

» Related reading: My favourite investing books for newbs

Without a ‘north star’ plan, that 30% market drop will mess you up.

The Foundations for Successful Investing in Switzerland

Once you have a rough why to your reasons behind investing – you need to get your house in order.

What does that mean exactly?

Let’s get tactical.

You need to understand your monthly (and ideally, yearly) expenses to live in Switzerland, and how much you can afford to invest on a regular basis.

That’s where a budget will help you to work out the real numbers. Despite the pain, it’s essential to get a real picture of your financial situation.

Drill down into it, and factor in the real costs of living in Switzerland. If you are a new Swiss expat, don’t overlook the ‘real’ cost of living here – your health insurance, annual tax bill, GA costs, online shopping and German lesson fees should be accounted for to get a clear picture.

» Related reading: How to Create a Simple Budget Plan & 5 simple budget tips

You’ll also want to build a CHF cash buffer in your bank account of 3-6months expenses for unforeseen circumstances. It’s called an emergency fund. This is money to cover a real emergency – the roof on your house collapses, special medical treatment overseas or if you lose your job.

Things pop up, and that’s life.

Having a cash buffer means you don’t need to touch your investments and you can let them grow as your life unfolds. Hold some cash for when it’s needed.

And before you decide on the best ways to invest your money – a few other ‘golden rules’ to keep in mind include:

- You shouldn’t expect regular and consistent returns in the short term

… it’s going to be a rollercoaster. - You shouldn’t think you ‘need’ a new car every 2 years

… car values drop like a stone and will eat up your capital - You shouldn’t be investing if you are loaded with credit card debt

… Aggressively eliminate bad debt as fast as possible. - You shouldn’t consider stock picking as a viable long-term strategy

… Related reading: 8 Common Investing Mistakes You Must Avoid

Once your financial foundations, and more importantly mindset are addressed, you are ready to start working out your risk profile.

Understanding your risk profile

As we mentioned above, investing comes with risk.

Understanding how much risk you want is a very personal choice, and there are no concrete rules for this, just general guidelines.

Your risk level will have a direct impact on the structure of your investment portfolio. We’ll get to the details on that later, but generally: The more risk you take, the more stocks you will hold.

Stocks have a lot of short-term volatility and greater price fluctuations, but over the long term return the biggest gains.

But short term, stocks are risky as hell.

However, for someone with a 10yr+ investing horizon, a high allocation of stocks will result in significant rewards further down the line. But it’ll be a choppy rollercoaster of a ride in the short term to get there.

Rollercoasters are fine if you hang on, and you don’t try and jump off at 70KM/hr.

That said, you need to be able to sleep comfortably, and avoid turning into a raging alcoholic after reading about a financial crash in the news.

Remember – With risk comes reward. And if you take no risk, there will be close to zero return on your investing. Only you can decide on that balance.

What does ‘no risk’ investing look like?

All investing carries risk – lets clear that up first.

But simply put, a savings account with a Swiss bank is close to zero risk. The money will always be there whatever happens in the world – Switzerland has great security for that!

But sadly, you’ll only get 0.05% interest, well below the inflation rate of 1.2%. You might not see it directly, but you are losing money. You’ll never get any financial freedom this way, and with every passing year you’ll have less and less purchasing power.

What does ‘low risk investing’ look like?

Investments with a focus on government and corporate bonds will form the basis of a ‘low risk’ investing portfolio. They’ll keep your nest egg protected from market downturns, whilst still beating inflation and making a small return each year.

Low risk investing is more suited for those looking to protect what you already have, and not aggressively growing what you have.

What does ‘high risk investing’ look like?

As mentioned above, higher risk investing typically carry 75-100% in stocks. But depending on your financial situation, age, job, savings rate and personal circumstances – this ‘high risk’ might not be high risk at all!

The longer your timeline, the less risky things really become. Don’t forget risk is relative to your timeline.

And arguably, taking ‘no risk’ and leaving your cash in a bank, is the greatest risk of all.

What type of investor are you?

Let’s work out what kind of investor you might be, apart from being a new one 🙂

I’d love to get this into a fancy calculator that spits out your risk profile, but I’m not there yet.

The top rated swiss roboadvisors, such as Selma Finance, can do that for you, and for free. But hopefully the below gives you some idea on the types of things you need to think about:

- How old are you?

- How long do you plan to invest for?

- What is the approx. CHF value of your savings and other assets (e.g. property) you own?

- Who else is dependant on your wealth (kids?)

- Do you have debt?

- Are you planning a big purchase (e.g. a house) in the next 3 years?

- Do you have a private pension? (e.g. pillar 3a)

- How much of your income can you comfortably save each month?

- How would you react when the market tanks 20% in a month?

- And then a further 10% in the same month?

Example risk profiles

Below I’ve provided two very simple profiles, and how the personal situation of each will impact the risk and type of portfolio they might hold.

Meet Cautious Colin.

Colin is new to investing and 28years old.

He’s looking to change jobs soon, actively property hunting and plans to buy an apartment to renovate within the next 3years, for which he’ll need a 100K deposit for the mortgage.

Rating: Low risk profile.

Considering Colin needs the cash in 3years time, he needs to focus on preserving his cash buffer. Investing over 3 years is too short a timeframe to see a reliable return in the stock market.

This timeframe is too risky for stocks, and you could see a significant drop disrupting his plans to buy the apartment. Being a newcomer to investing, he could panic if that happens and withdraw the investments at a loss.

Considering Colin is also looking to change job and might have renovation costs for the apartment, he should build cash, and have a portion held in short term government/corporate bonds (not Swiss!) to beat inflation.

Next, meet Ambitious Amanda.

Amanda is 27, married and has a well-paid programming role at a large tech firm in Zurich. She’s on the career track and moving up in the company. The job enables her to save 40% of her income every month, and she likes to live frugally.

Rating: High risk profile.

Amanda has a good job and is already tucking away a good chunk of her income every month, so the investments won’t need to be touched, and there is some flexibility if she needs cash. And that’s not counting her partner. Being in good standing at the company is another benefit and gives security of her income.

Given her age, she should have a long term 10+ year investing horizon enabling her to take advantage of the gains in the stock market that would come. Amanda could hold north of 75% stocks in her portfolio.

Swiss cash investments – What are the options in Switzerland?

There are a range of swiss cash investments available to you. Once you’ve decided to get started with investing in Switzerland, you want to familiarise yourself with the components that will make up your investment portfolio.

There is plenty of choice in Switzerland, and the key will be finding the right ones for your investment approach.

Here’s an overview of the types of options and phrases you’ll typically come across.

Stocks (aka. Equities)

Buying stocks (‘equities’ are another name for it) mean you own a small piece of a company.

As the company grows and becomes successful, the value of the stock will also increase. By buying stocks, you can benefit from the future success of that company.

On the flip side, if the company isn’t successful your stock could end up being worth zero, and you lose everything. Yikes.

For that reason, when dealing with stocks you should avoid picking single companies.

Instead you should buy many to spread your risk – a term known as ‘indexing’.

Indexing stocks enables you to purchase many hundreds of companies, and have a small allocation of your CHF, allocated to all of them.

Don’t look for the needle in the haystack. Just buy the haystack.

Jack Bogle, founder of Vanguard (Creators of the first index fund).

For example, the SMI (Swiss Market Index) is Switzerland’s stock market index, which is made up of the 20 largest companies in Switzerland.

Think Nestle, Novartis, Roche, UBS and others. Here are the top 5, which amount to 65% of the SMI:

| Company | Industry | % Allocation |

| Nestlé | Food products | 19.17 |

| Novartis | Pharmaceuticals | 18.01 |

| Roche | Pharmaceuticals | 17.87 |

| Zurich Insurance | Insurance | 5.76 |

| Richemont | Clothing and accessories | 4.42 |

And if you wanted, you could invest in Switzerland and buy the SMI today. This is an example of an index, although being Switzerland – a very small one 🙂

However, for swiss cash investments a portfolio of the SMI isn’t the greatest. Why? With only 20 companies, you can see from the table above you have a considerable portion, over 65%, invested in these big 5.

No doubt these are good companies, but your portfolio would be dependant on the performance of these 5 companies, and the industries you are invested in are heavily focused on Health Care (e.g. Pharma) as Roche and Novartis take 36% of the pie.

This means you are less diversified than other indexes, such as those in the US.

You can just as easily purchase US and other global stocks from Switzerland – you don’t need to be in country of origin to do so.

For example, the ‘Vanguard Total Stock Market’ enables you to invest in a whopping 3,579 companies!

With a long-term investing horizon, stocks will generally form a high allocation (75%+) of your portfolio and the average historical performance is 7%.

As mentioned in the risk section, the more stocks you take the greater the potential reward, but also the greater fluctuations in value.

📝 Stocks Recap

– Short term volatility, long term gains

– Suits investors looking to invest for 10yrs+

– Historical average return in the region of 6-8%

– Avoid the temptation to buy individual stocks – buy the index instead.

Bonds

Simply put, a bond is a loan. When you buy a bond, you are lending your cash to the issuer of the bond, in return for a set interest rate over a defined term.

Typically, the issuer of the bond are governments and businesses. Safe, steady and reliable.

Compared to stocks, bonds are a very low risk investment.

In times of uncertainty and drops in the financial markets, bonds are the safety net to dampen the impact. They’ll still drop in value, but not as much as stocks.

Bonds enable you to create a well-balanced portfolio which reflects your investing goals and risk tolerance. But with this lower risk, comes lower returns – bonds will never make you rich! But they will protect your investment in uncertain times and should keep you ahead of inflation over the long term.

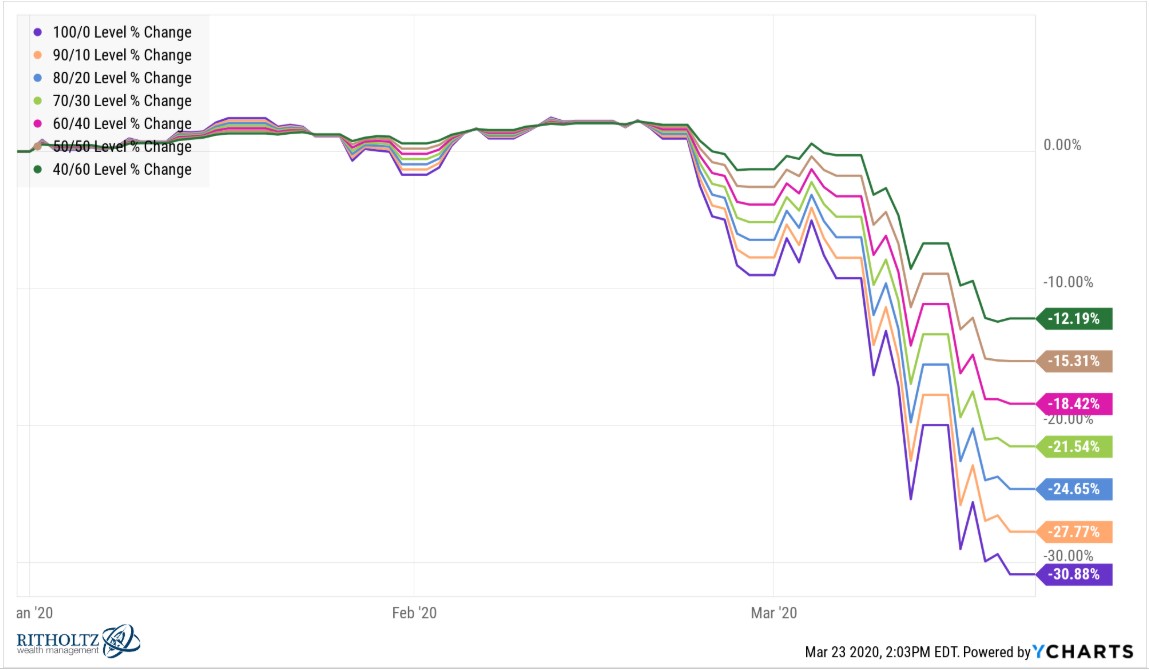

As you can see in this chart, having 40% bonds (shown in green) in your portfolio during the March 2020 market crash would have dampened the impact vs 100% stocks (shown in purple) quite considerably:

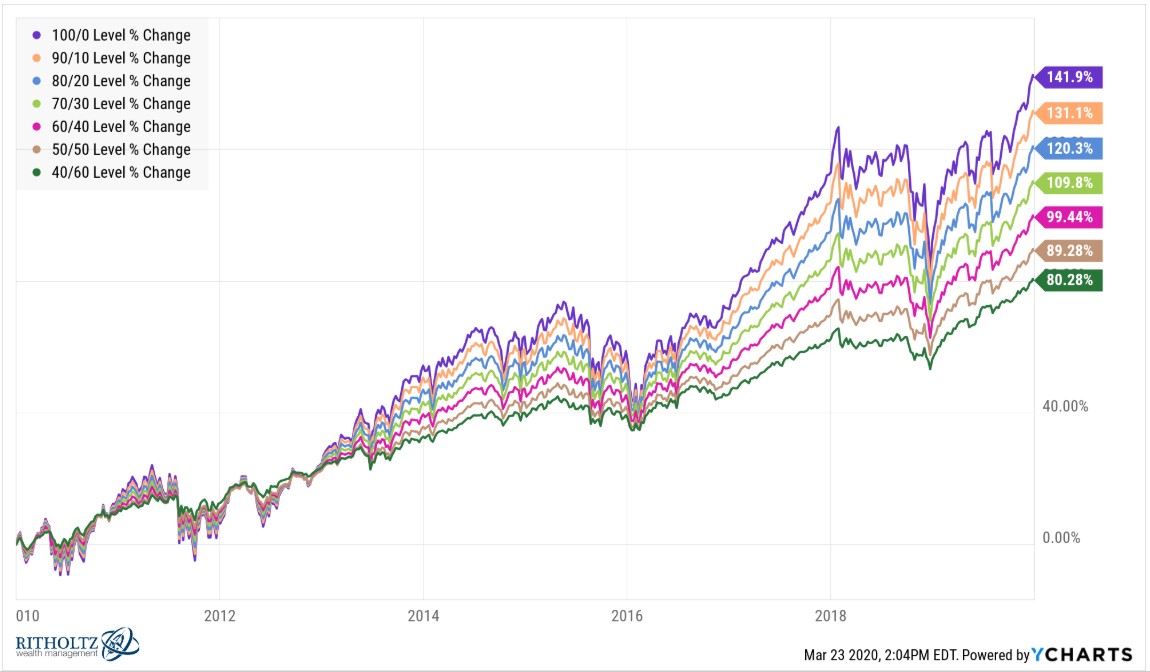

On the flip side however, the performance of bonds (shown in green) vs stocks (purple) when markets are going well…

One thing to note about Switzerland – currently, Swiss government bonds are a bad idea. They are returning negative interest and once you add related fees on top you’ll be losing money. Seek out corporate and US bonds instead.

📝 Bonds Recap

– Very safe and low risk

– Enable you to switch a portfolio to lower risk, e.g. when you near retirement.

– Historical average returns of bonds range between 2-4%

– Avoid Swiss bonds which are returning negative interest.

Real Estate

Buying physical real estate in Switzerland as an investment to rent out is typically reserved for those that already have well established portfolios and a high net worth. Mid-sized apartments with central locations and transport links start in the region of 500K+ CHF, which isn’t something easily accessible for many of us.

That said, interest rates are currently extremely low. Which could enable you to borrow cheaply and leverage your property purchase to something with a good location and a higher rental return.

However, this carries significant risk. When rates rise, you’ll need to be able to cover these costs.

Property prices in certain places are also considered to be in a bubble, maintenance needs to be paid and property valuation increases are much flatter than other parts of the world.

The ‘buy and flip for profit’ after 3years isn’t the norm in Switzerland compared to likes of the UK and US.

An alternative to gaining exposure into the real estate market is to buy a fund (in a similar style to buying stocks) which will give you all the benefits of real estate investment returns, but without the negative risks mentioned above.

Real Estate Investment Trusts (aka REITs) are widely accessible and easily added to a portfolio in a similar way to stocks and bonds. If a long-term investor has a portfolio of 75% stocks, 5-10% could be held in REITs.

📝 Real Estate Recap

– Physical property isn’t something realistic for newcomers

– High barrier to entry with lots of cost and risk

– Buying REITs are a much safer and easier option

Precious metals

Precious metals such as gold, silver, platinum and palladium have long been considered a ‘safe haven’ when it comes to investing and to protect your wealth.

Gold is the long-standing favourite, and you’ll often see prices soar in times when markets drop and there is uncertainty in the world.

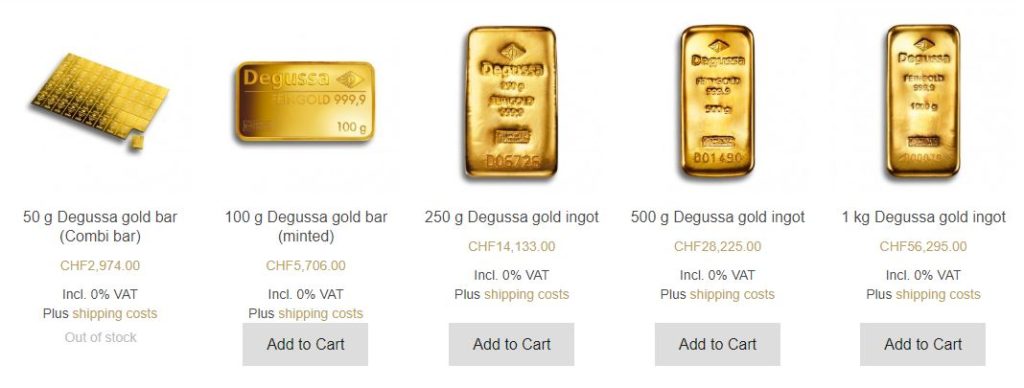

Buying physical gold is something not exactly realistic for most of us.

That said, it’s surprisingly easy to do so in Switzerland. For example, Degussa Goldhandel based in Zurich are the market leaders, offering a store front for walk in purchases and an online shop.

But keep in mind physical gold bars and coins pay no interest, offer no dividend and you’ll need to pay to have it insured and stored in a safety deposit box.

What’s the alternative?

Like we explained above with real estate and buying a fund (REITs) instead, you can do the same for precious metals such as gold through a fund, such as this one.

This will enable you to allocate a much smaller, more realistic % of your wealth into precious metals, without having to build a bunker to hide it all.

And like real estate, this might form around 5% of a long-term investment portfolio.

📝 Precious Metals Recap

– Physical metals are expensive and more favoured to protecting wealth

– Physical metals pay no interest and incur additional costs

– Buying a fund is a much cheaper and easier way to hold precious metals

⏱️ Timeout – We’ve covered a lot of ‘nitty gritty’ in this article. If all the above is freaking you out, stay cool. You don’t have to do any of the above if you use a swiss roboadvisor, such as Selma Finance. They work out the portfolio and all the geeky details for you.

Cryptocurrency

Cryptocurrency, such as Bitcoin, Litecoin and Ethereum have exploded in popularity in recent years and are a form of digital money.

There are no physical coins or paper notes, and there is no central bank or government which controls distribution.

» Related reading: What is Cryptocurrency?

As we mentioned in the investing basics article above, cryptocurrency is an extremely risky and volatile asset. Think carefully how much, if any, of your portfolio is allocated to crypto.

That said, there is growing investment and popularity in investing in the long-term value increase in the likes of Bitcoin due to potential profits, and the fact there is a limited number available.

Crypto could be viewed as an experiment to ‘dip your toe’ into the world of crypto, however it shouldn’t form a large portion of your portfolio. For example, under 1%.

If you are tempted, you can buy cryptocurrency in Switzerland easily through Coinbase, which offers a quick and simple way to purchase Bitcoin and others through a slick mobile app.

📝 Cryptocurrency Recap

– Extremely volatile and high risk

– Pays no interest or dividend

– Potentially worth a small allocation to ‘gamble’ on a future price increase.

Peer to Peer (P2P) Investing

P2P investing enables you to invest in various types of loans. Though a marketplace you can contribute, along with many other people, toward the funding of personal or business loans. In return, those that helped fund the loan will receive interest while the loan is repaid.

Once the loan repayment period is completed, you’ll receive your contribution back and can repeat the process.

P2P marketplaces enable you to do this at scale, investing in many hundreds of loans globally and have very attractive returns of over 10%.

Despite P2P investing in Switzerland being quite new, but there are several established players in the space such as Lend.ch, Cashare and Crowd4Cash.

That said, the leading platforms are generally in the Eurozone, which offer much higher returns and offer lower initial investments compared to Switzerland.

For example, Mintos are easily available to Swiss investors and straight forward to get started with.

Opening an account with Mintos in Switzerland takes about 10minutes, and you’ll just need to use Transferwise to move over some Euros to fund the account.

Like cryptocurrency, P2P is also a risky strategy and not something which should take a large allocation of your portfolio.

One last warning to consider, your capital will be held in jurisdictions that have less than squeaky clean track records in maintaining banking liquidity, and there have been scandals of platforms closing their doors and disappearing overnight. As we discussed above, go easy.

You could consider allocating 1% of your portfolio toward P2P and Cryptocurrency to test things out, but no more, and see how it performs over the next 12mths.

📝 Peer to Peer Investing Recap

– P2P is risky and shouldn’t take a large portion of your portfolio

– Mintos is the market leader in Europe and easy to setup in Switzerland

– Attractive returns and Mintos allows ‘auto pilot’ investing

What about investing in ETFs (Exchange traded funds)?

ETFs are a vehicle, in which you can invest in many different asset classes, such as stocks, bonds and real estate listed above. They will typically comprise of many companies (e.g. an index) and are not individual stocks.

ETFs have increased in popularity significantly in recent years and are an affordable an inexpensive way to build a portfolio.

ETF investments in Switzerland are commonly available and can be bought individually and also typically used by roboadvisors (more on that below) and now even banks, to create your investing portfolio.

As you enter the world of investing, you see the phrase ‘ETFs’ popping up everywhere.

What might an investing portfolio look like?

All of these options – stocks, bonds and precious metals amount to a big long list!

So let’s have a look how these might look in a portfolio, when you bring them all together.

These are just examples – your personal situation will differ, so don’t take this as ‘financial advice’. Please remember, I’m not a financial advisor.

Higher risk example (think Ambitious Amanda) to build capital over the long term:

> Related reading: What should you have in an investment portfolio?

As you can appreciate there are thousands of potential combinations for a portfolio.

And once you decide on your risk and portfolio allocation, getting into the different types of stocks, bonds and REITs (e.g. which ETF should you pick…) is another step down the rabbit hole.

But for now, hopefully the simple portfolios above give you an idea of how the split might look like.

How to start investing in Switzerland

Finally, the information you came for. What are the best ways to invest your money in Switzerland, and how can you get started?

We’ll be looking at three main ways to understand how to invest in Switzerland:

- With a bank

- Robo Advisor

- Hands on ‘DIY’

I’ll take you through the pros and cons for each option, step by step.

Let’s get started!

Investing with a Swiss bank

Investing through your existing bank is a common route for many first time Swiss investors.

You already have your local bank contact; they handle the portfolio and you don’t need to got through the swiss bank account opening process with another provider. It’s easy to understand why many opt for this convenience and use this trusted, safe partnership.

Banks offer a huge range of different funds and options to invest your money and cater for all types of investors and risk models.

That said, the big downside with investing with a swiss bank are the fees, and they are easy to overlook when you are landed with a glossy 50-page investing brochure.

Keep in mind, as we explained above, your portfolio will comprise of a combination of stocks, bonds, REITs etc. Each of these assets will have their own underlying costs, which combined will ultimately reduce the impact of your initial investment.

This means fees are important, amplified even more so over the long term. Ignore them at your peril.

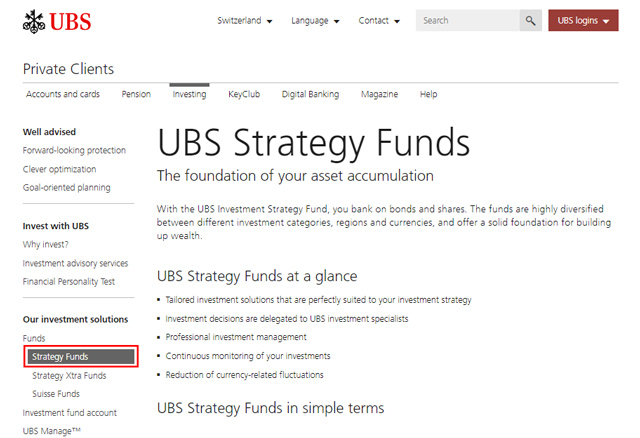

Let’s take an example I pulled at random, one of the popular UBS Strategy funds:

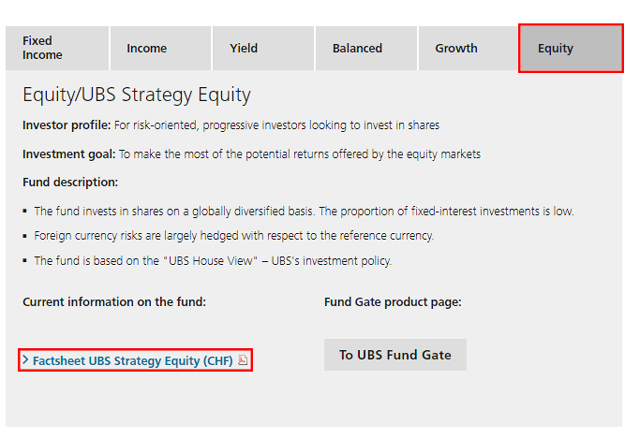

Scroll down to the fund options, I’ll pick the Equity version in this example, and open the PDF factsheet:

With any factsheet, all banks now need to display the ‘Ongoing charge’ figure (previous they used the ‘TER’ or ‘Total Expense Ratio’) which I’ve highlighted in the PDF factsheet below:

You’ll note this is 2%. As explained in the PDF, this 2% fee excludes other costs such as entry and exit fees and transaction costs throughout the year.

And to find those, we need to browse to the UBS Fund Gate:

…to find the ‘Key Investor Information’ PDF.

And then scroll down to page 2 of the PDF to see these figures:

A 3% entry fee, which means as you sign the contract and deposit 100K of your savings, they take 3K on day 1. You’ll notice there is no exit fee in this example, however this is generally quite typical with other bank funds.

There is a 3% ‘conversion fee’ – which applies when you convert your investment into CHF and withdraw it. As this fund contains 52% in foreign currency, this is another sizable chunk of cost on your investment.

Finally, there are transaction costs not included in the above fees. Unfortunately, I couldn’t find this figure anywhere despite looking through various PDFs and throughout the website. None the less, it’s another cost you need to remember to factor in as they are triggered on every buy and sell in your potfolio throughout the year.

Investing with a Swiss bank – Pros and Cons

| Pros | Cons |

|

|

Investing with a Swiss robo advisor

Robo advisors are ideal for newcomers to investing as they take care of the all the things that would otherwise put you off with taking those first steps.

For example, they’ll calculate your risk, work out your portfolio, and buy and sell assets on autopilot without you needing to touch anything.

The nice thing is, if you want to geek out and learn more – everything is there to tinker with and tweak if you wish to do so.

For example, if you find you are comfortable with more risk, you can update your account to reflect that, and the algorithm will update your portfolio. Here’s an example of the Selma Finance platform:

🧠 Fun fact – I created InvestingHero originally to document robo advisor reviews in Switzerland. I’m still working on covering them all, but you can read about Selma Finance and True Wealth to dig into the details.

The big players are pretty good cost wise, hugely undercutting banks, and in general onboarding and customer experience is excellent. Robo advisors are a logical first step for newcomers looking to get started with investing.

Investing with a Swiss robo advisor – Pros and Cons

| Pros | Cons |

|

|

Reader offers and deals

🎁 Reader Bonus: We’ve partnered with the roboadvisor Selma Finance to give our readers (that’s you!) a special offer when you open a live account.

If you use the following invitation link you won’t have to pay ANY management fees upto 5K CHF for the first year. That’s completely free portfolio management, for an entire year!

Investing with a Swiss broker – aka. the DIY approach.

For those that are keen to get their hands dirty creating a portfolio, find the assets they want to buy, and make the transactions themselves – you can do so easily through a broker in Switzerland.

The DIY approach is, by far, the cheapest way to purchase stocks in Switzerland.

Some brokers, such as DEGIRO, even offer a list of ETFs you can trade for free every month, bringing the cost down even further.

You can buy individual stocks through a bank, however when compared to the likes of Swissquote, Interactive Brokers and DEGIRO they’ll come out a lot more expensive.

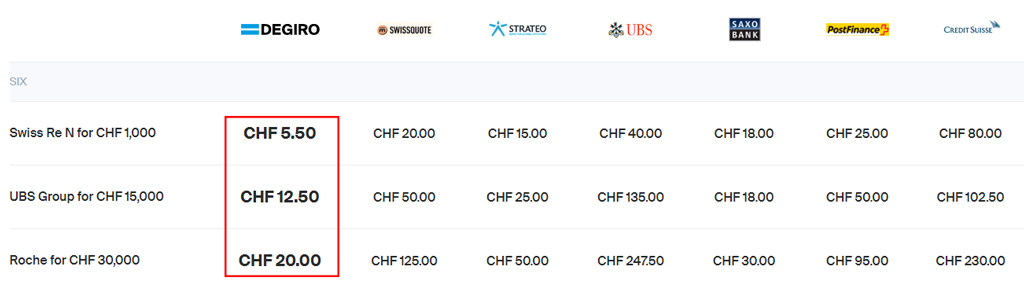

Here’s an example taken from our recent DEGIRO review that shows that cost comparison:

» Related reading: Read the full DEGIRO review.

While building your own portfolio is straight forward and cost effective, for some the DIY approach will be too much.

If the idea of buying stocks every month through a broker platform isn’t for you, that’s understandable – you might want to consider the robo advisor route instead.

Investing with a Swiss broker – Pros and Cons

| Pros | Cons |

|

|

What about investing the Pillar 3a?

I sneaked this one in at the end – but yes, you can invest (and probably should!) your Pillar 3a pension contribution.

Banks, robo advisors (although just Selma Finance for now) and dedicated pillar 3a providers (e.g. VIAC) offer the ability to have your pillar 3a invested.

Aside from a few reasons (mortgage, leaving the country etc) due to the nature of the pillar 3a being pretty ‘untouchable’ until you reach 60+, the timeframe alone generally makes sense for most of us to have it invested and generate some solid long-term returns.

Despite the benefits listed above, there is some dispute on the value of the pillar 3A if you are already investing heavily elsewhere.

However, the general feeling is yes – they are worth contributing toward for the tax benefit if you can combine it with an inexpensive investment provider, such as VIAC.

» Related reading: Read the full VIAC review.

Remember do not, ever, combine your pillar 3a with a life insurance policy.

How much money do I need to start investing?

The amount you need will depend on the way you choose to invest.

Banks have very low (under 100CHF) account minimums, and via the DIY route with the likes of DEGIRO you can open an account for 1CHF. However, you won’t be able to buy much with that 🙂

Robo advisors have slightly higher deposit minimums, as they already operate on tight margins and need to cover their back-office costs. Selma Finance for example require 2K CHF to start, True Wealth 8.5k CHF.

How much you want to invest depends on your goals, timeframe, risk appetite and your budget. Once you have those, you’ll arrive at your figure.

But more importantly once you open an investing account, you commit regular CHF into it.

Common pitfalls when investing in Switzerland

Despite the benefits to investing, there is still a lot of confusion and general lack of common understanding about the benefits long term investing can bring.

For example, when I started, I had friends compare investing to gambling in a casino. In their minds, holding a pair of dice at a casino table was the exact same thing.

Explaining that in a casino you hold nothing of actual real value, vs. long term investing in little pieces of actual companies that rise in value, just doesn’t sink in for some.

This stigma toward investing in Switzerland, and the misconception that holding cash in a bank account is the right way, is a huge wasted opportunity.

Ultimately, it’s stopping them from having more options in the future and passing more wealth onto their kids – which is a shame.

Don’t be influenced by the naysayers.

I also get that finance is boring, budgets suck and investing is confusing. But the biggest pitfall with all this is simply not starting. Not taking action, falling into the ‘someday’ mindset and not moving forward.

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”

Warren Buffet

At the very least you need to keep ahead of inflation (1.2% btw), so just get started!

I covered a bigger list of 8 more common mistakes that newcomers (ahem, me included) typically make when they start out investing.

» Related reading: 8 Common Investing Mistakes You Must Avoid.

Swiss Investing FAQ

No more so than other countries, but all investing carries risk. The amount of risk you are willing to take will depend on your personal profile, but generally the more stocks you hold in a portfolio, the greater the risk. See the section above for more detail.

Yes – In general to open a swiss bank or robo advisor account in Switzerland you need to have B or C permit. With these at hand, the process is straight forward.

There are generally three main options with investing in Switzerland, through a bank, robo advisor or directly with a broker. All have their pros and cons, to find out which is right for you read the section above.

Investing isn’t a good idea, it’s a great idea. The long term impact of investing will have a considerable impact on your overall wealth giving you more options and flexibility in the future.

Typically when dealing with stocks to grow your wealth, you should conisder a timeline of 10+ yrs.

Prices will vary depending on how you choose to invest. Banks will charge north of 1.5-2%, with a number of extra costs in addition. Roboadvisors are generally under 1% with no hidden fees.

At time of writing, I’ve given Selma Finance 4.7 out of 5 in our Selma Finance review. True Wealth comes in a close second with 4.5 out of 5.

Yes. You can read more about taxes in Switzerland to learn more.

I’m anonymous on the blog, so I guess you can call me ‘Mr Investing Hero’, or ‘Mr IH’ for short 🙈

I’m a British expat who’s been living in Switzerland for the last 10 years. I’m a digital marketing professional by day, and a finance and investing blogger by night.

You can read more about me here.

Thanks for reading!

Mr. IH

Comments are closed.

Comments: 10

Hi,

Very good thread!

Looks like you havent covered the pillar 2 for those who have vested benefits account?

Any chance to have similar article like you did for VIAC or Frankly for pillar 3a?

Ray

Good point Ray – the pillar 2 is also an option although often needs to linked into a higher cost banking fund. Waiting for some roboadvisors/VIAC to shake up this space.. 😉

Simply incredible! Thank you, Mr. IH! Great content as always.

Thanks for the feedback!

Thanks for this – very useful!

As a foreign resident in Switzerland on a B permit, my main concern with starting to invest is a lack of knowledge on what will happen once I leave the country, and settle somewhere else (in EU or not).

Some key questions: Would I have to sell all stocks and re-purchase upon moving? Would I be forced to close my robo advisor account, etc.

I have reached out to the local authorities / robo advisor providers, but there seem to be a lot of uncertainties on how it would work. Is there perhaps an article in the pipeline on this front?

Very nice article and very useful. I appreciate your work, thanks for sharing for all the informative content.

Hi, thanks for the post! So you recommend Degiro vs Interactive Brokers? thanks

This is indeed a very useful read, thank you!

Would you know if a foreign resident on a CDL can invest in Switzerland?

Excellent website

Wonderful explanation! Thanks a million!